A Utah Loan Agreement for Personal Loan is a legally binding contract between a lender and a borrower in the state of Utah. This agreement outlines the terms and conditions under which a personal loan is granted and repaid. It provides clarity to both parties involved regarding the loan amount, interest rate, repayment schedule, and other essential details. In Utah, several types of loan agreements for personal loans exist. Let's take a closer look at some common variations: 1. Fixed-Rate Personal Loan Agreement: This type of loan agreement offers a fixed interest rate throughout the entire loan term, providing predictability for borrowers. 2. Variable-Rate Personal Loan Agreement: Unlike the fixed-rate agreement, the interest rate on this loan can fluctuate over time, often tied to a specific benchmark rate such as the prime rate. 3. Secured Personal Loan Agreement: This agreement requires the borrower to provide collateral, such as a property or vehicle, as security for the loan. In case of default, the lender can seize the asset to recover the outstanding amount. 4. Unsecured Personal Loan Agreement: In contrast to a secured loan, an unsecured agreement does not require collateral. These loans typically rely on the borrower's creditworthiness and may carry higher interest rates to compensate for the increased risk to the lender. 5. Payday Loan Agreement: Payday loans are short-term loans typically meant to cover unexpected expenses until the borrower's next paycheck. These agreements often come with high interest rates and fees and should be approached with caution. Utah Loan Agreements for Personal Loans are subject to the laws and regulations specific to the state. It is crucial for both borrowers and lenders to understand and comply with Utah's lending laws, including maximum interest rate limits, usury provisions, and consumer protection regulations. When entering into a Utah Loan Agreement for Personal Loan, it is recommended for both parties to seek legal counsel to ensure the contract is fair, compliant, and protects their rights and interests. This detailed contract serves as a vital tool in establishing a transparent and mutually beneficial relationship between the lender and borrower.

Utah Loan Agreement for Personal Loan

Description

How to fill out Utah Loan Agreement For Personal Loan?

Choosing the best authorized papers template can be quite a battle. Of course, there are a lot of layouts available on the net, but how can you find the authorized form you need? Take advantage of the US Legal Forms website. The service offers thousands of layouts, such as the Utah Loan Agreement for Personal Loan, which can be used for organization and personal needs. All the kinds are examined by experts and satisfy state and federal needs.

When you are presently signed up, log in to the bank account and click the Obtain switch to find the Utah Loan Agreement for Personal Loan. Make use of bank account to appear through the authorized kinds you may have bought formerly. Go to the My Forms tab of the bank account and acquire yet another backup of your papers you need.

When you are a whole new user of US Legal Forms, here are simple guidelines that you can adhere to:

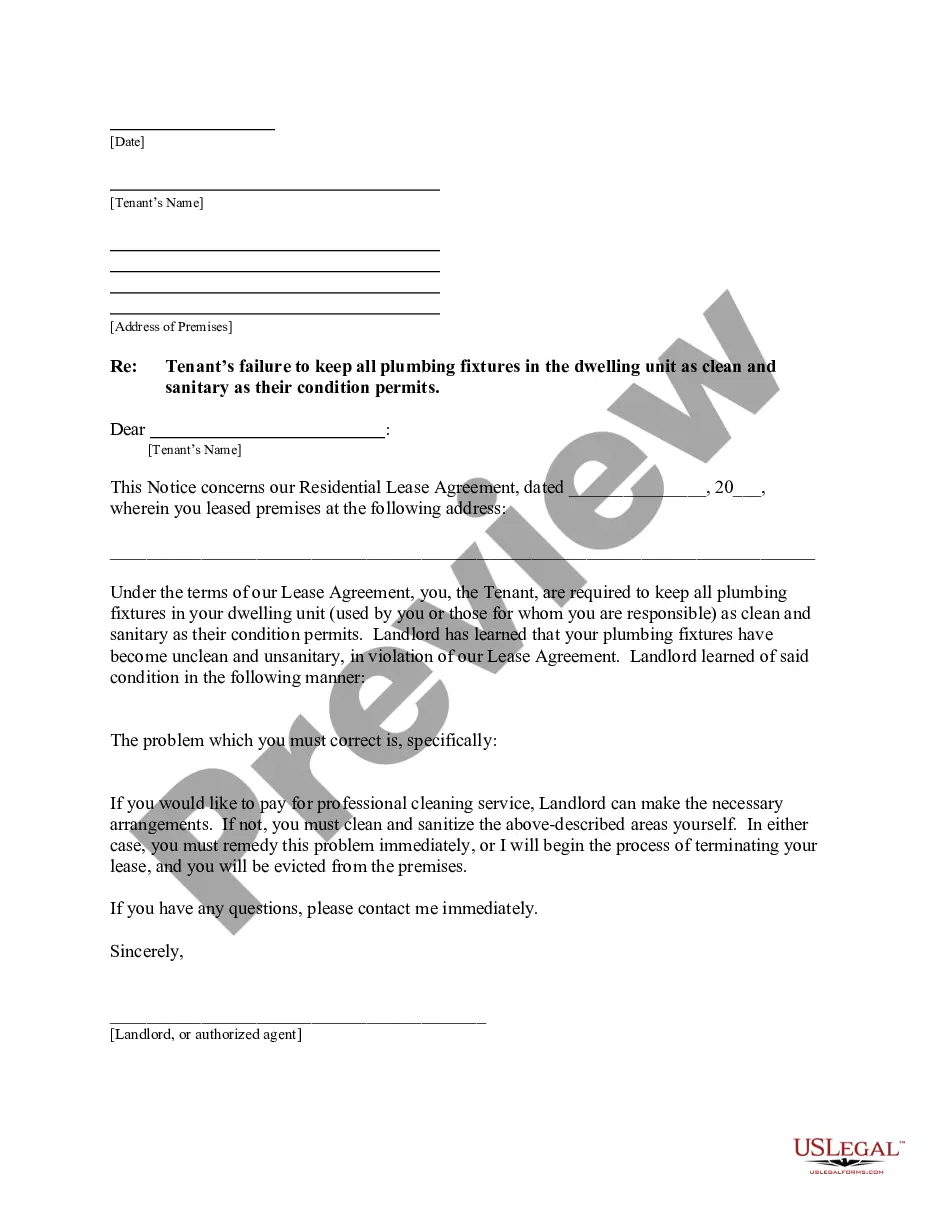

- Initially, be sure you have selected the right form for the metropolis/county. It is possible to examine the form using the Review switch and read the form explanation to make sure it will be the right one for you.

- If the form is not going to satisfy your preferences, use the Seach industry to discover the correct form.

- When you are certain that the form is acceptable, select the Acquire now switch to find the form.

- Choose the rates program you want and enter the essential information. Build your bank account and pay money for an order with your PayPal bank account or credit card.

- Opt for the document formatting and down load the authorized papers template to the system.

- Comprehensive, change and produce and indicator the acquired Utah Loan Agreement for Personal Loan.

US Legal Forms may be the most significant local library of authorized kinds for which you can find various papers layouts. Take advantage of the company to down load appropriately-produced documents that adhere to status needs.