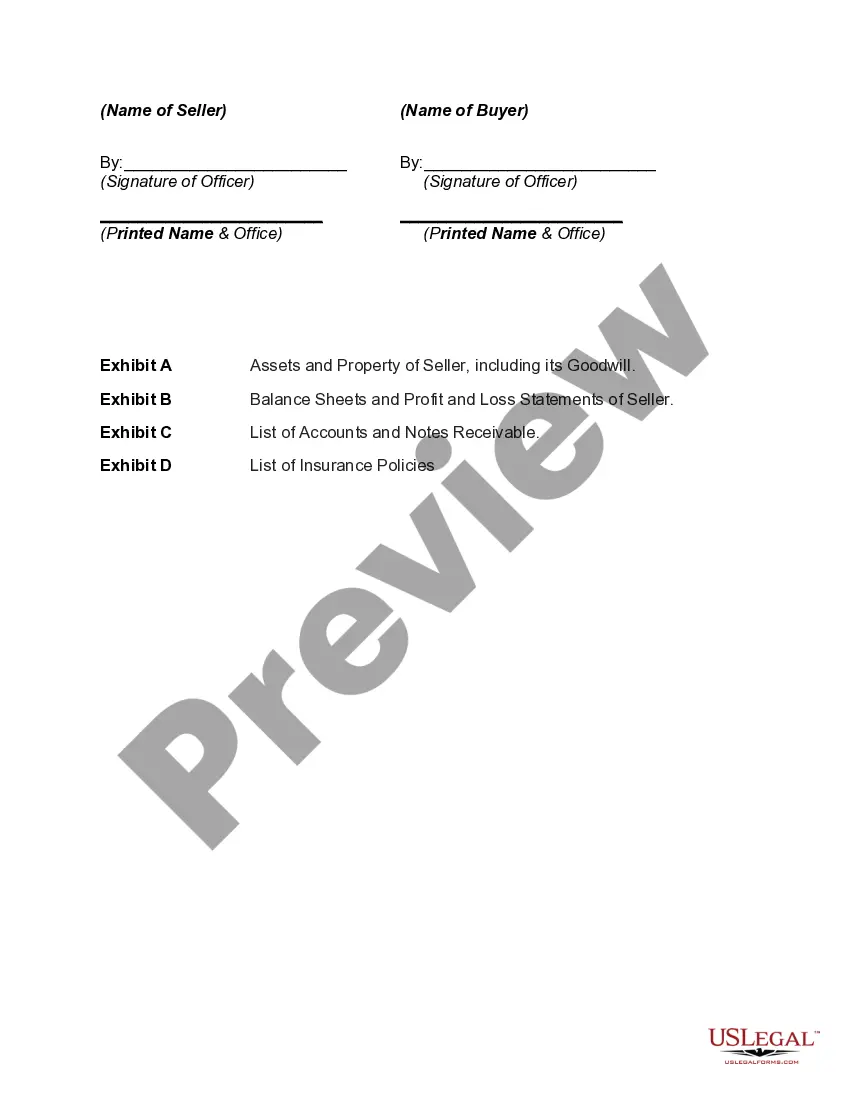

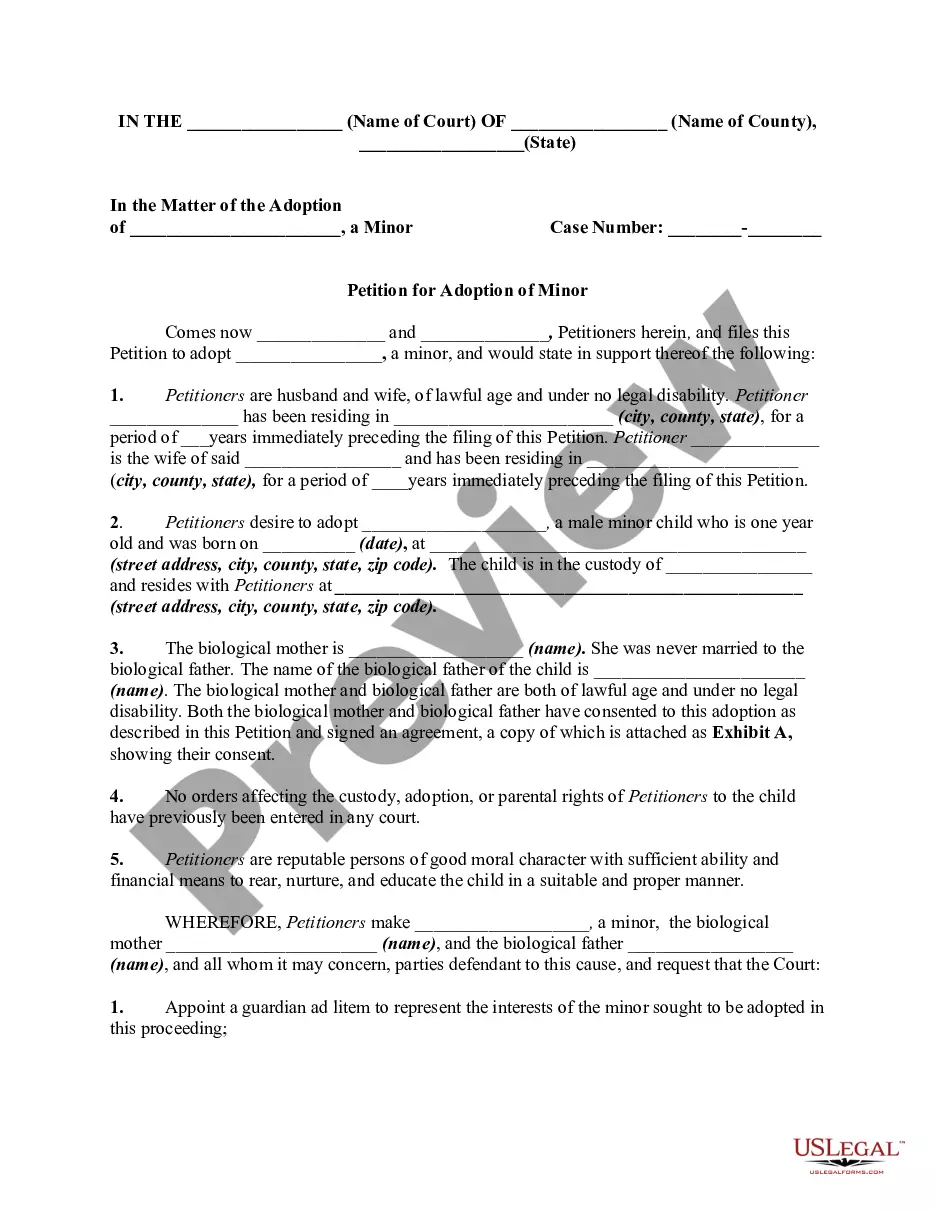

Utah Agreement for Sale of Assets of Corporation

Description

How to fill out Agreement For Sale Of Assets Of Corporation?

If you require to obtain, retrieve, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require. Numerous templates for business and personal use are sorted by categories and regions, or by keywords.

Use US Legal Forms to find the Utah Agreement for Sale of Assets of Corporation in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download and print the Utah Agreement for Sale of Assets of Corporation with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the Utah Agreement for Sale of Assets of Corporation.

- You can also access forms you have previously saved from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Review option to review the form's details. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal template database.

- Step 4. Once you have found the form you need, click the Get now button. Choose your payment plan and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it to your system.

- Step 7. Fill out, edit, and print or sign the Utah Agreement for Sale of Assets of Corporation.

Form popularity

FAQ

You can file a complaint against a company in Utah by contacting the Utah Division of Corporations and Commercial Code. Additionally, submitting your complaint to the Better Business Bureau can be helpful. When involved in a Utah Agreement for Sale of Assets of Corporation, addressing your concerns quickly is vital to safeguard your rights and interests.

To dissolve a corporation in Utah, you must file Articles of Dissolution with the Utah Secretary of State. Ensure you first settle all debts and distribute remaining assets according to the agreement. This process is crucial for completing a Utah Agreement for Sale of Assets of Corporation smoothly, as it addresses any obligations the corporation has before closure.

To file a UCC 1 in Utah, you must go to the Utah Secretary of State's office. You can complete this process online or in person, which makes it easy and accessible for those involved in a Utah Agreement for Sale of Assets of Corporation. This filing secures your interest in the assets and is essential for protecting your investments.

A UCC should be filed in the state where the debtor is located. In the context of the Utah Agreement for Sale of Assets of Corporation, filing in Utah ensures that your security interest is properly recorded. The Secretary of State’s office in Utah is the designated authority for managing these filings.

In Utah, you can file a UCC financing statement at the Utah Secretary of State's office. This office oversees all UCC filings in the state, including those related to the Utah Agreement for Sale of Assets of Corporation. Filing online offers a convenient option, as it allows you to manage your documents efficiently and securely.

While selling assets can provide liquidity and relieve liabilities, there are notable disadvantages to consider. Sellers may incur higher tax obligations and potentially face compliance issues with existing contracts. It is advisable to clearly outline all terms in a Utah Agreement for Sale of Assets of Corporation and consider using services like USLegalForms to navigate the complexities effectively.

In an asset sale, specific assets are sold directly to the buyer, while in a stock sale, ownership and obligations associated with the corporation are transferred. This distinction is critical in a Utah Agreement for Sale of Assets of Corporation because it impacts taxes and liabilities. Buyers typically prefer asset sales to avoid inheriting potential liabilities, while sellers might prefer stock sales to achieve easier transfer and tax benefits.

Accounting for the sale of business assets involves recording the transactions accurately in financial statements. When assets are sold, it’s important to recognize any gains or losses that arise, which can affect your taxes. Utilizing tools and platforms like USLegalForms can help ensure that your Utah Agreement for Sale of Assets of Corporation is compliant and well-documented, simplifying this accounting process.

The asset sale rule governs the sale of business assets during a transaction. It involves transferring specific assets rather than the entire business entity. Understanding this rule is essential when preparing for a Utah Agreement for Sale of Assets of Corporation, as it affects taxation and liability. By following the asset sale rule, sellers can retain less risk while buyers gain valuable assets.