Utah Loan Agreement for Equipment

Description

How to fill out Loan Agreement For Equipment?

If you need to full, acquire, or print legitimate papers web templates, use US Legal Forms, the greatest assortment of legitimate kinds, that can be found online. Make use of the site`s easy and practical research to obtain the paperwork you will need. Different web templates for enterprise and individual purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Utah Loan Agreement for Equipment with a few mouse clicks.

When you are presently a US Legal Forms customer, log in for your profile and then click the Obtain switch to obtain the Utah Loan Agreement for Equipment. You can also accessibility kinds you earlier saved within the My Forms tab of your own profile.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the form for that proper metropolis/land.

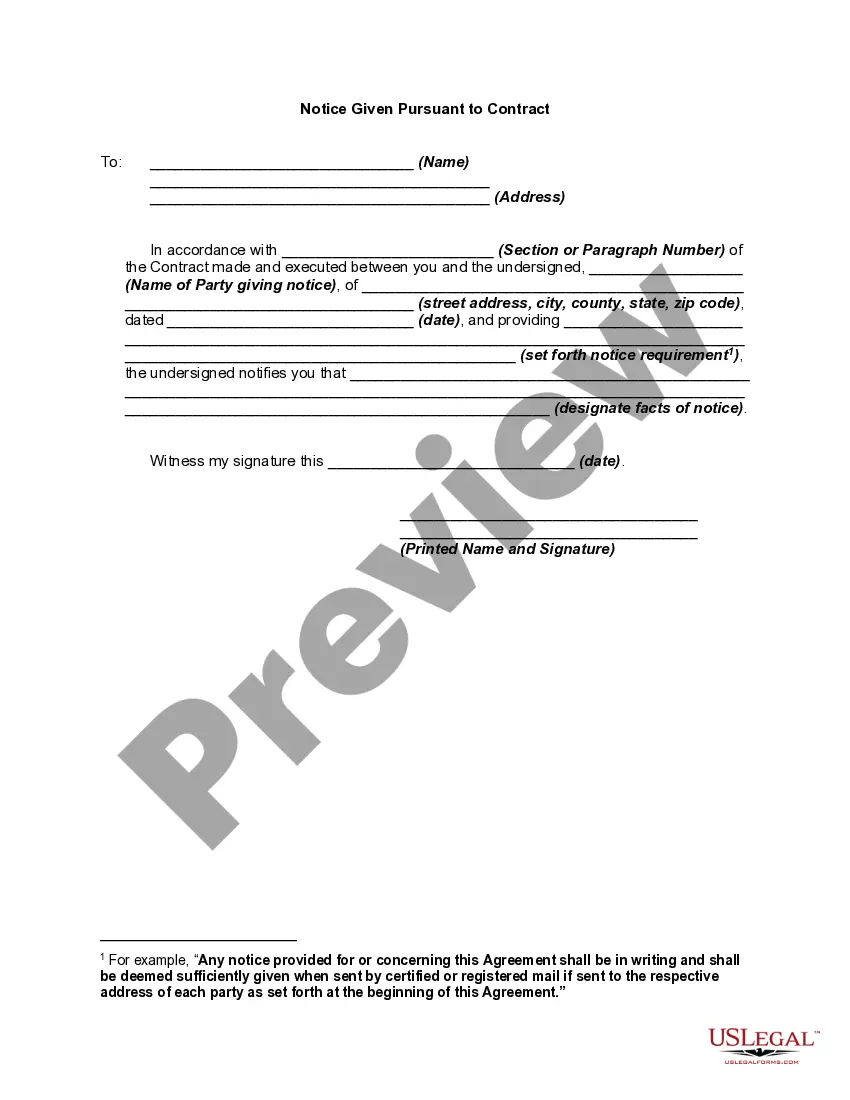

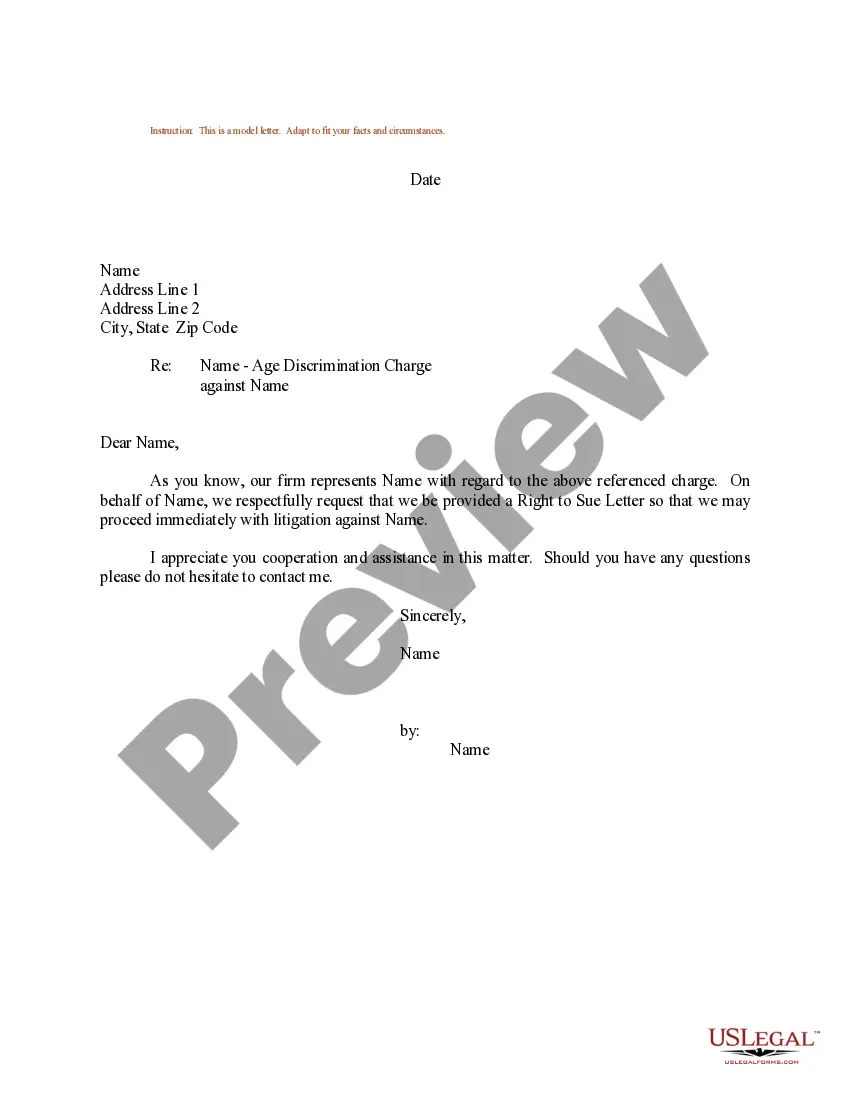

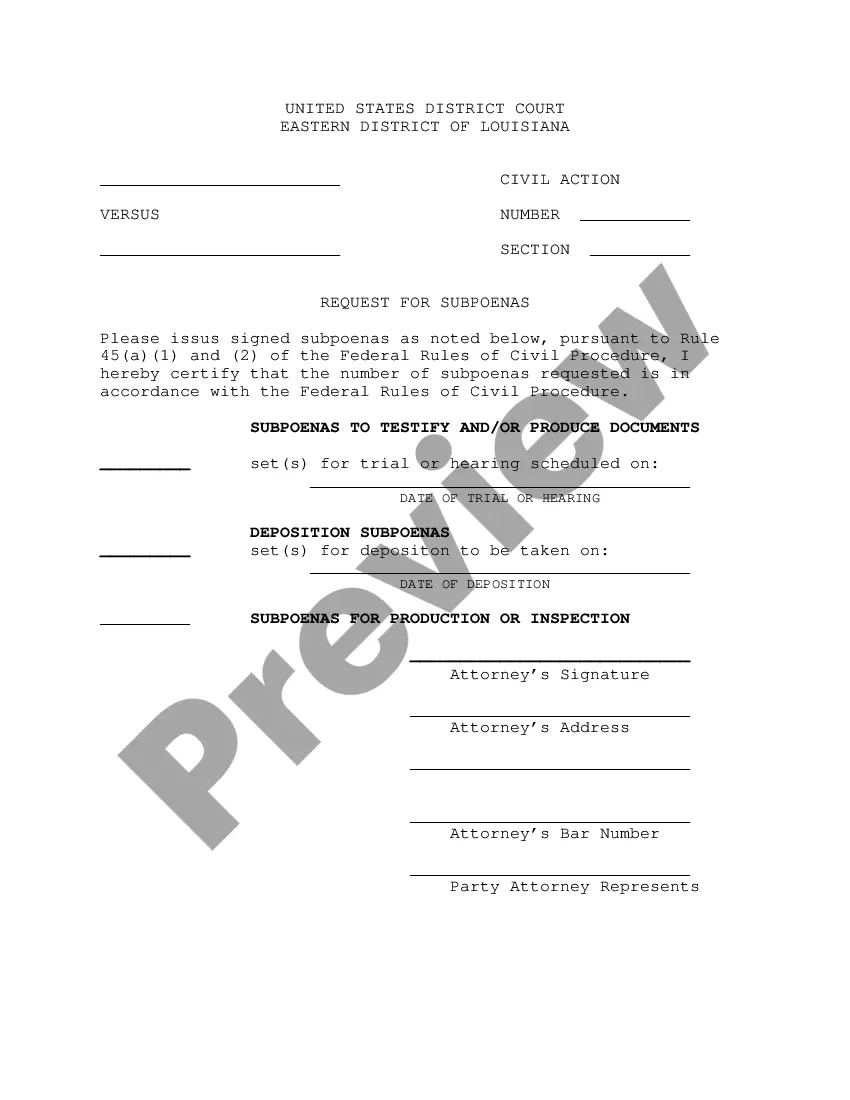

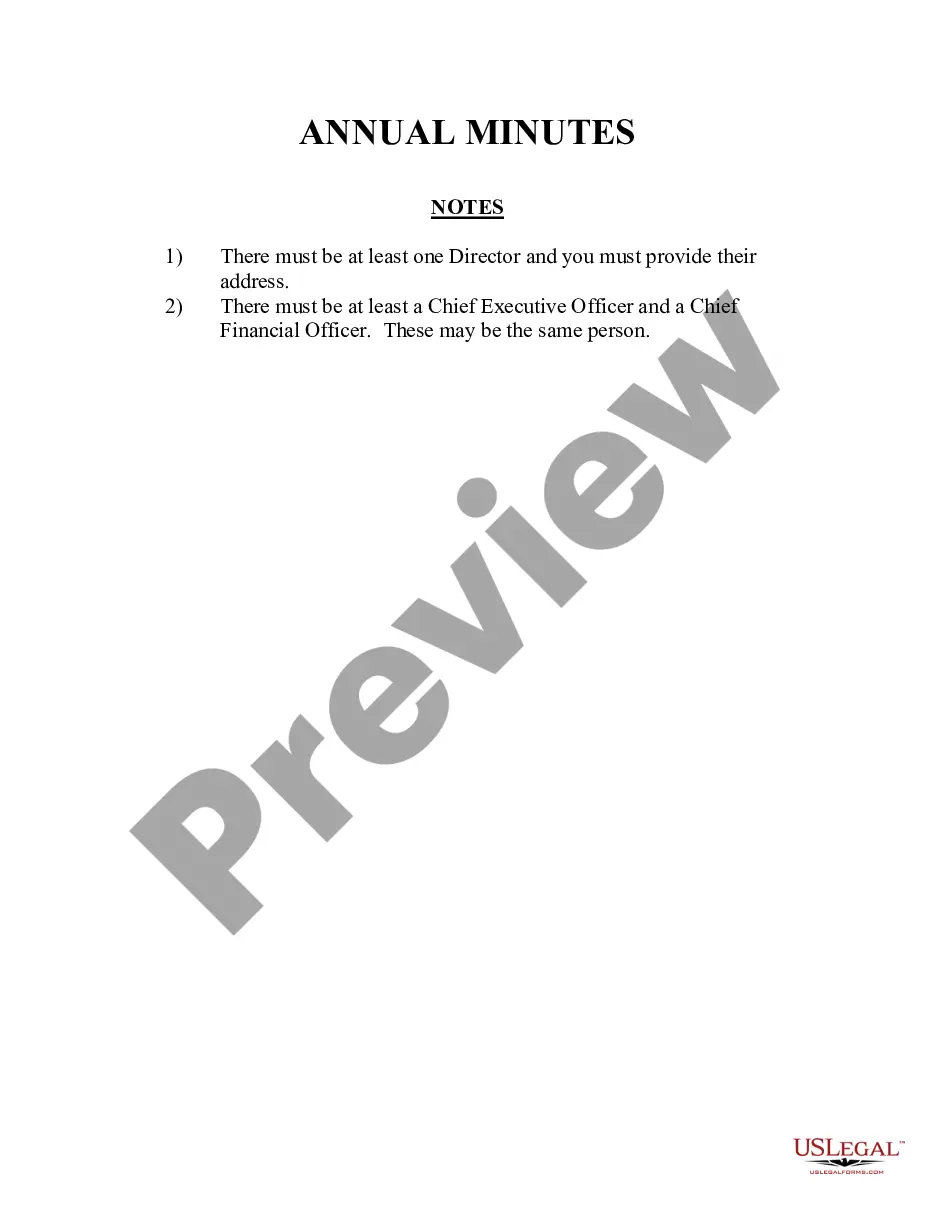

- Step 2. Use the Review choice to examine the form`s information. Don`t forget to read the information.

- Step 3. When you are not satisfied using the kind, use the Look for area near the top of the screen to find other variations of your legitimate kind template.

- Step 4. Once you have located the form you will need, click on the Get now switch. Opt for the rates prepare you like and add your qualifications to sign up for the profile.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the format of your legitimate kind and acquire it on your own product.

- Step 7. Full, edit and print or signal the Utah Loan Agreement for Equipment.

Each legitimate papers template you purchase is your own property forever. You might have acces to every single kind you saved with your acccount. Go through the My Forms area and decide on a kind to print or acquire once again.

Compete and acquire, and print the Utah Loan Agreement for Equipment with US Legal Forms. There are millions of specialist and state-specific kinds you may use for your enterprise or individual demands.

Form popularity

FAQ

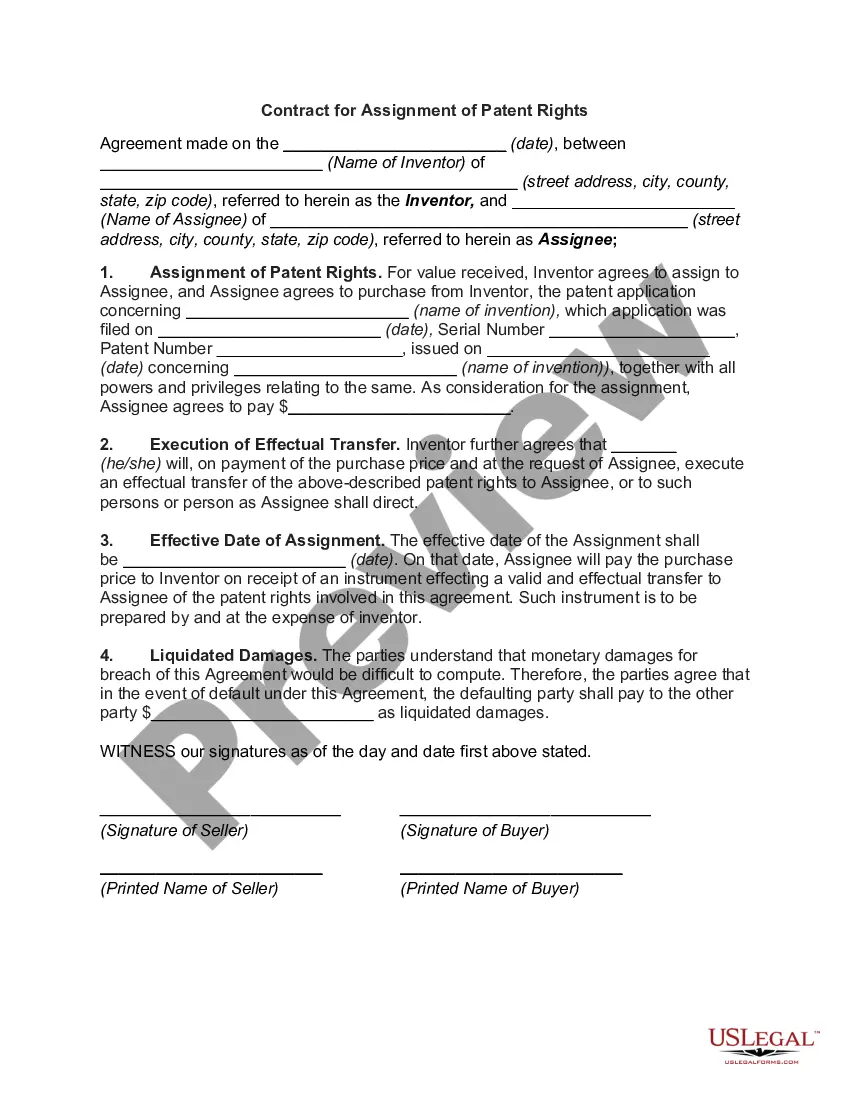

An equipment loan agreement is a business agreement intended to offer a business loan for a company to purchase equipment. Oftentimes the equipment loan agreement uses the equipment itself as collateral for the loan, making it an appealing borrowing and lending situation for both parties.

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms. Each agreement, though, is likely to have the same main provisions.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

The agreement dictates new terms and actions to be met. If not navigated well, it can result in financial penalties, a recall of the loan, or even legal action.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

An equipment loaner agreement is a legally binding contract between a company or the borrower and a lender to secure funds for the financing of equipment for the business.