Subject: Request for Verification of Debt and Cease Foreclosure — Utah Sample Letter to Foreclosure Attorney Dear [Foreclosure Attorney's Name], I hope this letter finds you well. I am writing to address a matter concerning the foreclosure proceedings related to my property [property address] in [City, State], Utah. I kindly request your assistance in verifying the debt in question and subsequently halting the foreclosure process until such verification is provided. As a responsible homeowner, I believe it is within my rights to seek full disclosure and validation of the debt claimed by the mortgage service or lender before proceeding further. Under the Fair Debt Collection Practices Act (FD CPA), I am entitled to the verification and validation of any alleged debt. I kindly request that you provide comprehensive documentation that proves the mortgage service or lender has the legal authority to enforce and collect the debt, along with a detailed breakdown of the outstanding balance owed. This may include, but is not limited to, the original loan agreement, account statements, payment history, and any subsequent modifications or assignments. Furthermore, I would appreciate your cooperation in halting the foreclosure proceedings until the verification of debt is provided. This request aligns with the rights bestowed upon me under the FD CPA, and I trust that you understand the importance of adhering to these legal requirements. In the event that you are unable to verify the debt, please provide an explanation as to why it cannot be verified. In such circumstances, I urge you to cease any foreclosure actions as it would be unjust and unlawful to proceed without proper validation. Additionally, I would like to bring to your attention that under Utah law, a mortgage service or lender is mandated to send a written notice to the borrower stating the specific reasons for any denial of an application for loss mitigation assistance. If any such notice has been sent, I kindly request that you attach a copy of it to your response. I kindly ask for your prompt attention to this matter. As an experienced foreclosure attorney in Utah, your expertise will be invaluable in resolving this issue, ensuring that all legal processes are followed diligently, and protecting my rights as a homeowner. Please provide your written response within 30 days from the date of receipt of this letter to allow for proper evaluation and resolution of the matter. Your cooperation in this regard will be greatly appreciated. Thank you in advance for your time and attention to this important matter. I look forward to receiving your prompt response. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address] Note: Utah's regulations and specific laws regarding foreclosures and debt verification can vary. This sample letter should act as a starting point and may need to be adjusted to fit the individual circumstances and legal requirements for your particular case. It is advisable to seek guidance from a qualified attorney or legal professional familiar with Utah foreclosure laws.

Utah Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

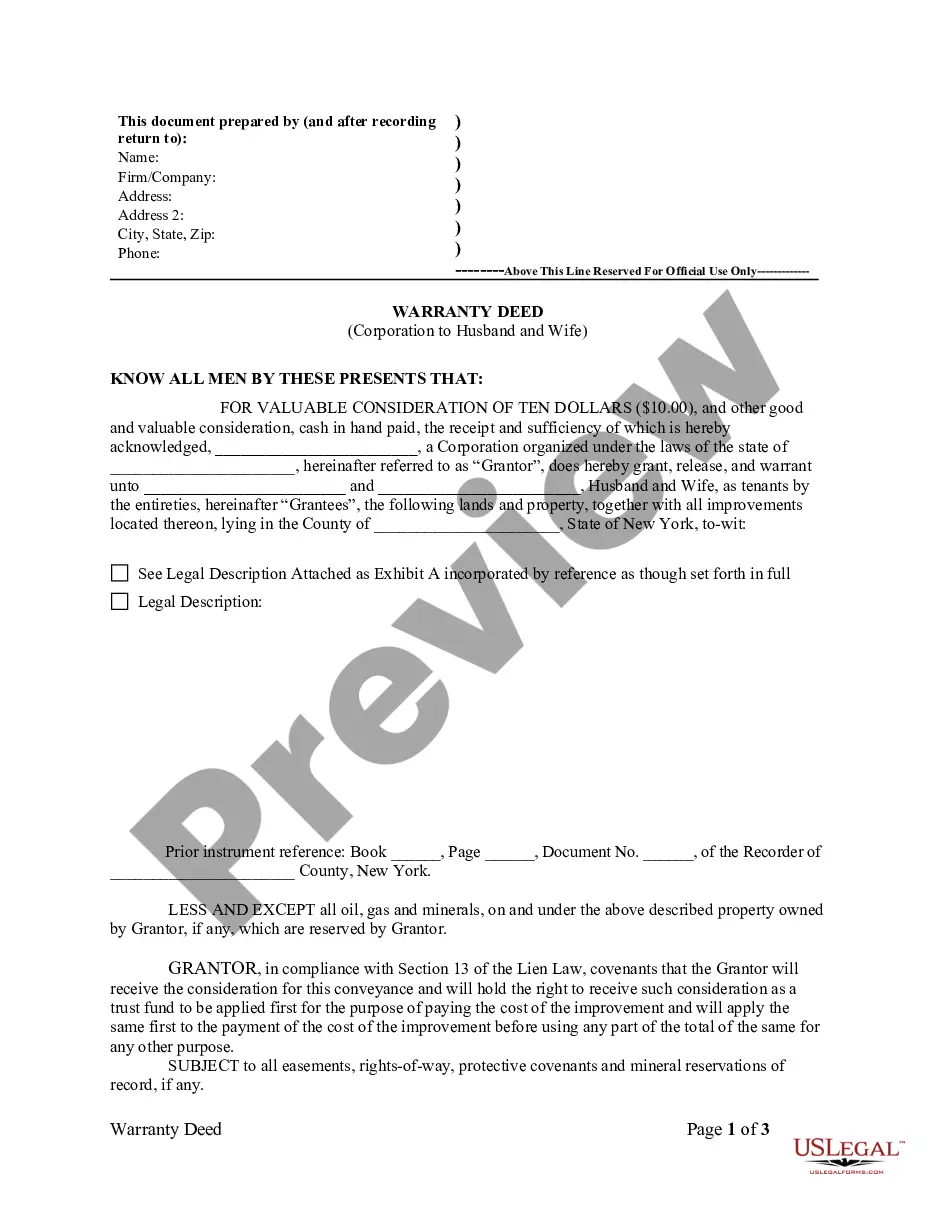

How to fill out Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

It is possible to devote several hours on the Internet searching for the authorized record format that meets the federal and state demands you want. US Legal Forms offers a huge number of authorized forms that happen to be evaluated by professionals. You can actually download or printing the Utah Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure from my assistance.

If you currently have a US Legal Forms account, you may log in and click on the Down load option. Next, you may comprehensive, change, printing, or indication the Utah Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure. Each authorized record format you buy is your own forever. To have yet another version of any acquired kind, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms web site the very first time, keep to the easy recommendations below:

- First, be sure that you have chosen the correct record format for that area/area of your choosing. Browse the kind information to make sure you have selected the proper kind. If accessible, take advantage of the Review option to search from the record format as well.

- If you would like locate yet another version of your kind, take advantage of the Look for field to obtain the format that meets your needs and demands.

- Upon having discovered the format you would like, click on Get now to move forward.

- Select the costs strategy you would like, type your accreditations, and register for your account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal account to cover the authorized kind.

- Select the file format of your record and download it to the device.

- Make changes to the record if required. It is possible to comprehensive, change and indication and printing Utah Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

Down load and printing a huge number of record layouts while using US Legal Forms web site, which provides the biggest variety of authorized forms. Use expert and condition-distinct layouts to handle your company or person demands.

Form popularity

FAQ

Collectors who don't send these letters could get in trouble with the Federal Trade Commission (FTC) if you file a complaint against them. To formally request debt validation, start by sending a letter via certified mail to the debt collector ? LendingTree's debt validation letter template can help you get started.

How to Write a Debt Verification Letter Proof that this debt really belongs to you?like a signed contract. How much you owe (based on a last statement or bill) If the debt is past the statute of limitations. The last action taken on the account.

I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt. This is NOT a request for ?verification? or proof of my mailing address, but a request for VALIDATION made pursuant to 15 USC 1692g Sec.

The debt validation letter must include at least the following information: The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

Although you can ask for many details, debt collectors are only required to provide information on the original creditor, the balance owed and the name of the person who owes the debt before resuming collection efforts.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

State the amount of the debt when you obtained it, and when that was. If there have been any additional interest, fees or charges added since the last billing statement from the original creditor, provide an itemization showing the dates and amount of each added amount.