The Utah Asset Information Sheet is a comprehensive document that serves as a valuable tool for individuals, businesses, and organizations looking to assess, manage, and track their assets in the state of Utah. This sheet contains crucial details and pertinent information related to various types of assets, helping users make informed decisions and effectively handle their financial matters. The Utah Asset Information Sheet is primarily used for documenting and organizing an individual's or entity's assets held within Utah's boundaries. It offers a structured template that allows users to input key asset-related information, such as the asset's type, description, value, location, and ownership details. It serves as a centralized repository, enabling a systematic approach to asset management and facilitating efficient asset tracking. Keywords: Utah, asset information, asset management, asset tracking, financial matters, documentation, organized, template, asset type, asset description, asset value, asset location, ownership details, repository, systematic approach. Different types of Utah Asset Information Sheets may include: 1. Personal Asset Information Sheet: This type of sheet assists individuals in managing their personal assets located in Utah. It focuses on individuals' tangible and intangible assets, such as real estate properties, vehicles, investments, bank accounts, insurance policies, valuables, and more. 2. Business Asset Information Sheet: Tailored specifically for businesses operating in Utah, this sheet helps companies keep track of their assets, including office equipment, inventory, machinery, intellectual property, trademarks, contracts, business accounts, and leases. 3. Investment Asset Information Sheet: Designed for investors, this variant of the Utah Asset Information Sheet focuses on recording and evaluating investment-related assets held within the state. It covers stocks, bonds, mutual funds, retirement accounts, portfolios, and any other financial instruments pertinent to investment management. 4. Real Estate Asset Information Sheet: Targeting those with real estate interests in Utah, this sheet provides a comprehensive overview of various properties owned by individuals, businesses, or organizations. It records property details, legal documents, ownership history, rental income, maintenance schedule, and other property-specific information. 5. Trust Asset Information Sheet: For individuals or entities with Utah-based trusts, this sheet aids in efficiently managing and administering trust assets. It encompasses assets held in trust, their distribution, beneficiaries, trustees, appraisals, and any legal or financial considerations associated with the trust. By utilizing the Utah Asset Information Sheet, individuals, businesses, and organizations gain a structured approach to asset management, empowering them with accurate and organized data necessary for making informed decisions, assessing risks, planning investments, tax obligations, and overall financial well-being.

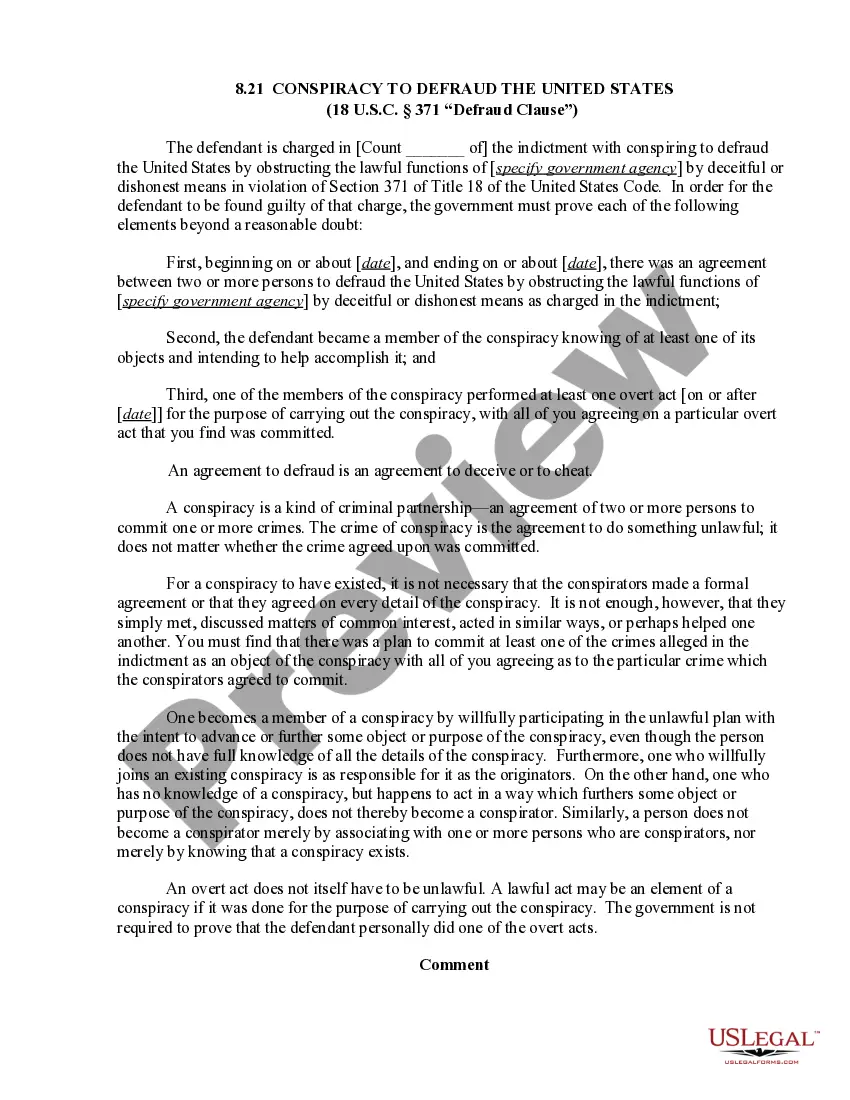

Utah Asset Information Sheet

Description

How to fill out Utah Asset Information Sheet?

Are you currently within a place in which you need to have files for either organization or personal reasons just about every day? There are a lot of legal file web templates available on the net, but finding kinds you can rely isn`t effortless. US Legal Forms gives a huge number of develop web templates, just like the Utah Asset Information Sheet, that are created to meet federal and state demands.

When you are presently knowledgeable about US Legal Forms internet site and have an account, basically log in. Following that, you can down load the Utah Asset Information Sheet web template.

Should you not come with an profile and wish to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is to the proper area/county.

- Make use of the Preview switch to review the shape.

- Look at the description to actually have chosen the proper develop.

- If the develop isn`t what you`re searching for, take advantage of the Look for industry to find the develop that meets your needs and demands.

- When you find the proper develop, simply click Get now.

- Select the prices strategy you desire, fill in the necessary info to generate your money, and pay for the transaction utilizing your PayPal or credit card.

- Pick a convenient document structure and down load your backup.

Find every one of the file web templates you might have purchased in the My Forms menus. You can obtain a further backup of Utah Asset Information Sheet anytime, if required. Just go through the required develop to down load or produce the file web template.

Use US Legal Forms, by far the most comprehensive variety of legal types, to save efforts and avoid mistakes. The assistance gives appropriately manufactured legal file web templates which you can use for a range of reasons. Create an account on US Legal Forms and initiate generating your way of life a little easier.