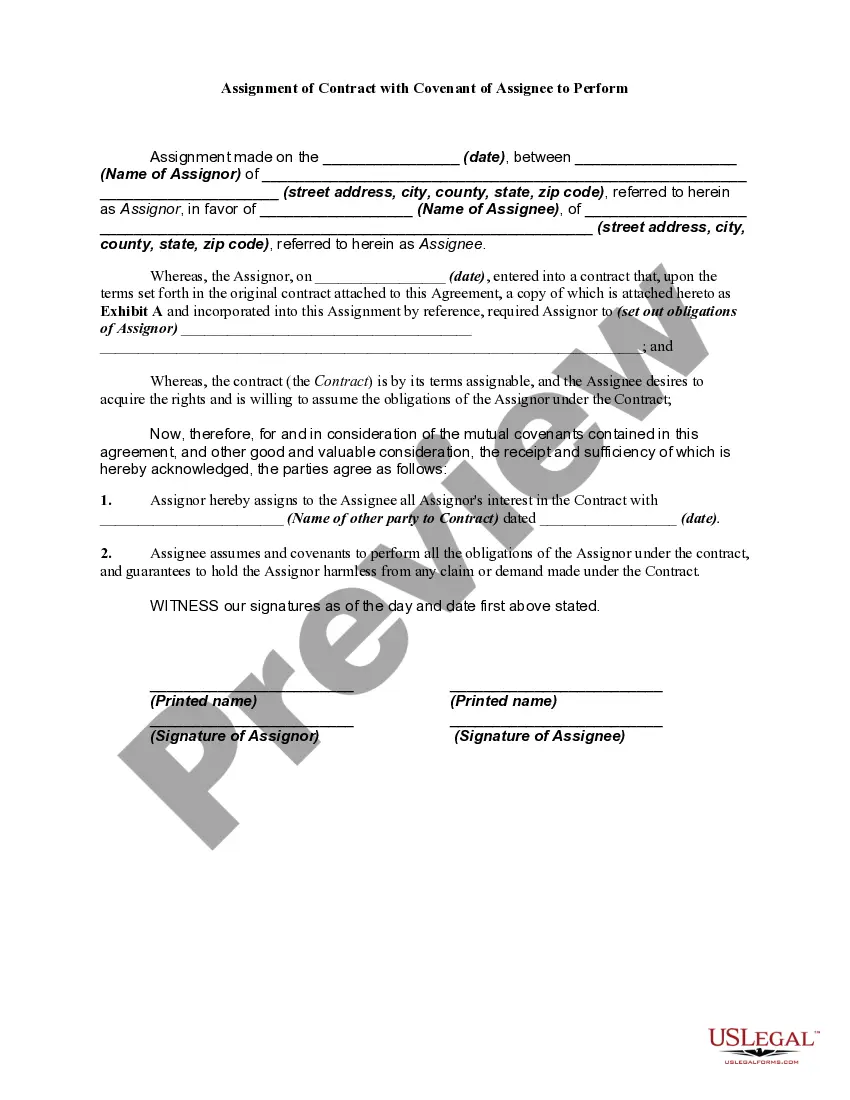

Utah Assignment of Contract as Security for Loan is a legal agreement where a borrower assigns their rights and obligations under a contract to a lender as collateral for a loan. This provides the lender with additional security and allows them to recover their investment if the borrower defaults on the loan. In Utah, there are two main types of Assignment of Contract as Security for Loan: 1. Absolute Assignment: This type of assignment allows the lender to assume full control over the assigned contract. The lender gains the right to receive all payments and benefits from the contract, as well as the responsibility to fulfill any obligations or liabilities associated with it. Once the loan is fully repaid, the assignment is terminated, and the contract rights are returned to the borrower. 2. Conditional Assignment: In this type of assignment, the lender only acquires partial rights to the contract. The borrower authorizes the lender to collect payments from the assigned contract until the loan is repaid. Unlike absolute assignment, the borrower retains some control over the contract and continues to fulfill their obligations and liabilities. Once the loan is fully repaid, the assignment is terminated, and the borrower regains full control over the contract. Regardless of the type of assignment, a Utah Assignment of Contract as Security for Loan typically includes the following key elements: 1. Identification of Parties: The document clearly identifies the borrower, lender, and any third party (if applicable) involved in the assignment. 2. Contract Identification: The contract to be assigned is fully described, including details such as contract date, parties involved, and a brief summary of its terms and conditions. 3. Assignment of Rights: The borrower assigns their rights, title, and interest in the contract to the lender, providing them with the authority to enforce the contract and collect payments. 4. Collateral Description: The document specifies the loan amount, interest rate, repayment terms, and any specific collateral offered as security for the loan. 5. Representations and Warranties: Both parties may include statements ensuring the legality of the contract, borrower's ownership of rights, and absence of any claims or encumbrances on the contract. 6. Default Clause: This section outlines the consequences if the borrower fails to repay the loan, including the lender's rights to enforce the contract and recover any outstanding amounts owed. 7. Governing Law: The agreement specifies that Utah law will govern the assignment, and any disputes will be resolved in Utah courts. Utah Assignment of Contract as Security for Loan serves to protect the interests of lenders while providing borrowers with access to financing. It is crucial for all parties involved to carefully review and understand the terms and conditions outlined in the agreement before entering into such a legal arrangement.

Utah Assignment of Contract as Security for Loan

Description

How to fill out Utah Assignment Of Contract As Security For Loan?

Discovering the right legitimate document format can be quite a struggle. Needless to say, there are tons of layouts available online, but how would you obtain the legitimate form you will need? Make use of the US Legal Forms site. The support offers thousands of layouts, such as the Utah Assignment of Contract as Security for Loan, that you can use for enterprise and personal requires. Every one of the types are inspected by specialists and fulfill federal and state requirements.

In case you are previously authorized, log in in your accounts and click the Down load key to find the Utah Assignment of Contract as Security for Loan. Use your accounts to appear with the legitimate types you have acquired previously. Visit the My Forms tab of your own accounts and get an additional duplicate of your document you will need.

In case you are a fresh consumer of US Legal Forms, here are easy directions so that you can follow:

- Initial, make sure you have selected the right form for your personal area/state. You may examine the form making use of the Preview key and read the form information to ensure it will be the right one for you.

- In case the form fails to fulfill your expectations, use the Seach discipline to discover the correct form.

- When you are positive that the form is acceptable, select the Acquire now key to find the form.

- Opt for the prices prepare you desire and enter in the required details. Build your accounts and pay money for the transaction using your PayPal accounts or credit card.

- Opt for the document format and down load the legitimate document format in your device.

- Complete, change and produce and signal the attained Utah Assignment of Contract as Security for Loan.

US Legal Forms is definitely the most significant catalogue of legitimate types in which you can see a variety of document layouts. Make use of the service to down load professionally-produced papers that follow condition requirements.