Utah Loan Agreement for Employees

Description

How to fill out Loan Agreement For Employees?

Discovering the right legal papers template can be a battle. Needless to say, there are plenty of templates available online, but how do you obtain the legal type you will need? Utilize the US Legal Forms internet site. The support delivers 1000s of templates, like the Utah Loan Agreement for Employees, which can be used for business and private requires. Each of the varieties are inspected by specialists and fulfill federal and state demands.

In case you are already listed, log in to the accounts and click the Down load switch to get the Utah Loan Agreement for Employees. Make use of your accounts to search through the legal varieties you have ordered formerly. Visit the My Forms tab of the accounts and obtain yet another copy of your papers you will need.

In case you are a fresh consumer of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- Initial, ensure you have chosen the proper type for your town/state. You can check out the form utilizing the Preview switch and look at the form explanation to ensure it is the best for you.

- If the type does not fulfill your requirements, take advantage of the Seach area to obtain the right type.

- Once you are positive that the form is suitable, select the Buy now switch to get the type.

- Opt for the prices plan you desire and enter the necessary information. Design your accounts and buy your order with your PayPal accounts or Visa or Mastercard.

- Pick the data file formatting and down load the legal papers template to the gadget.

- Comprehensive, revise and print out and indicator the acquired Utah Loan Agreement for Employees.

US Legal Forms is the biggest library of legal varieties where you will find numerous papers templates. Utilize the company to down load appropriately-produced papers that adhere to state demands.

Form popularity

FAQ

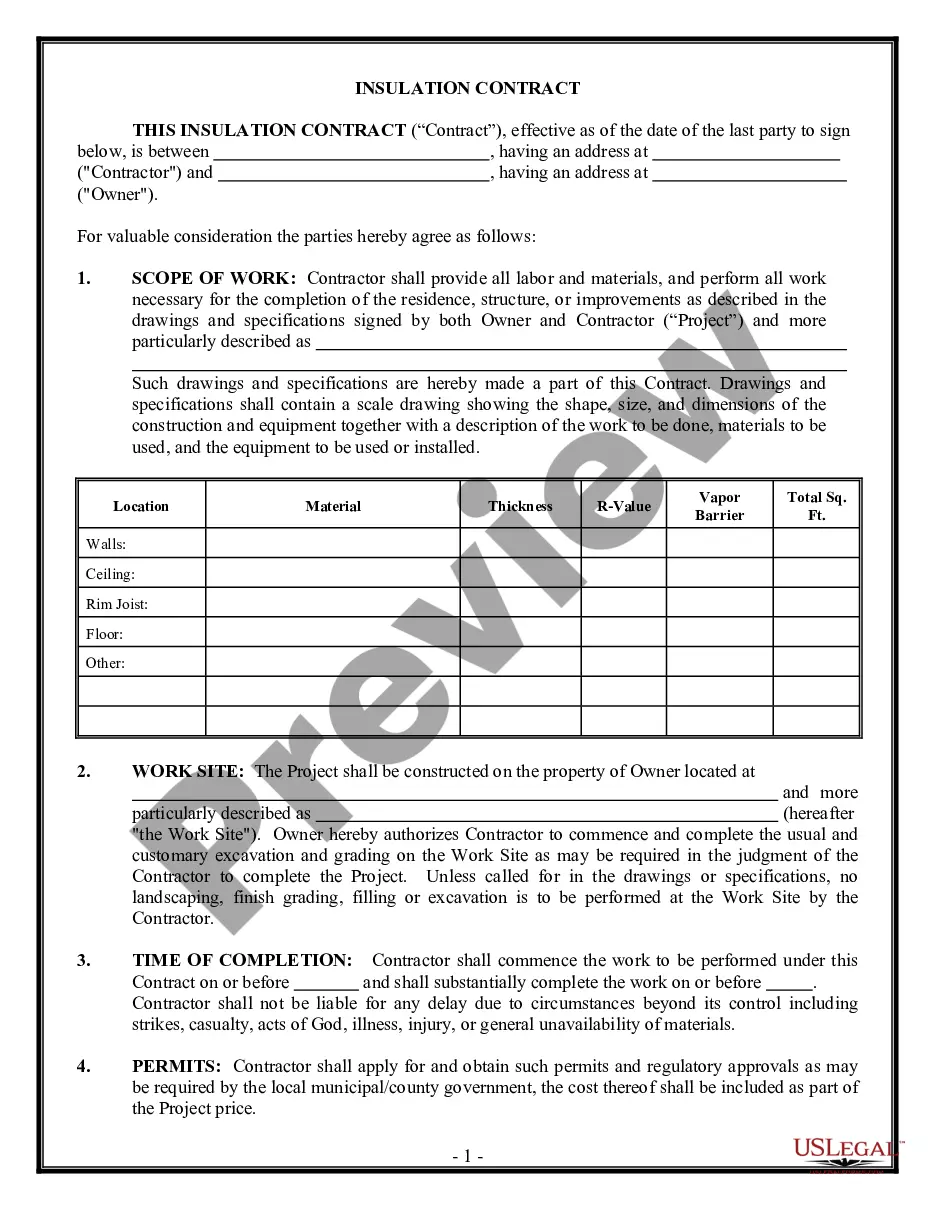

Here's some of the critical information you should ensure is included in every business loan agreement: Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate.

A contract for a loan is a promissory note. In a promissory note, each party provides consideration; the consideration of the lender is the money that is being lent, the consideration of the borrower is the promise to make payments.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

If you're going to create a personal loan agreement from the ground up, it should include the following information: Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.