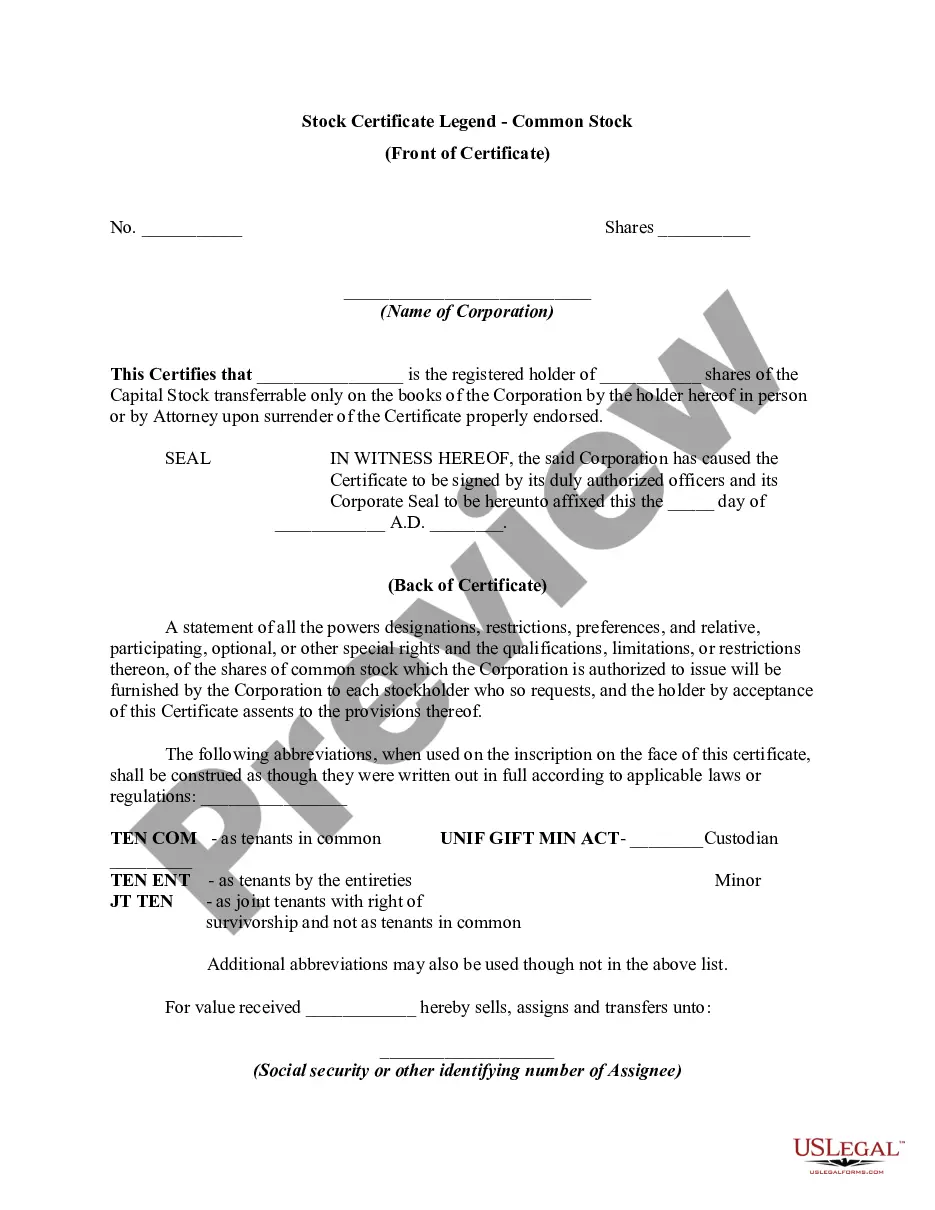

Utah Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

If you need to full, acquire, or printing authorized papers layouts, use US Legal Forms, the largest selection of authorized varieties, which can be found on the Internet. Take advantage of the site`s easy and hassle-free look for to get the files you want. Different layouts for company and individual purposes are categorized by classes and claims, or search phrases. Use US Legal Forms to get the Utah Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares in a number of click throughs.

Should you be presently a US Legal Forms buyer, log in to the bank account and click the Obtain key to get the Utah Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares. You may also entry varieties you earlier delivered electronically inside the My Forms tab of your bank account.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape to the proper area/region.

- Step 2. Take advantage of the Review method to examine the form`s information. Do not overlook to learn the description.

- Step 3. Should you be unsatisfied with all the develop, utilize the Look for area on top of the display to get other variations of your authorized develop web template.

- Step 4. After you have located the shape you want, select the Buy now key. Choose the pricing prepare you favor and include your qualifications to sign up for an bank account.

- Step 5. Approach the transaction. You can use your credit card or PayPal bank account to finish the transaction.

- Step 6. Find the structure of your authorized develop and acquire it on your own gadget.

- Step 7. Comprehensive, modify and printing or sign the Utah Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares.

Every single authorized papers web template you buy is your own property eternally. You have acces to each develop you delivered electronically inside your acccount. Go through the My Forms segment and pick a develop to printing or acquire again.

Compete and acquire, and printing the Utah Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares with US Legal Forms. There are millions of professional and express-certain varieties you may use for the company or individual demands.

Form popularity

FAQ

Restricted Stock Units cannot be sold or transferred while they are subject to forfeiture. This means that the employee cannot sell or transfer the units until they are vested.

Restricted stock units are a form of stock-based employee compensation. RSUs are restricted during a vesting period that may last several years, during which time they cannot be sold. Once they are vested, RSUs can be sold or kept like any other shares of company stock.

You can sell your restricted stock after the vesting period is over. However, you cannot sell restricted stock units within the vesting period. How long do you have to hold restricted stock? You need to hold restricted stock until the end of the vesting period.

Rule 144 is a set of regulations that outline the conditions in which the sale of unregistered or restricted stock shares can be sold. Typically, criteria must be met before a sale is allowed, including a minimum period in which the stock should be held, which can be up to one year.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

Removing a restricted stock legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes about the removal of legends. Thus, the SEC will not take action in any decision or dispute about removing a restrictive legend.

Sometimes they don't allow transfers, or only allow them during an open window. Assuming they allow transfers it is important to note that, notwithstanding how you acquired them (RSU/ESPP/NQ) they are nothing but long shares of common stock. So they can be transferred to any brokerage firm.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar ...