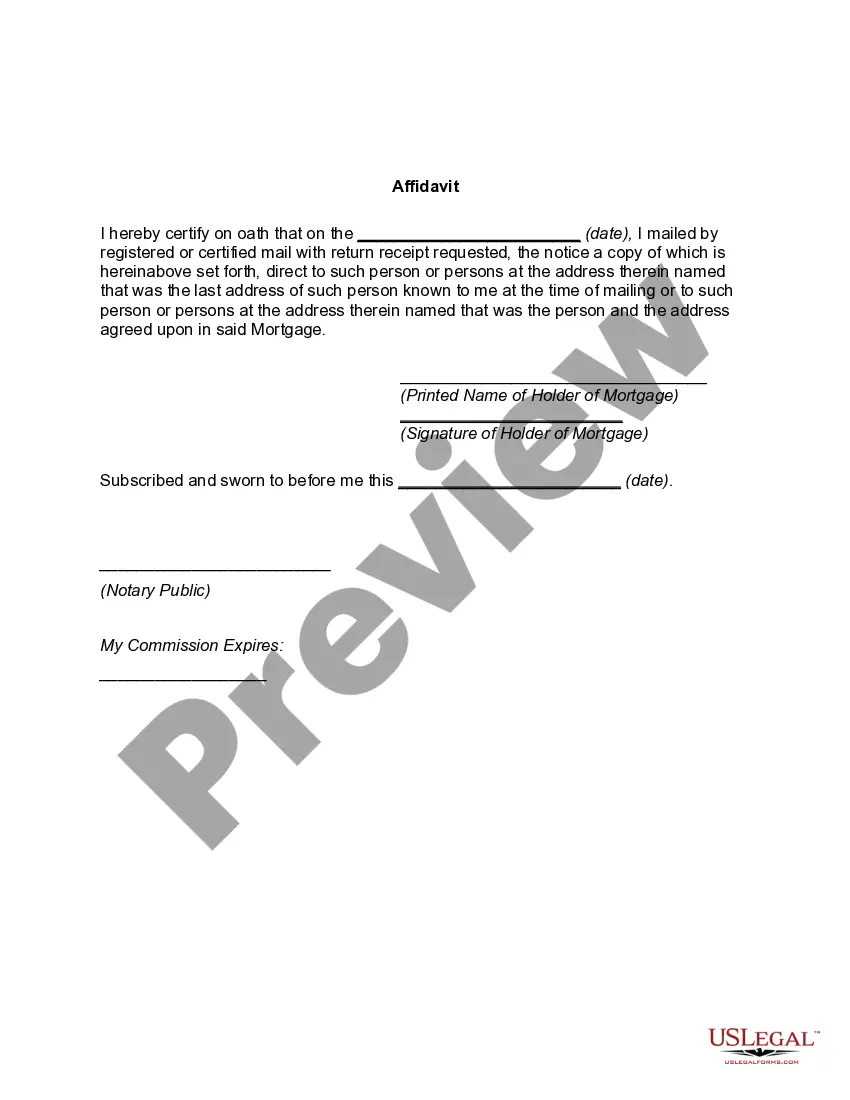

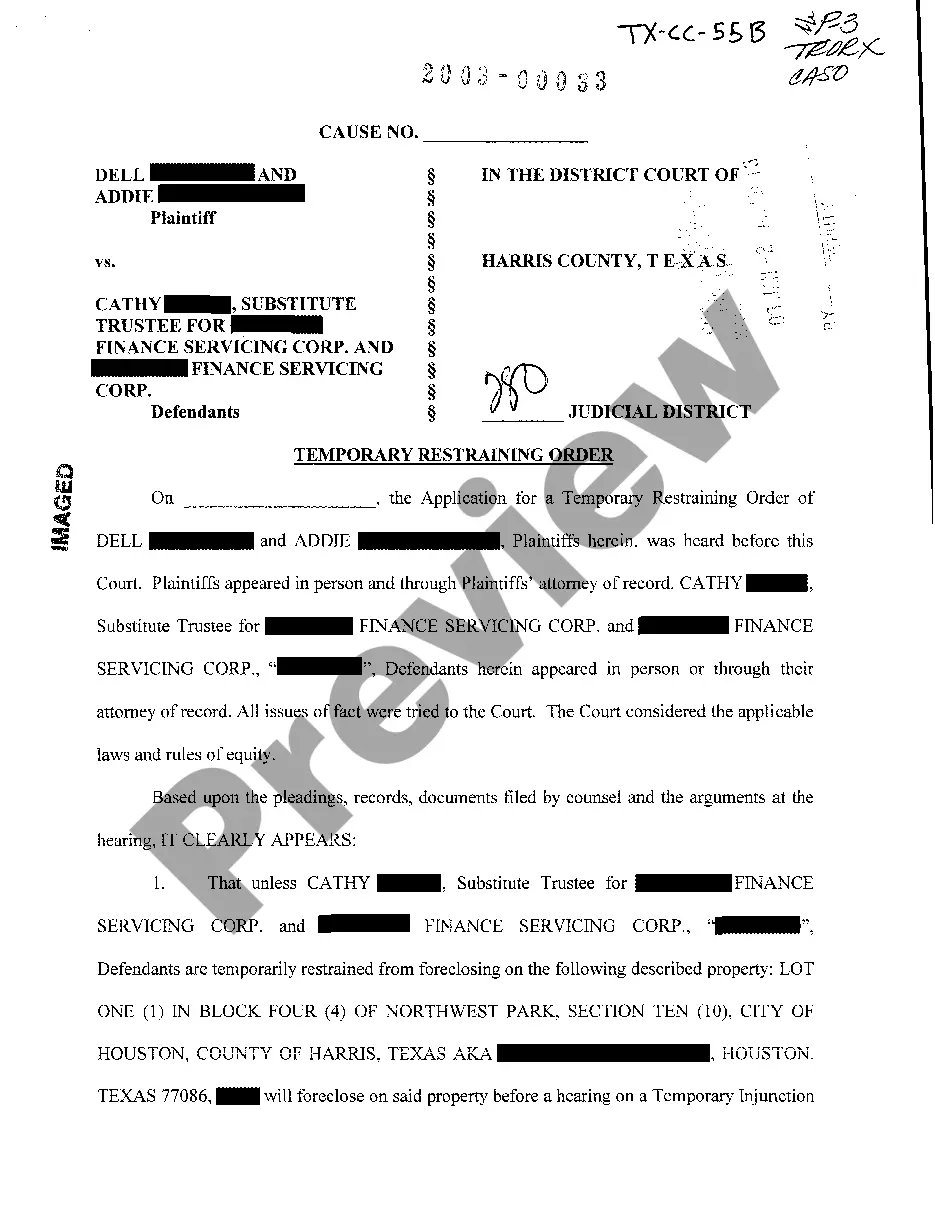

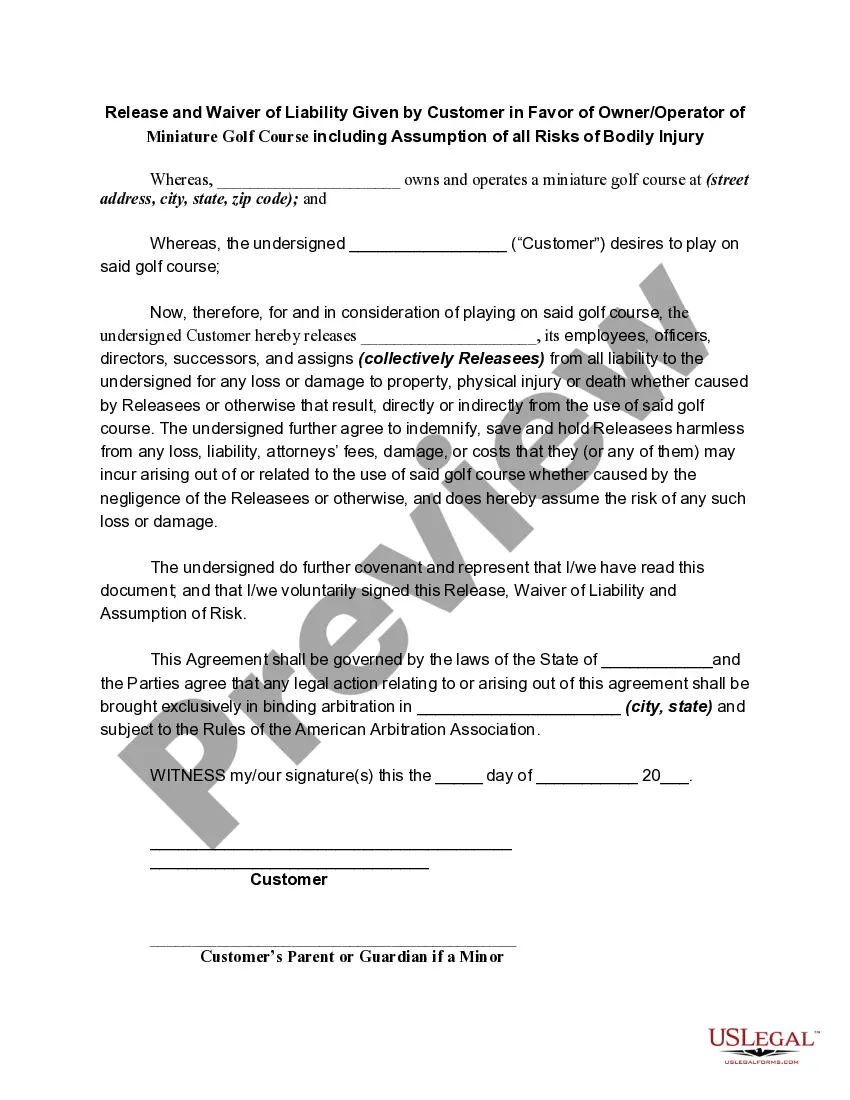

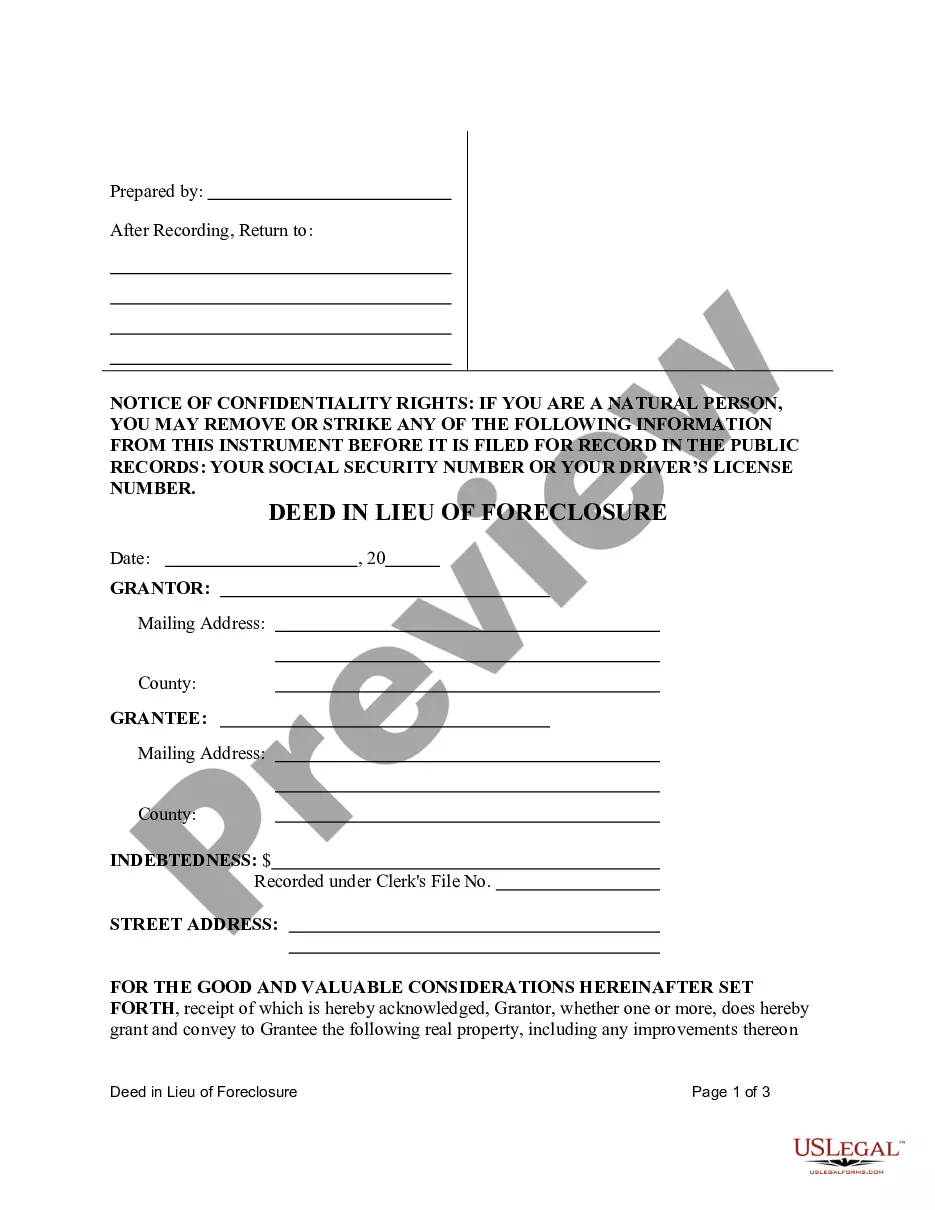

Utah Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

If you wish to full, download, or print out legitimate record themes, use US Legal Forms, the biggest selection of legitimate forms, which can be found on the web. Make use of the site`s simple and hassle-free research to obtain the papers you want. A variety of themes for organization and specific purposes are categorized by categories and says, or search phrases. Use US Legal Forms to obtain the Utah Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage in a handful of click throughs.

If you are presently a US Legal Forms client, log in to the account and click on the Obtain button to have the Utah Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage. You can even entry forms you formerly delivered electronically in the My Forms tab of your respective account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the correct town/region.

- Step 2. Make use of the Preview option to look through the form`s articles. Don`t overlook to learn the explanation.

- Step 3. If you are not happy with the develop, use the Search industry on top of the display screen to discover other versions of the legitimate develop format.

- Step 4. Once you have discovered the shape you want, go through the Purchase now button. Opt for the pricing prepare you favor and put your references to sign up for an account.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal account to finish the purchase.

- Step 6. Pick the formatting of the legitimate develop and download it in your gadget.

- Step 7. Complete, edit and print out or indicator the Utah Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

Each and every legitimate record format you get is your own property permanently. You have acces to every single develop you delivered electronically inside your acccount. Click the My Forms area and choose a develop to print out or download once again.

Contend and download, and print out the Utah Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage with US Legal Forms. There are thousands of professional and state-certain forms you may use for your organization or specific requirements.

Form popularity

FAQ

Utah's anti-deficiency statute is codified in the Utah law prevents a lender from seeking a deficiency judgment after foreclosure when the mortgage loan was made to help purchase the home, the property is less than 2.5 acres in size and less than two ?dwelling units? in size.

If a foreclosure is nonjudicial, the foreclosing lender must file a lawsuit following the foreclosure to get a deficiency judgment. On the other hand, with a judicial foreclosure, most states allow the lender to seek a deficiency judgment as part of the underlying foreclosure lawsuit.

Most foreclosures in Utah are done without a court case. They follow a process known as "nonjudicial foreclosure." This is also sometimes called a "trustee sale." The steps in a nonjudicial foreclosure are below.

In order for deficiency judgment to be granted, a creditor must be in a state that recognizes deficiency judgments for the type of debt and prove that the asset was sold at a fair price. Deficiency judgment most often arises in mortgage foreclosures where the home does not cover the cost of the mortgage.

In Utah, the lender can get a deficiency judgment after a nonjudicial foreclosure by filing a lawsuit within three months of the sale. (Utah Code Ann. § 57-1-32).

Utah's anti-deficiency statute is codified in the Utah law prevents a lender from seeking a deficiency judgment after foreclosure when the mortgage loan was made to help purchase the home, the property is less than 2.5 acres in size and less than two ?dwelling units? in size.

California law generally prohibits a deficiency judgment following the short sale of a residential property with no more than four units. Junior lienholders are also prohibited from pursuing a deficiency judgment if they agree to the short sale and they receive proceeds as agreed.

Therefore, a lender seeking to foreclose on a property secured by a trust deed must ?(1) commence an action to foreclose the trust deed, or (2) file for record a notice of default under [Utah Code] Section 57-1-24? before the six-year statute of limitations period expires. See Utah Code Ann. § 57-1-34.