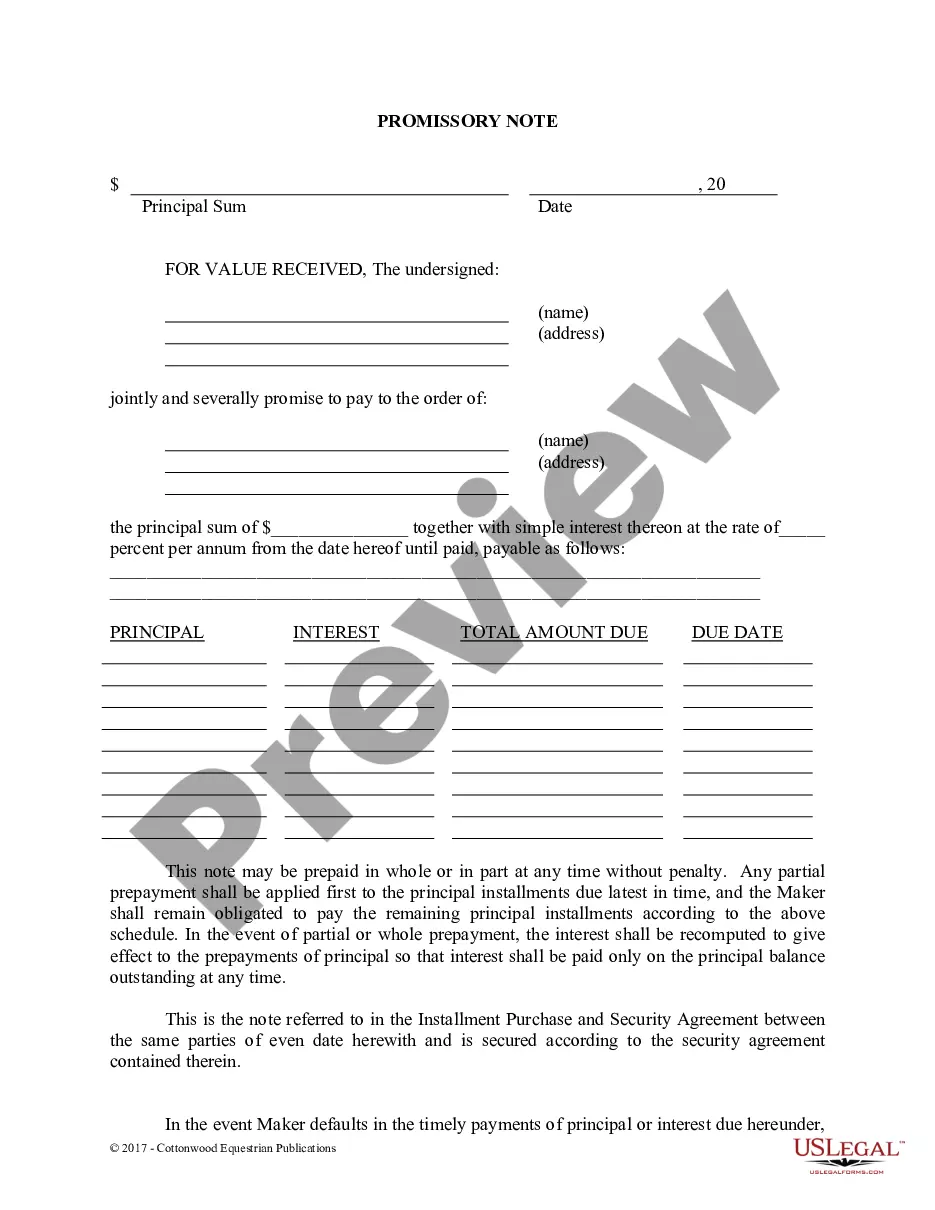

A Utah Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a commercial loan agreement between a borrower and a lender in the state of Utah. It is specifically designed for loans that are secured by real property, such as commercial buildings or land. This promissory note serves as evidence of the borrower's promise to repay the loan according to the agreed-upon terms. It includes essential details like the loan amount, interest rate, repayment schedule, and any additional provisions specific to the commercial loan and the real property being used as collateral. In Utah, there are different types of promissory notes for commercial loans secured by real property, including: 1. Fixed-rate Promissory Note: This type of promissory note establishes a fixed interest rate for the entire duration of the loan, ensuring that the borrower's monthly payments remain consistent. 2. Adjustable-rate Promissory Note: An adjustable-rate promissory note allows for changes in the interest rate over time, typically based on a predetermined index. The interest rate may fluctuate, resulting in varying monthly payments for the borrower. 3. Balloon Payment Promissory Note: This type of promissory note includes regular payments over an agreed-upon period, but with a larger "balloon" payment at the end of the loan term. This payment typically covers the remaining principal amount, providing flexibility for borrowers who anticipate refinancing or selling the property before the balloon payment is due. 4. Installment Promissory Note: An installment promissory note outlines a repayment plan in which the loan amount, including principal and interest, is repaid in regular installments over a fixed period. This type of note is useful for borrowers looking for consistent, manageable payments. It is important to note that the specific terms and conditions of each promissory note may vary depending on the agreement between the borrower and the lender, the nature of the commercial loan, and the real property being used as collateral. Consulting with a legal professional is always recommended ensuring that the promissory note complies with Utah state laws and adequately protects the interests of all parties involved.

Utah Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Utah Promissory Note For Commercial Loan Secured By Real Property?

It is possible to spend hrs online looking for the legal document format which fits the federal and state demands you require. US Legal Forms offers thousands of legal forms that happen to be reviewed by specialists. It is simple to obtain or printing the Utah Promissory Note for Commercial Loan Secured by Real Property from my service.

If you have a US Legal Forms account, you are able to log in and click on the Acquire switch. After that, you are able to complete, modify, printing, or signal the Utah Promissory Note for Commercial Loan Secured by Real Property. Every legal document format you acquire is your own for a long time. To acquire an additional backup of any bought type, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms internet site for the first time, follow the simple recommendations beneath:

- First, be sure that you have chosen the right document format for your state/city of your liking. Browse the type information to ensure you have picked out the proper type. If offered, take advantage of the Preview switch to check through the document format at the same time.

- In order to find an additional version of the type, take advantage of the Lookup industry to get the format that meets your needs and demands.

- When you have discovered the format you want, click on Buy now to continue.

- Find the pricing strategy you want, enter your references, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal account to pay for the legal type.

- Find the format of the document and obtain it for your device.

- Make modifications for your document if required. It is possible to complete, modify and signal and printing Utah Promissory Note for Commercial Loan Secured by Real Property.

Acquire and printing thousands of document templates while using US Legal Forms web site, which provides the greatest assortment of legal forms. Use specialist and express-certain templates to handle your small business or individual requires.