Utah Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Utah Crummey Trust Agreement for the Benefit of a Child with Parents as Trustors in seconds.

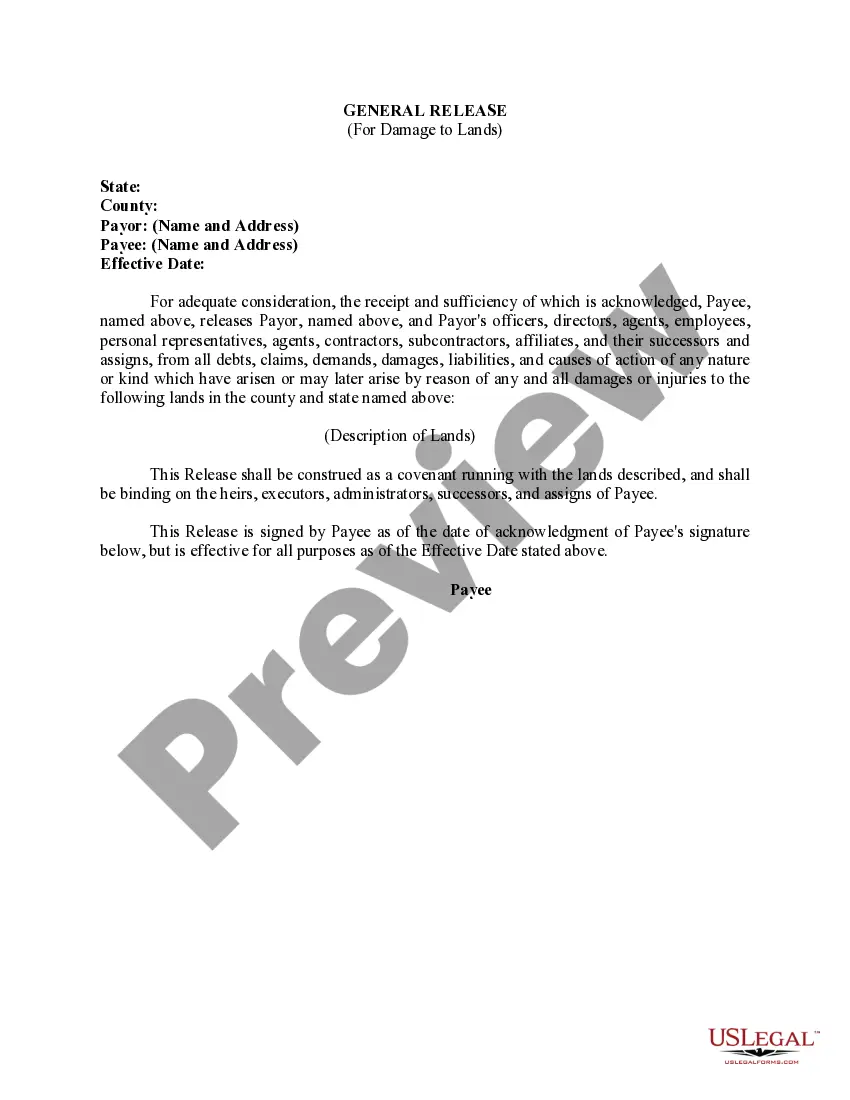

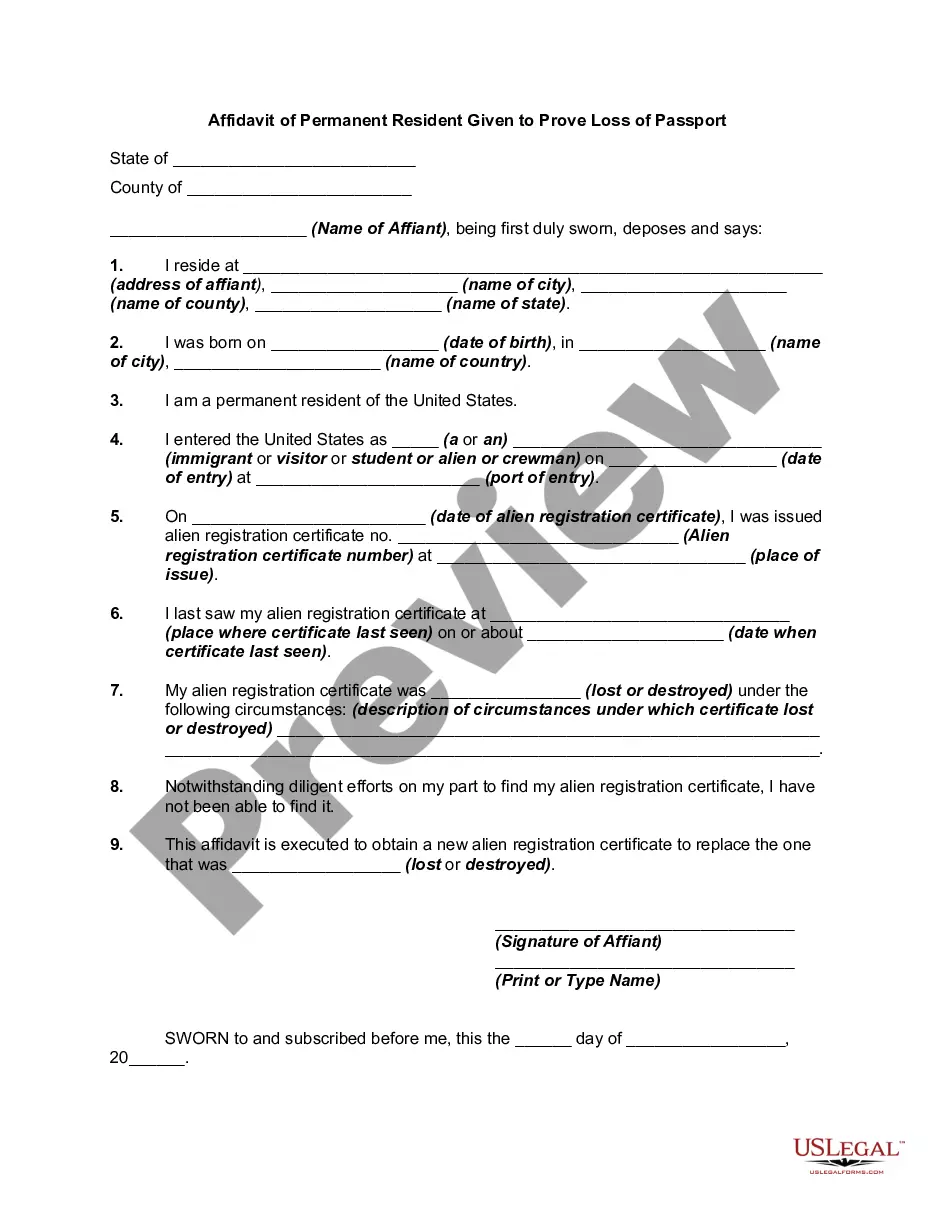

Click the Review button to examine the content of the form.

Review the form details to ensure you have chosen the correct one.

- If you already have an account, Log In and download the Utah Crummey Trust Agreement for the Benefit of a Child with Parents as Trustors from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

The trustee manages assets of Crummey trusts, and you set terms that determine when distributions should be made. A Crummey Trust is generally more flexible and advantageous than a 529 college savings account. Multiple beneficiaries can be included in the trust, including beneficiaries over 21.

Crummey power is a technique that enables a person to receive a gift that is not eligible for a gift-tax exclusion and change it into a gift that is, in fact, eligible. Individuals often apply Crummey power to contributions in an irrevocable trust.

Under the doctrine of merger, if the sole trustee and the sole beneficiary are occupied by the same person, there is no division of property interests between legal and equitable title. Therefore, this would make the trust legally invalid because the two types of title have merged.

So can a trustee also be a beneficiary? The short answer is yes, but the trustee will have to be exceedingly careful to never engage in any actions that would constitute a breach of trust, including placing their personal interests above those of the other beneficiaries.

A Crummey Trust allows you to take advantage of the gift tax exclusions and simultaneously minimize your estate taxes. You do not have to provide an opportunity for the beneficiary to withdraw the entire balance of the trust until a certain age. A Crummey trust can have multiple beneficiaries.

Key Takeaways. Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion.

Crummey Trust, Definition This type of trust is typically used by parents who want to make financial gifts to minor or adult children, though anyone can establish one on behalf of a beneficiary.

A Hanging Crummey power allows the withdrawal right to lapse only for the amount that IRC § 2514(e) protects from treatment of release, which is the gift amount less the greater of $5,000 or 5% of the value of the property out of which the withdrawal right could have been satisfied.

A Section 2503c trust is a type of minor's trust established for a beneficiary under the age of 21 which allows parents, grandparents, and other donors to make tax-free gifts to the trust up to the annual gift tax exclusion amount and the generation skipping transfer tax exclusion amount.