Utah Employee Lending Agreement

Description

How to fill out Employee Lending Agreement?

If you wish to aggregate, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Leverage the site's simple and convenient search functionality to locate the documents you require.

A range of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document template you acquire is yours permanently. You will have access to all forms you saved in your account.

Complete and download, and print the Utah Employee Lending Agreement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to locate the Utah Employee Lending Agreement in just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click the Download button to retrieve the Utah Employee Lending Agreement.

- You can also access forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these instructions.

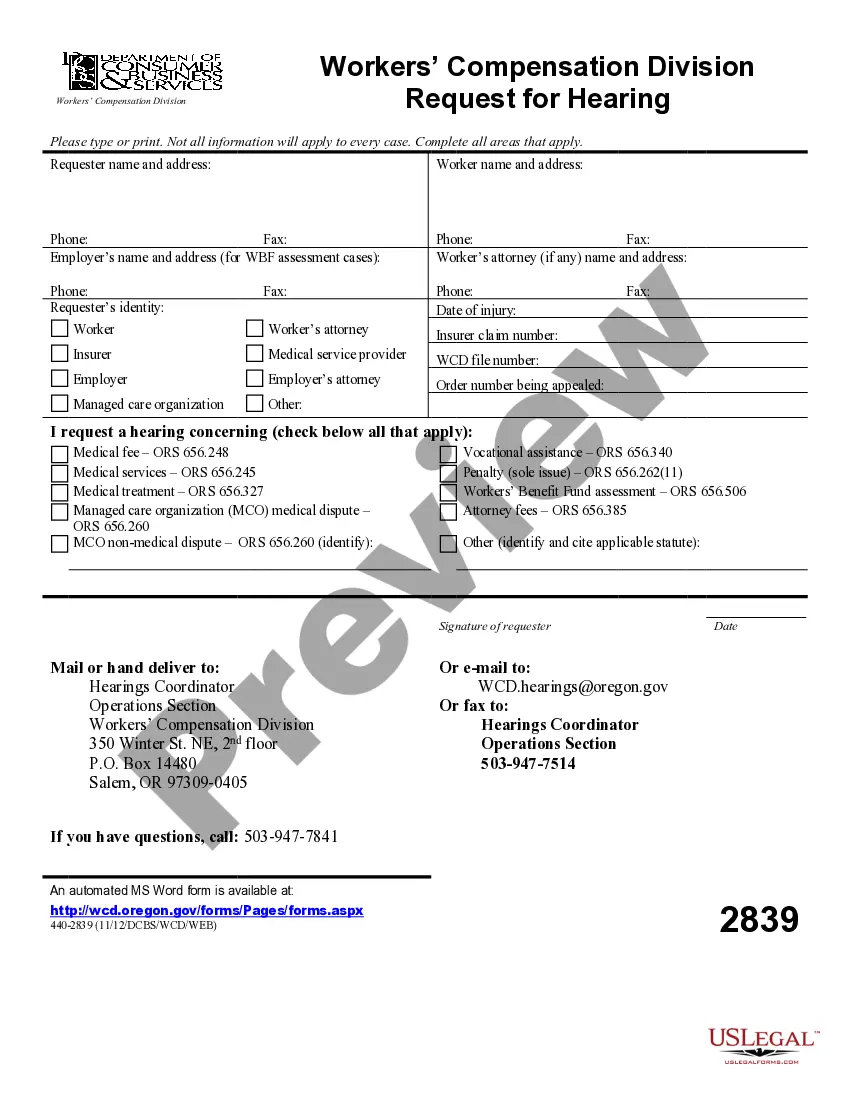

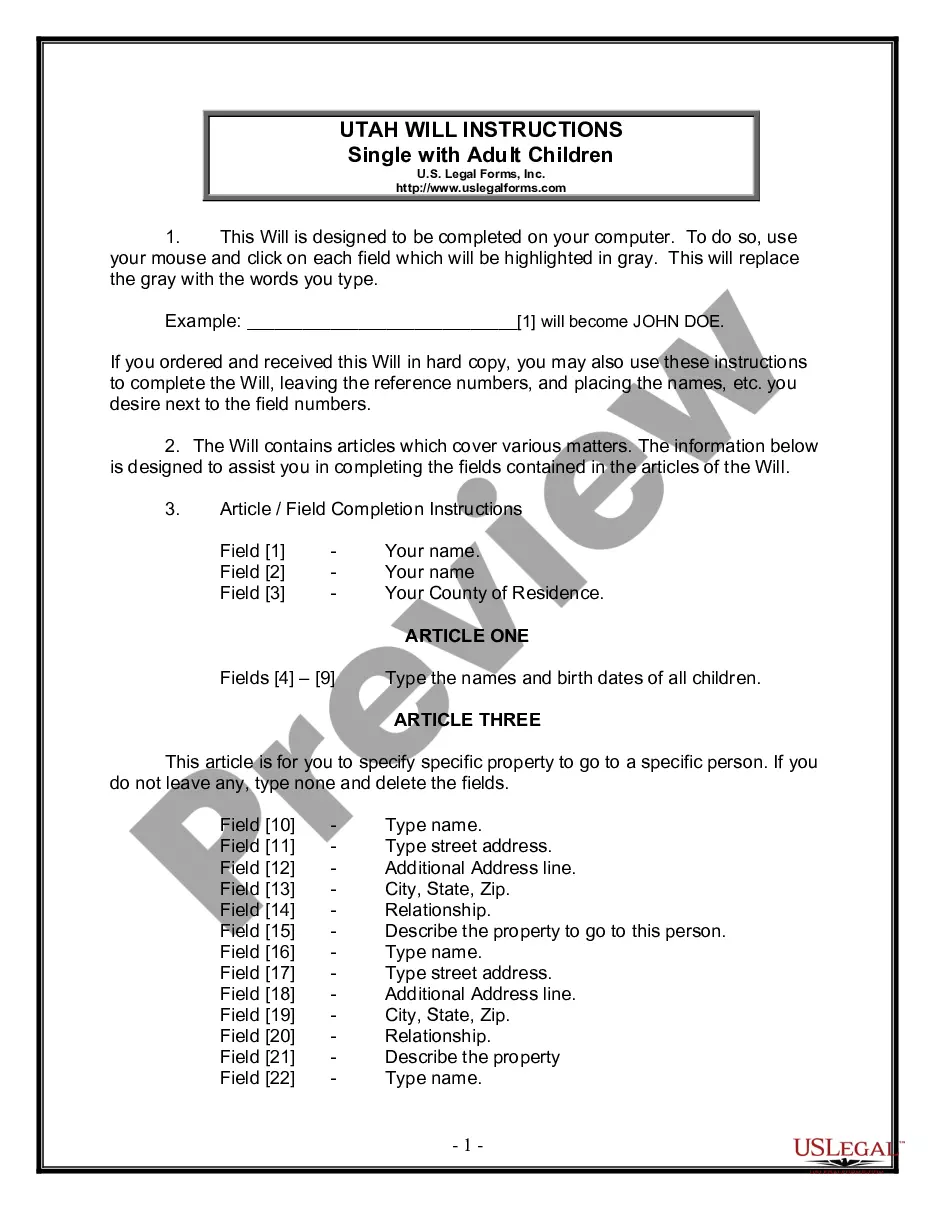

- Step 1. Ensure you have chosen the form for the correct region/country.

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, print, or sign the Utah Employee Lending Agreement.

Form popularity

FAQ

Utah is an employment-at-will state. This means that an employer may generally terminate an employee at any time and for any reason, unless a law or contract provides otherwise.

Utah Law: No Meal or Rest Breaks Required Employers in Utah must follow the federal rules explained above. In other words, although breaks are not required, employers must pay employees for time they spend working and for shorter breaks during the day.

All employment agreements are legally binding on the employer and, therefore, employers are best served by having them drafted and reviewed by an experienced employment law attorney. Contract law is a particularly complex discipline that relies largely on common law, which is law as developed by judges and court cases.

A contract between an employer and an employee or worker is a legally binding agreement. This could be a 'contract of employment' or a 'contract of service'. A contract can be agreed verbally or in writing.

With Utah being an at-will employment state, your rights as an employee have limits. However, your employer's power is not absolute. While businesses may attempt to hide an improper firing by hiding behind their right to do so without reason, an informed employee can fight back.

Utah labor regulations require that workers offer a meal period that is less than thirty (30) minutes to workers under the age of eighteen (18) working over (5) hours. Employers must offer a 10-minute break to workers eighteen (18) and under for every three (3) hour work phases or part thereof that is operated.

Once the applicant has accepted the job, there is a legally binding contract of employment between the employer and the applicant. The law does not require witnesses or a signature to make it valid. What really matters is that there is an offer, acceptance, consideration and the intention to create legal relations.

Employees have a right to: Not be harassed or discriminated against (treated less favorably) because of race, color, religion, sex (including pregnancy, sexual orientation, or gender identity), national origin, disability, age (40 or older) or genetic information (including family medical history).

Under Utah law, employees are entitled to certain leaves or time off, including jury duty and witness leave, voting leave, minor child court appearance leave, military leave and emergency responder leave. See Time Off and Leaves of Absence.

The best way to pay your employees is through direct deposit. But cash and paper checks are also options. Utah does not have a state minimum wage, so the federal minimum wage of $7.25 per hour applies. You can pay your federal and Utah state taxes online.