Utah Expense Reimbursement Form for an Employee is a vital document used by employers in Utah to reimburse their employees for the business-related expenses incurred during official duties. This form ensures that employees are compensated appropriately and in line with company policies and regulations. The Utah Expense Reimbursement Form typically includes fields that require the employee to provide detailed information about each expense, such as the date of purchase, description of the expense, vendor name, and total amount spent. It also requires employees to categorize the expenses under specific headings such as transportation, meals, lodging, or miscellaneous expenses. Furthermore, the Utah Expense Reimbursement Form may include sections where employees can attach supporting documents like receipts or invoices to validate their expenses. This ensures transparency and accuracy in the reimbursement process. It is crucial for employees to accurately complete the Utah Expense Reimbursement Form and submit it within the designated time frame specified by their employer. Once submitted, the form is reviewed by the employer or the accounting department for verification and approval. Different types of Utah Expense Reimbursement Forms for an Employee may include variations based on the specific reimbursement policies set by different employers. These variations can range from additional fields to separate specific expense types to modifications in the format of the form. Examples of different forms could include a Utah Mileage Reimbursement Form, a Utah Travel Expense Reimbursement Form, or a Utah Business Meal Reimbursement Form, among others. In conclusion, the Utah Expense Reimbursement Form for an Employee is a crucial document that ensures employees are appropriately reimbursed for business-related expenses. Completing this form accurately and attaching necessary supporting documents is essential for employees to receive their reimbursement in a timely manner. Different variations of the form may exist depending on the specific reimbursement policies outlined by employers.

Utah Expense Reimbursement Form for an Employee

Description

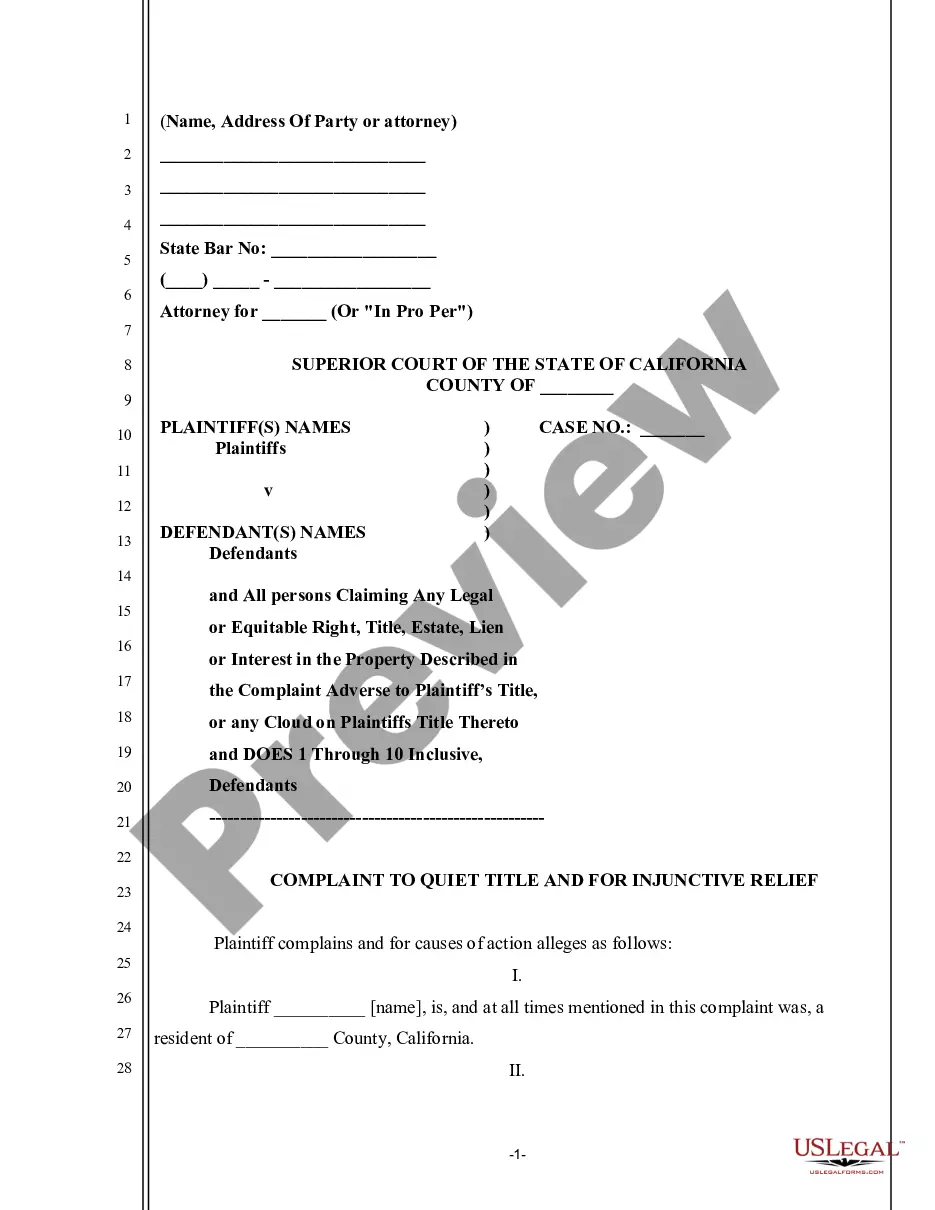

How to fill out Utah Expense Reimbursement Form For An Employee?

Have you been within a situation in which you need to have paperwork for sometimes organization or individual functions nearly every time? There are a variety of lawful document web templates available on the net, but discovering versions you can rely on isn`t simple. US Legal Forms delivers a huge number of form web templates, such as the Utah Expense Reimbursement Form for an Employee, which are created to satisfy state and federal needs.

Should you be presently knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Afterward, you may obtain the Utah Expense Reimbursement Form for an Employee format.

If you do not provide an account and would like to begin using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for that right city/county.

- Utilize the Preview button to examine the shape.

- Look at the information to ensure that you have chosen the appropriate form.

- In the event the form isn`t what you are trying to find, make use of the Search discipline to discover the form that meets your requirements and needs.

- If you find the right form, simply click Get now.

- Opt for the pricing prepare you desire, fill out the necessary info to generate your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Pick a practical document format and obtain your duplicate.

Locate each of the document web templates you might have purchased in the My Forms food list. You can aquire a additional duplicate of Utah Expense Reimbursement Form for an Employee at any time, if necessary. Just click the essential form to obtain or printing the document format.

Use US Legal Forms, one of the most comprehensive collection of lawful forms, in order to save time and steer clear of faults. The service delivers appropriately produced lawful document web templates which you can use for a selection of functions. Produce a merchant account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

How to record reimbursementsKeep your receipts. It's important to keep an accurate record of your expenses.Add reimbursement costs to client bill. Add up all expenses for the project and add this amount to the client's bill.Bill client up to agreed-upon limits. Issue the bill promptly.Know before you go.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

General rule - IRS Treas. Reg. 1.62-2(c): expense reimbursements, both for business and personal expenses, are taxable as part of gross income for employees. Exception: if reimbursements are made pursuant to an "accountable plan", the payments are not included in gross income (see IRS Publ.

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

Handling Reimbursable Expenses There are two ways to handle reimbursements: Assign money for the initial expense. Temporarily overspending, then using the reimbursement to cover it.

Generally speaking, to qualify as an expense reimbursement: The expense must be for deductible business expenses that are paid or incurred by an employee in the course of performing services for your organization.

An employee reimbursement form is a standardized template an employee may use to report expenses paid on behalf of the company to receive reimbursement. The exact reimbursable items will be strictly up to the agreement between the employer and employee.

What Expenses Should a Business Cover?Business-related travel. Airfare, train, and/or other transportation expenses should be reimbursed to employees.Meals. Employees should also be reimbursed for meals as part of travel or business-related activities.Smartphones.Accommodations for travel.Training.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Can expenses be reimbursed through payroll? While the IRS does allow employers to reimburse employee expenses through payroll, some tax implications can come with doing it this way. For example, if the reimbursement is not made as part of an accountable plan, it will be taxable to the employee as wages.