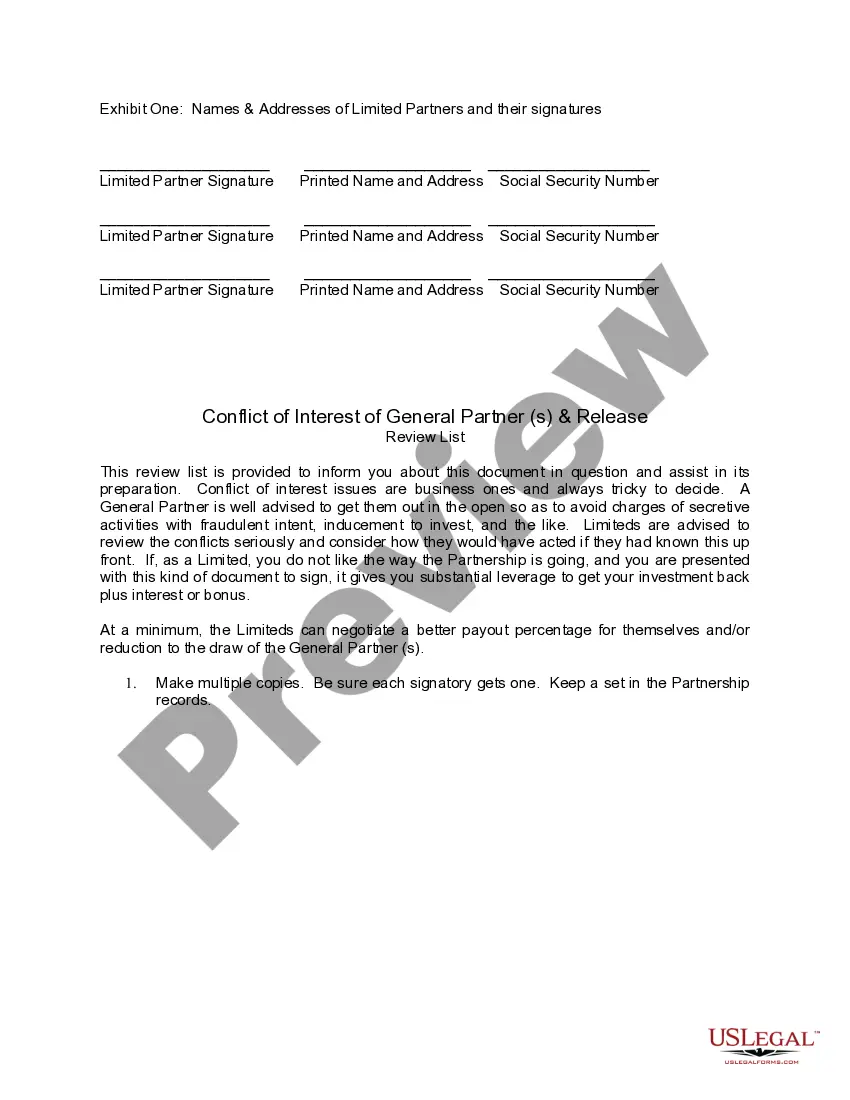

Utah Conflict of Interest of General Partner and Release is a legal term used to describe a situation wherein a general partner involved in a business entity, such as a partnership or limited partnership, has a personal interest that potentially conflicts with the best interests of the partnership or its other partners. When such conflicts arise, various legal provisions in Utah help address and manage these situations. One type of Utah Conflict of Interest of General Partner is related to financial matters. This occurs when a general partner engages in transactions or activities that may result in personal financial gain or loss but could harm the partnership's financial well-being. Examples may include a general partner diverting partnership funds for personal use, engaging in self-dealing transactions to benefit themselves at the expense of the partnership, or accepting bribes or kickbacks from third parties. Another type of Conflict of Interest of General Partner in Utah could involve competing with the partnership. This occurs when a general partner participates in activities that directly compete with the partnership's business operations. This conflict may arise if a general partner establishes or invests in a competing business, exploits business opportunities that should have been presented to the partnership, or discloses confidential partnership information to a competitor. Furthermore, conflicts of interest may extend to the personal relationships of a general partner, such as family or close friendships, which may influence decision-making processes. It is crucial for general partners to avoid favoring their personal relationships at the expense of the partnership's best interests. To address Conflict of Interest situations in Utah, general partnerships typically establish clear guidelines and provisions within their partnership agreements. These agreements define circumstances that could give rise to a conflict and outline the steps to be taken, such as disclosure of the conflict to all partners, refusal from decision-making processes, or seeking unanimous consent from all partners. Additionally, Utah law requires general partners to act with fiduciary duty towards the partnership and its partners. This means that they must act in perfect faith, honesty, and loyalty, always placing the partnership's interests before their own. When conflicts of interest arise, general partners must promptly disclose the conflict and seek a resolution that best serves the partnership. A Release in the context of Utah Conflict of Interest may refer to a legal document signed by partners or the partnership, releasing a general partner from any liability or claims arising out of a disclosed conflict of interest. This release ensures that the general partner will not be held personally responsible for any losses or damages incurred by the partnership due to the conflict. However, it is important to note that such releases must be carefully drafted, considering the specific circumstances and potential consequences they may have. In summary, Utah Conflict of Interest of General Partner and Release is a significant aspect of partnership law, aimed at managing situations where a general partner's personal interests conflict with the partnership's best interests. Provisions within partnership agreements and adherence to Utah's legal requirements play a crucial role in addressing, resolving, and preventing conflicts of interest, while ensuring the partnership's stability and success.

Utah Conflict of Interest of General Partner and Release

Description

How to fill out Utah Conflict Of Interest Of General Partner And Release?

Choosing the best legitimate record web template might be a battle. Obviously, there are a variety of web templates accessible on the Internet, but how do you obtain the legitimate type you want? Make use of the US Legal Forms website. The assistance gives 1000s of web templates, for example the Utah Conflict of Interest of General Partner and Release, which can be used for organization and private needs. All of the kinds are examined by experts and meet state and federal needs.

If you are previously signed up, log in to the account and click on the Down load button to find the Utah Conflict of Interest of General Partner and Release. Use your account to appear through the legitimate kinds you have bought in the past. Check out the My Forms tab of your account and have an additional duplicate from the record you want.

If you are a new customer of US Legal Forms, listed here are basic instructions that you should comply with:

- Initial, ensure you have selected the appropriate type for your area/area. It is possible to check out the form using the Preview button and browse the form information to ensure it will be the right one for you.

- When the type is not going to meet your preferences, use the Seach industry to discover the proper type.

- When you are certain the form is proper, select the Purchase now button to find the type.

- Choose the costs prepare you need and enter in the essential information. Make your account and pay for your order utilizing your PayPal account or bank card.

- Opt for the submit format and down load the legitimate record web template to the device.

- Full, change and printing and indication the obtained Utah Conflict of Interest of General Partner and Release.

US Legal Forms will be the most significant collection of legitimate kinds that you can find different record web templates. Make use of the company to down load skillfully-manufactured documents that comply with status needs.

Form popularity

FAQ

Broadly, following is the process for dissolving a Utah LLC:Hold a meeting of members and pass a resolution to dissolve the company.File the annual and other required reports with the state agency.Pay off all the outstanding business debts of the company.Pay all the outstanding taxes and fees owed by the company.More items...

To dissolve your corporation in Utah, you must provide the completed Articles of Dissolution (After Issuance of Shares) form to the Division of Corporations & Commercial Code by mail, fax or in person. File it in duplicate if you need a returned copy along with a prepared envelope.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

A. The person engaged in wrongful conduct that adversely and materially affected the. limited partnership activities. b. The person willfully or persistently committed a material breach of the partnership.

You can cancel/dissolve a Domestic Limited Liability Limited Partnership by filing a Statement of Dissolution . You can also terminate a Domestic LLLP by filing a Statement of Termination . Or you can withdraw a Foreign Limited Liability Limited Partnership by filing a Withdrawal of Registration of a Foreign LLLP .

Limited Partnership For any other person to be a limited partner, the company must have at least one general partner. General partners can be an individual, a group, or a business can serve as general partners. Limited partners aren't involved in the day-to-day operations and management of the company.

General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

How to Remove a Member from an LLCDetermine whether the LLC's governing documents set out formal procedures.Implement the formal procedure.Have the former member submit a written notice of withdrawal.File a petition for judicial dissolution.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

In basic terms, the dissolution of a partnership refers to the steps involved in winding up the business, preparing for termination. Termination is the final result; the company has ceased all business activity and no longer exists. How to dissolve a partnership?