Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is an agreement between an insurance agency and a general agency based in Utah, which grants exclusive representation rights to the general agency for all lines of insurance. This agreement outlines the terms and conditions, roles, and responsibilities of both parties involved in the partnership. The purpose of this agreement is to establish a mutually beneficial relationship between the insurance agency and the general agency. The insurance agency appoints the general agency as its sole representative for various lines of insurance, which may include property and casualty, life, health, auto, commercial, and other specialized insurance products. There are several types of Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, including: 1. Property and Casualty Insurance General Agency Agreement: This type of agreement exclusively delegates the representation rights of all property and casualty insurance policies to the general agency. It covers a wide range of insurance products related to property damage, liability coverage, and other related risks. 2. Life Insurance General Agency Agreement: This specific agreement grants exclusive representation for all life insurance policies to the general agency. It encompasses various life insurance products, such as term life insurance, whole life insurance, universal life insurance, and annuities. 3. Health Insurance General Agency Agreement: This type of agreement focuses on granting the general agency exclusive representation for all health insurance policies. It covers individual health insurance plans, group health insurance, Medicare supplements, and other related health coverage options. 4. Auto Insurance General Agency Agreement: This agreement pertains to granting exclusive representation for all auto insurance policies to the general agency. It includes coverage for personal automobiles, commercial vehicles, motorcycle insurance, and other motor vehicle-related insurance products. 5. Commercial Insurance General Agency Agreement: This type of agreement provides exclusive representation rights to the general agency for all commercial insurance lines. It covers various business insurance products, such as general liability insurance, professional liability insurance, commercial property insurance, and workers' compensation insurance. The Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is designed to facilitate a collaborative partnership between the insurance agency and the general agency, allowing them to leverage their respective expertise and resources to effectively market and sell a wide spectrum of insurance products. Through this agreement, both parties aim to maximize their business potentials and provide comprehensive insurance solutions to clients in Utah and beyond.

Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

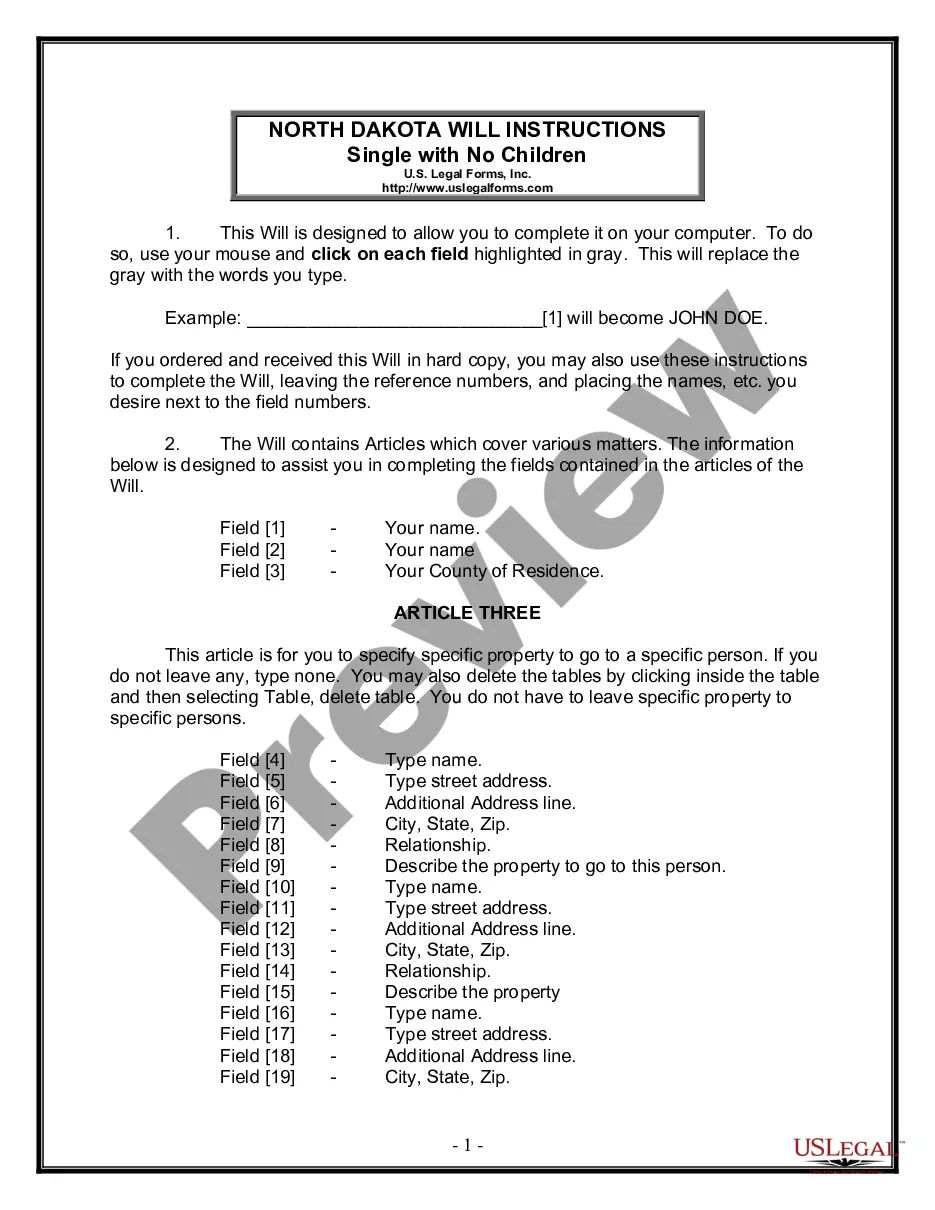

How to fill out Utah Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

It is feasible to spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are evaluated by professionals.

You can easily obtain or create the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance through my service.

If available, use the Review option to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Subsequently, you can fill out, modify, create, or sign the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

- Every legal document template you receive is yours permanently.

- To obtain another version of a purchased form, navigate to the My documents tab and click on the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- Initially, ensure you have selected the correct document template for the county/area of your choice.

- Review the document description to confirm you have chosen the right document.

Form popularity

FAQ

The best state to sell life insurance can depend on various factors, including market demand and regulatory environment. Utah is often considered favorable due to its growing economy and supportive insurance framework. Engaging with a Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can help you maximize your opportunities in this promising market.

An insurance agent can represent multiple companies, but this depends on their licensing agreements. Exclusive representation often ties agents to one insurance provider, while non-exclusive arrangements allow them to offer products from various companies. Exploring the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance helps you understand different representation options in the market.

Yes, a foreigner can become licensed as a US insurance agent, but the process can vary by state. In Utah, for instance, they would need to fulfill specific educational and exam requirements. Obtaining a Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance may provide additional guidance on navigating this process effectively.

The four requirements of an insurance contract, which are offer, acceptance, consideration, and competence, must be present for the contract to be legally binding. The Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance ensures that all involved parties understand these elements, fostering a fair and enforceable agreement. Meeting these requirements establishes a solid foundation for a successful insurance partnership.

Representation in a contract refers to statements or assertions made by one party to induce another party to enter the agreement. In an insurance context, as found in the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, these representations can determine the outcome of claims and coverage. Therefore, clarity and accuracy in these statements are essential.

A representative in an insurance policy is an individual or entity authorized to act on behalf of the insurer in dealings with clients. Within the framework of the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, the representative essentially bridges the gap between the company and policyholders. This role is crucial for effective communication and service delivery.

Representation in an insurance contract is considered a statement of fact made by one party to the other. These statements, highlighted in the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, can influence the decision-making process of the insurance provider. Accurate representations are vital for a fair assessment of risk and trust between all parties involved.

The four requirements of an insurance contract include offer, acceptance, consideration, and the parties being competent to contract. These foundational elements are well illustrated in the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Properly meeting these requirements ensures that the contract is legally enforceable and protects both the insurer and the insured.

The purpose of an agency agreement is to define the roles, responsibilities, and expectations of both the agent and the principal. In the case of the Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, this understanding facilitates the smooth operation of insurance sales and client interactions. Clear agency agreements help prevent misunderstandings and protect valuable relationships.

An agency contract is a legal agreement that outlines the responsibilities and authority of an agent acting on behalf of a principal. The Utah Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance serves as a prime example, demonstrating how this contract dictates the relationship between the insurance company and the agent. Clarity in these agreements fosters trust and efficiency in transactions.

Interesting Questions

More info

Agent Exclusive Independent Agent What Difference Agreements Group Menu Home Business Auto InsuranceBondsTruc&Co.