Utah Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

If you wish to comprehensive, obtain, or printing lawful papers templates, use US Legal Forms, the largest selection of lawful varieties, which can be found on-line. Use the site`s simple and easy handy research to obtain the documents you will need. Various templates for organization and specific uses are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the Utah Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor in just a number of clicks.

Should you be presently a US Legal Forms buyer, log in in your bank account and click the Obtain key to obtain the Utah Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor. You can also entry varieties you earlier downloaded within the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for that correct town/nation.

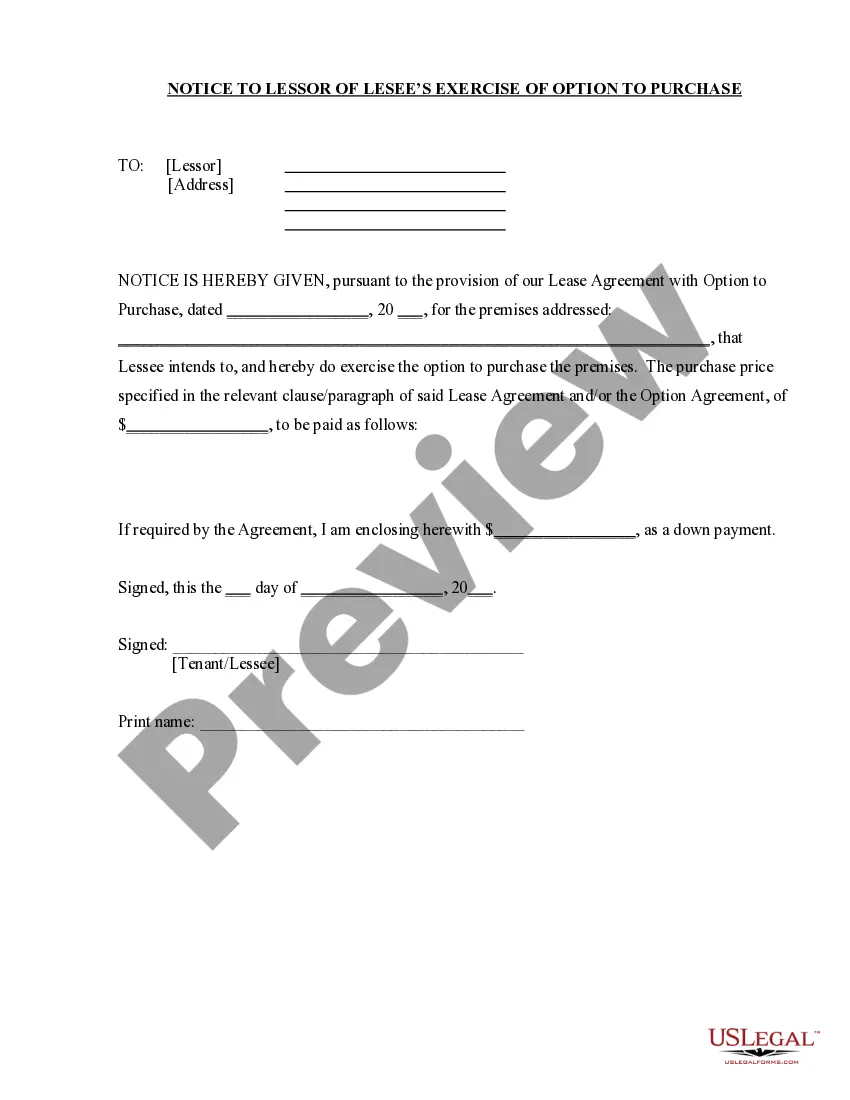

- Step 2. Make use of the Preview solution to look through the form`s content. Don`t forget about to read through the outline.

- Step 3. Should you be unsatisfied with the type, utilize the Look for area near the top of the display to get other models of the lawful type format.

- Step 4. Once you have found the shape you will need, go through the Purchase now key. Select the prices plan you choose and include your accreditations to sign up for the bank account.

- Step 5. Procedure the deal. You may use your credit card or PayPal bank account to perform the deal.

- Step 6. Select the file format of the lawful type and obtain it on your product.

- Step 7. Comprehensive, revise and printing or sign the Utah Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor.

Every lawful papers format you get is yours for a long time. You possess acces to each and every type you downloaded inside your acccount. Click the My Forms section and select a type to printing or obtain again.

Be competitive and obtain, and printing the Utah Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor with US Legal Forms. There are thousands of skilled and status-certain varieties you can utilize to your organization or specific needs.

Form popularity

FAQ

Any individual may be a trustee and a beneficiary of a trust assuming that the trust agreement names other lifetime beneficiaries or successor beneficiaries after the death of the initial beneficiaries. For example, suppose a client wanted to serve as trustee of an irrevocable trust created for his benefit.

Removing a Trustee But if the trustor is no longer alive or has an irrevocable trust, anyone wishing to remove a trustee will have to go to court. Any party with a reasonable interest in the trustsuch as co-trustee or a beneficiarymust file a petition with the probate court requesting that it remove the trustee.

While a grantor may technically be allowed to serve as the trustee of an irrevocable trust he creates, this can cause some problems.

A grantor does not have to give up rights of ownership and control of a living trust so s/he may be the Trustee of the living trust. On the other hand, if the grantor creates an irrevocable trust s/he cannot be the trustee of that trust.

With an irrevocable trust, you must get written consent from all involved parties to switch the trustee. That means having the trustmaker (the person who created the trust), the current trustee and all listed beneficiaries sign an amendment to remove the trustee and replace him or her with a new one.

Can a Beneficiary be removed from an Irrevocable Trust. A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust.

Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

The short answer is yes, a beneficiary can also be a trustee of the same trustbut it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.