Utah Jury Instruction — 1.9.5.1 Corporation As Alter Ego Of Stockholder Utah Jury Instruction 1.9.5.1 addresses the legal concept of a corporation being considered the "alter ego" of its stockholder(s). When individuals form a corporation, they often aim to separate their personal liabilities from those of the corporation. However, situations may arise where a court may "pierce the corporate veil" and hold stockholders personally liable for the corporation's debts or actions. This jury instruction helps the jury understand the circumstances under which this legal principle applies. Keywords: Utah, jury instruction, 1.9.5.1, corporation, alter ego, stockholder, legal concept, separate liabilities, personal liabilities, pierce the corporate veil, debts, actions. Types of Utah Jury Instruction — 1.9.5.1 Corporation As Alter Ego Of Stockholder: 1. Basic Instruction: This type of instruction provides a general overview of the legal principle of a corporation as the alter ego of its stockholders. It explains the concept, its purpose, and the circumstances under which a court may consider stockholders personally liable for the corporation's obligations. 2. Factors for Alter Ego Determination: This instruction outlines specific factors the jury should consider when determining whether the corporation acts as the alter ego of its stockholder(s). These factors often include inadequate capitalization, disregard of corporate formalities, commingling of assets, and using the corporation as a mere façade or instrumentality for personal business. 3. Permissible Consequences: This instruction elucidates the potential consequences if the jury determines that the corporation is the alter ego of its stockholder(s). It may detail the remedies available to the plaintiff, such as holding the stockholders personally liable for the corporation's debts, lifting the corporate veil, and allowing the plaintiff to access the stockholders' personal assets. 4. Comparative Negligence: In some cases, the stockholder(s) may allege that the plaintiff's own actions contributed to the corporation's liability, modifying the concept of alter ego. This instruction advises the jury on how to evaluate comparative negligence and proportionately allocate responsibility between the stockholder(s) and the plaintiff. 5. Burden of Proof: This instruction clarifies the burden of proof applicable to the altar ego claim. It explains whether the burden lies with the plaintiff to demonstrate that the corporation is an alter ego, or if the defendant stockholder(s) must disprove it. It's essential to consult the official Utah jury instructions for the most accurate and up-to-date information on Utah Jury Instruction — 1.9.5.1 Corporation As Alter Ego Of Stockholder, as these instructions may vary over time.

Utah Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

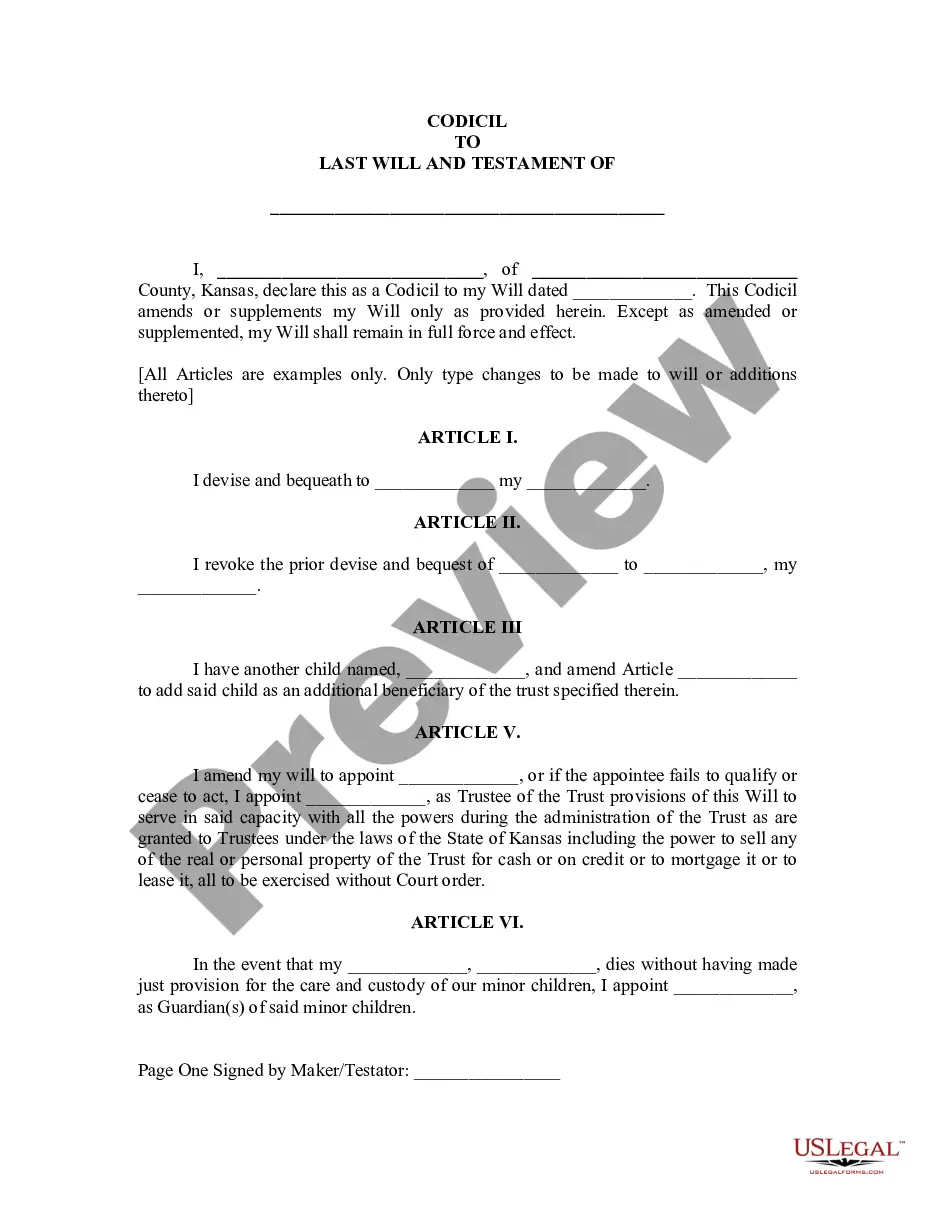

You may invest hours on the Internet looking for the lawful file design that fits the federal and state needs you need. US Legal Forms offers thousands of lawful forms that happen to be examined by experts. You can easily obtain or printing the Utah Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder from my support.

If you have a US Legal Forms account, it is possible to log in and click the Down load key. Afterward, it is possible to comprehensive, revise, printing, or signal the Utah Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder. Every lawful file design you buy is the one you have permanently. To have another version for any obtained type, visit the My Forms tab and click the related key.

If you work with the US Legal Forms website the first time, follow the straightforward instructions listed below:

- Very first, ensure that you have selected the correct file design to the state/area of your liking. Browse the type information to ensure you have picked out the correct type. If readily available, use the Preview key to check through the file design as well.

- In order to find another edition of the type, use the Look for industry to find the design that fits your needs and needs.

- Upon having discovered the design you desire, simply click Get now to move forward.

- Choose the rates prepare you desire, type your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal account to fund the lawful type.

- Choose the format of the file and obtain it in your product.

- Make alterations in your file if possible. You may comprehensive, revise and signal and printing Utah Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder.

Down load and printing thousands of file layouts making use of the US Legal Forms website, which provides the most important assortment of lawful forms. Use skilled and status-certain layouts to take on your small business or person requirements.