Utah Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

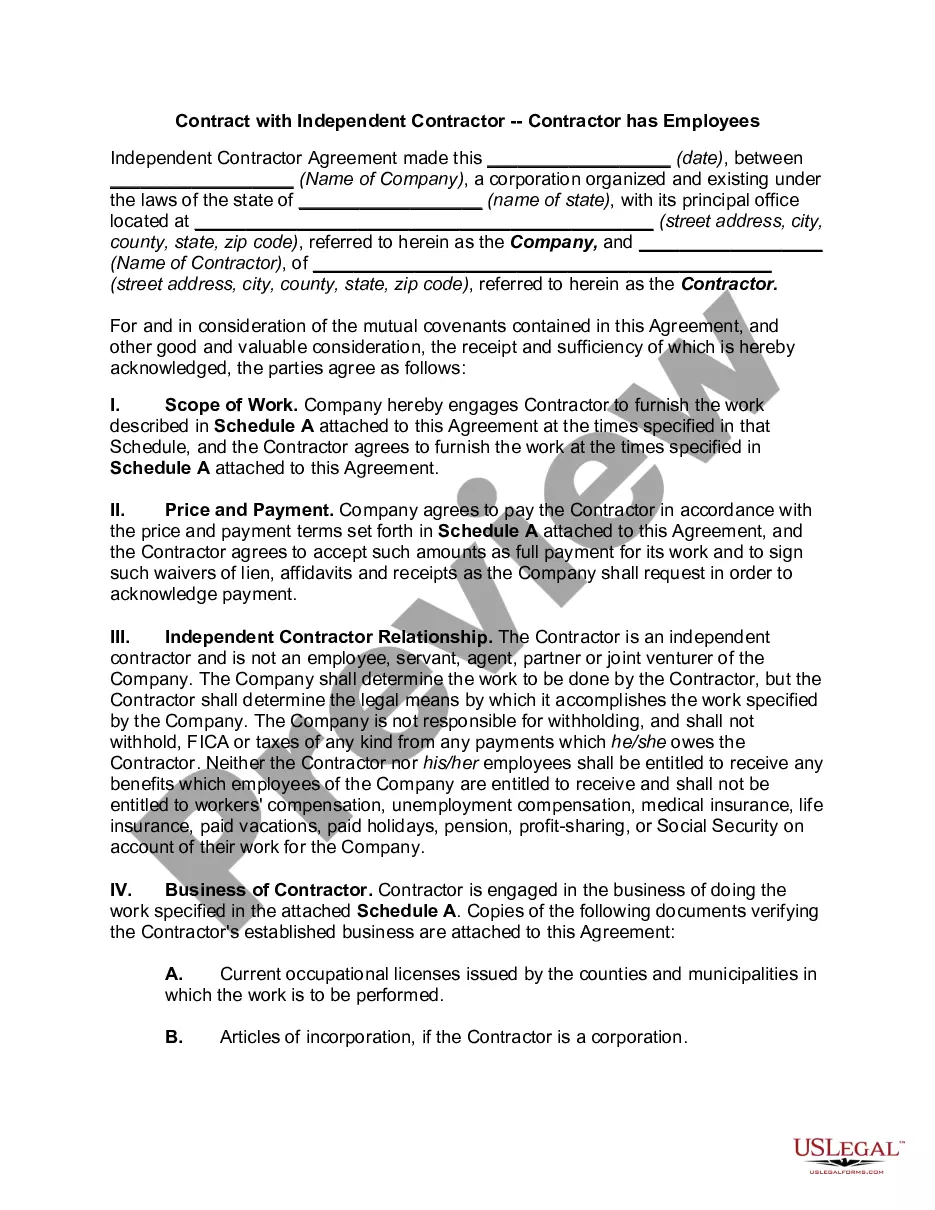

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

If you have to total, obtain, or print out legitimate record web templates, use US Legal Forms, the biggest collection of legitimate forms, that can be found on-line. Use the site`s simple and practical research to discover the documents you need. Various web templates for organization and specific uses are categorized by groups and suggests, or key phrases. Use US Legal Forms to discover the Utah Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose in a handful of clicks.

When you are currently a US Legal Forms customer, log in for your bank account and click on the Down load key to obtain the Utah Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose. You may also accessibility forms you in the past saved inside the My Forms tab of the bank account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your appropriate metropolis/nation.

- Step 2. Use the Review choice to examine the form`s articles. Do not forget about to see the explanation.

- Step 3. When you are unhappy with all the kind, utilize the Look for area towards the top of the screen to discover other types of the legitimate kind web template.

- Step 4. When you have located the shape you need, go through the Purchase now key. Opt for the pricing program you choose and add your accreditations to register for the bank account.

- Step 5. Method the transaction. You may use your charge card or PayPal bank account to finish the transaction.

- Step 6. Choose the structure of the legitimate kind and obtain it on your own gadget.

- Step 7. Complete, change and print out or indicator the Utah Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

Every single legitimate record web template you buy is your own for a long time. You possess acces to every single kind you saved in your acccount. Click the My Forms area and pick a kind to print out or obtain yet again.

Compete and obtain, and print out the Utah Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose with US Legal Forms. There are millions of skilled and condition-specific forms you can use for your organization or specific requirements.

Form popularity

FAQ

As noted above, estates and some older trusts may be eligible for an expanded charitable deduction for amounts permanently set aside for charity. For an irrevocable trust to qualify for a charitable set-aside deduction, in general, (1) no assets may have been contributed to the trust after Oct.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Although we commonly think of trust beneficiaries as single individuals, it is also possible to name an organization, such as a charity, as the beneficiary of a revocable trust. The process of naming the charity as the beneficiary is virtually no different than the one used to name an individual.

You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as Trust for Public Land without having to pay income taxes on the money.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Generally, you can name anyone, even a charity, as the beneficiary of your life insurance policy or retirement account. You can leave the entire amount of your death benefit to a charity or designate that only a portion of the proceeds goes to the charity and the remainder to a family member or other beneficiary.

Subject to the terms of the trust deed, the trustee can distribute income or capital to a charity.

Trusts can be grouped into several different categories, but two of the most common are simple trusts and complex trusts. By definition, simple trusts are not permitted to make charitable contributions, as all the income generated through a simple trust must be distributed to the trust's beneficiaries.

Beneficiary: Beneficiary(ies) refers to the person, persons, or organization that receives payments or assets from a trust. Beneficiaries can be either charitable or non-charitable, and can be either an income beneficiary or a remainder beneficiary. The beneficiary holds the beneficial title to the trust property.

Naming a charity as a life insurance beneficiary is simple: Write in the charity name and contact information when you choose or change your beneficiaries. You can name multiple beneficiaries and specify what percentage of the death benefit should go to each.