Title: Utah Sample Letter for Distribution of Estate to Church — Comprehensive Guide Introduction: The distribution of an estate is a crucial process that involves disbursing the assets and properties left behind by a deceased individual. In the state of Utah, if a person wishes to distribute their estate to a church, a well-drafted sample letter can help facilitate the process. This article will provide a detailed description of what Utah Sample Letter for Distribution of Estate to Church entails, highlighting its significance and different types. Keywords: Utah, sample letter, distribution of estate, church, assets, properties, deceased, disbursement, process, comprehensive guide. 1. Purpose of the Utah Sample Letter for Distribution of Estate to Church: The purpose of this type of letter is to notify the church, designate the local branch, or ecclesiastical authority of the deceased individual's intention to allocate their estate to the said church. 2. Content of a Utah Sample Letter for Distribution of Estate to Church: — Date: The letter should begin by mentioning the date it is drafted. — Recipient's Details: Include the full name, address, and contact information of the intended recipient (church, local branch, or ecclesiastical authority). — Deceased Individual's Information: Provide the full legal name of the deceased, their date of birth, date of death, and their last known address. — Executor/Administrator Details: Mention the name, contact information, and relation (executor, administrator) of the individual responsible for handling the deceased's estate. — Statement of Intention: Clearly state the deceased individual's intention to distribute their estate to the mentioned church or religious organization. — Estate Description: Provide a comprehensive list of the assets, properties, and any other relevant items that encompass the deceased's estate. — Legal Process: Explain the steps that have been taken to abide by the legal requirements for estate distribution, such as probate proceedings or other necessary documentation. — Request for Assistance: Express the willingness to coordinate and cooperate with the church or religious organization to ensure a smooth distribution process. — Contact Information: Provide the executor's/administrator's contact details for further correspondence or queries. 3. Different Types of Utah Sample Letter for Distribution of Estate to Church: — Sample Letter for Distribution of Real Estate to Church: This type of letter focuses specifically on the distribution of real estate properties, including land, houses, or any other immovable assets, to the designated church. — Sample Letter for Distribution of Financial Assets to Church: Here, the letter emphasizes the allocation of financial assets, including cash, bank accounts, stock investments, or any other monetary possessions, to the mentioned church or religious organization. — Sample Letter for Distribution of Personal Belongings to Church: This variant highlights the intention of distributing personal belongings such as furniture, vehicles, jewelry, artwork, or sentimental possessions of the deceased to the nominated church. Conclusion: A well-crafted Utah Sample Letter for Distribution of Estate to Church is an essential document in the estate distribution process. It enables beneficiaries, the church, or religious organization to understand the deceased individual's intention clearly. By following the appropriate format and highlighting the necessary details, the distribution process can be carried out smoothly and efficiently.

Utah Sample Letter for Distribution of Estate to Church

Description

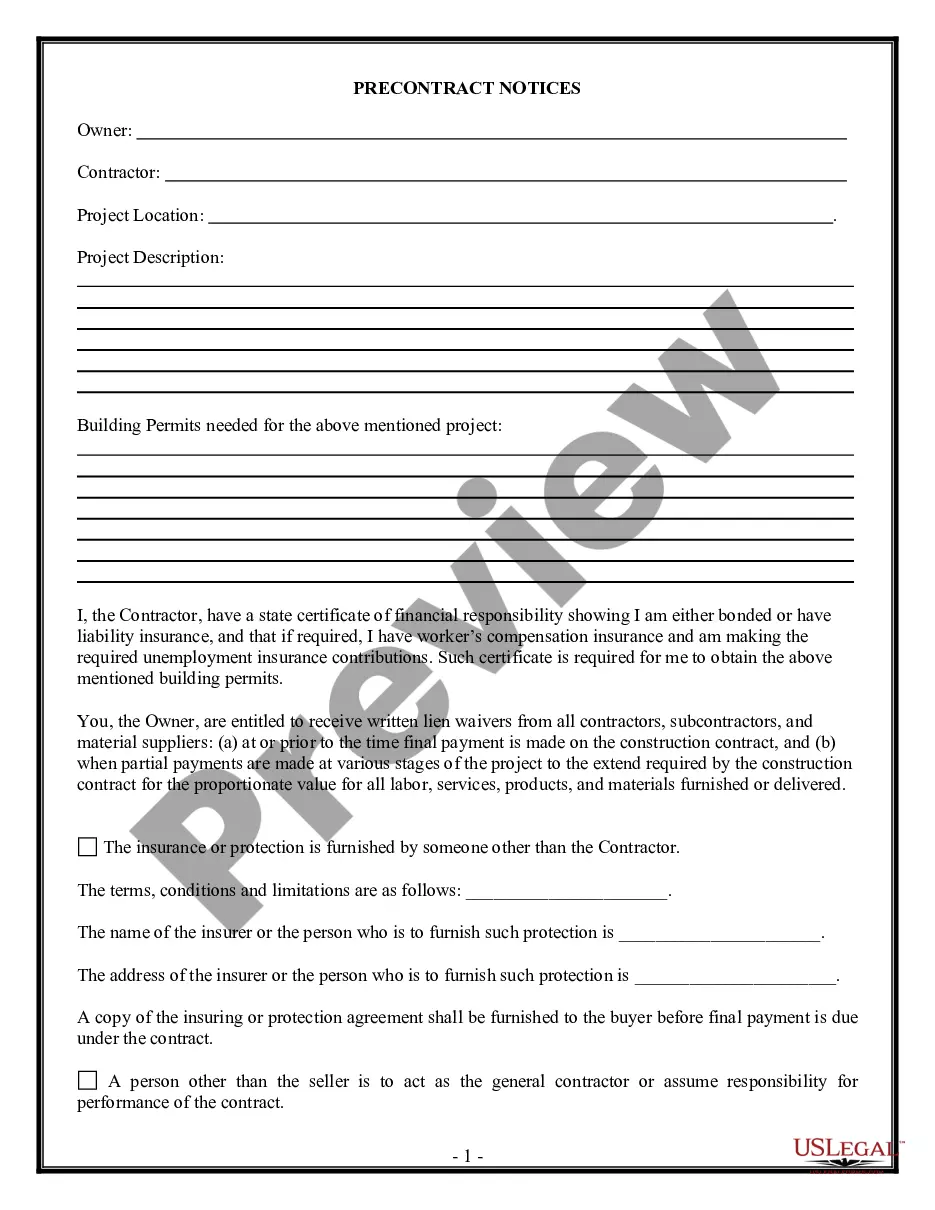

How to fill out Utah Sample Letter For Distribution Of Estate To Church?

Are you presently within a situation where you will need documents for both organization or personal reasons almost every working day? There are a variety of authorized papers templates accessible on the Internet, but finding kinds you can depend on is not effortless. US Legal Forms delivers 1000s of develop templates, just like the Utah Sample Letter for Distribution of Estate to Church, that are composed to satisfy state and federal demands.

When you are already informed about US Legal Forms internet site and get your account, simply log in. After that, you can download the Utah Sample Letter for Distribution of Estate to Church template.

Unless you provide an account and want to start using US Legal Forms, follow these steps:

- Find the develop you need and ensure it is for the correct town/region.

- Make use of the Preview switch to check the form.

- Look at the information to ensure that you have selected the correct develop.

- In case the develop is not what you`re looking for, use the Search area to get the develop that fits your needs and demands.

- Whenever you find the correct develop, simply click Buy now.

- Select the prices prepare you want, fill out the required information to generate your account, and buy your order using your PayPal or Visa or Mastercard.

- Select a hassle-free document formatting and download your copy.

Find every one of the papers templates you might have bought in the My Forms food list. You can obtain a more copy of Utah Sample Letter for Distribution of Estate to Church whenever, if necessary. Just click on the essential develop to download or print the papers template.

Use US Legal Forms, by far the most substantial variety of authorized types, to conserve efforts and steer clear of faults. The services delivers skillfully produced authorized papers templates which you can use for a variety of reasons. Produce your account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

Once disbursement is complete, meaning all debts and final taxes are paid, a trustee can distribute the inheritance to beneficiaries. This is called distribution. It is only then that money should be paid to the benefit or care of the beneficiary.

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.

How to write a beneficiary letter List important contact information. ... Give specific and clear instructions. ... Address your beneficiary personally. ... Keep multiple copies. ... Check the letter annually and update as needed.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.