Utah Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Are you currently in a situation in which you require paperwork for either enterprise or personal uses just about every working day? There are a lot of authorized document web templates available online, but getting ones you can depend on isn`t simple. US Legal Forms delivers a huge number of kind web templates, like the Utah Challenge to Credit Report of Experian, TransUnion, and/or Equifax, which can be composed to meet federal and state demands.

If you are currently acquainted with US Legal Forms site and also have an account, merely log in. Following that, you may obtain the Utah Challenge to Credit Report of Experian, TransUnion, and/or Equifax template.

If you do not come with an account and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for that right area/county.

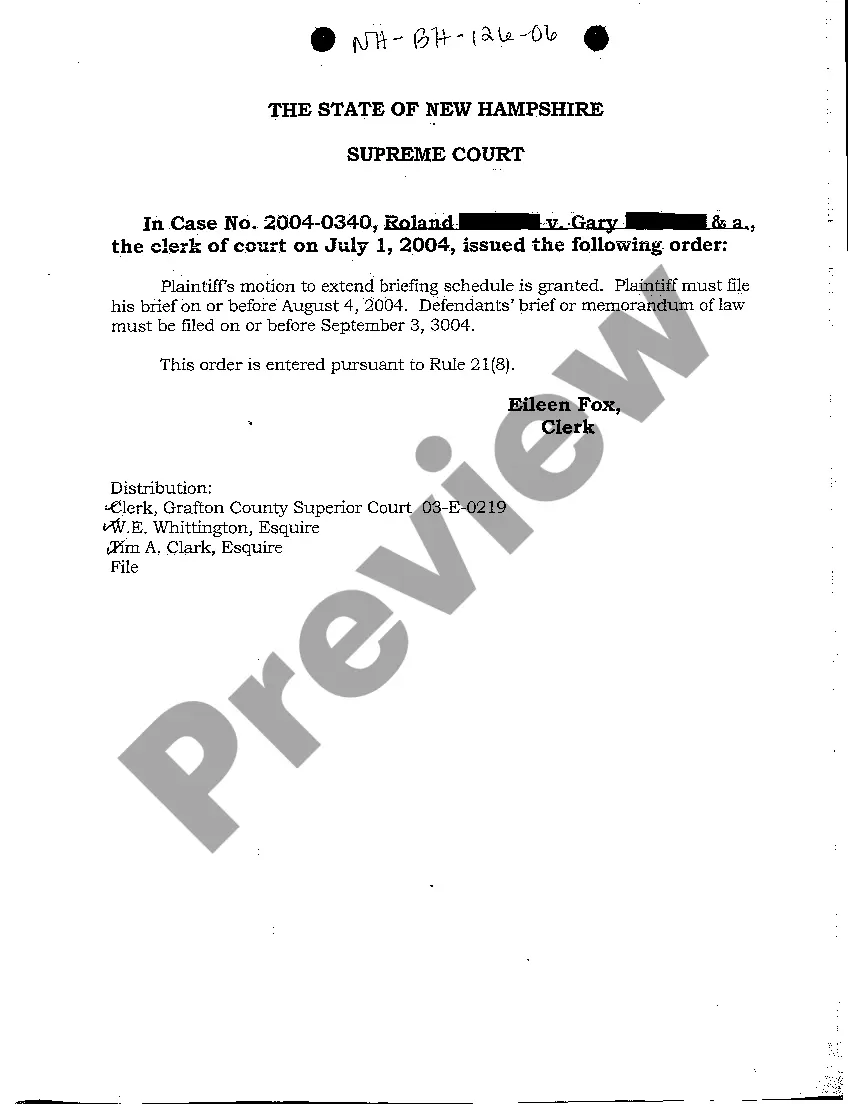

- Take advantage of the Preview option to review the shape.

- Browse the outline to actually have chosen the appropriate kind.

- In the event the kind isn`t what you`re searching for, utilize the Look for discipline to get the kind that fits your needs and demands.

- Once you discover the right kind, simply click Get now.

- Pick the prices strategy you want, complete the desired information to make your account, and pay money for your order with your PayPal or charge card.

- Select a convenient data file structure and obtain your duplicate.

Get each of the document web templates you may have bought in the My Forms menus. You may get a more duplicate of Utah Challenge to Credit Report of Experian, TransUnion, and/or Equifax anytime, if necessary. Just click the required kind to obtain or produce the document template.

Use US Legal Forms, the most comprehensive assortment of authorized kinds, to save time as well as steer clear of errors. The services delivers skillfully manufactured authorized document web templates that can be used for a variety of uses. Generate an account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries can't be removed, however, unless they're the result of identity theft. Otherwise, they'll have to fall off naturally, which happens after two years.

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

The quickest and easiest way to dispute your Experian credit report is to check your credit report online and submit corrections through the online Dispute Center.

How To Create The Dispute Help-desk: 0861 10 56 65. Email: EZA.consumer@experian.com. Fax: 011 707 6786.

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

The Experian Dispute Center is your source for correcting credit report information that you consider incomplete or inaccurate. Once you've had a chance to read through the information there, click "Start a new dispute" to view your credit report and select an entry to dispute. Indicate the reason for each dispute.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.