Utah Petty Cash Form

Description

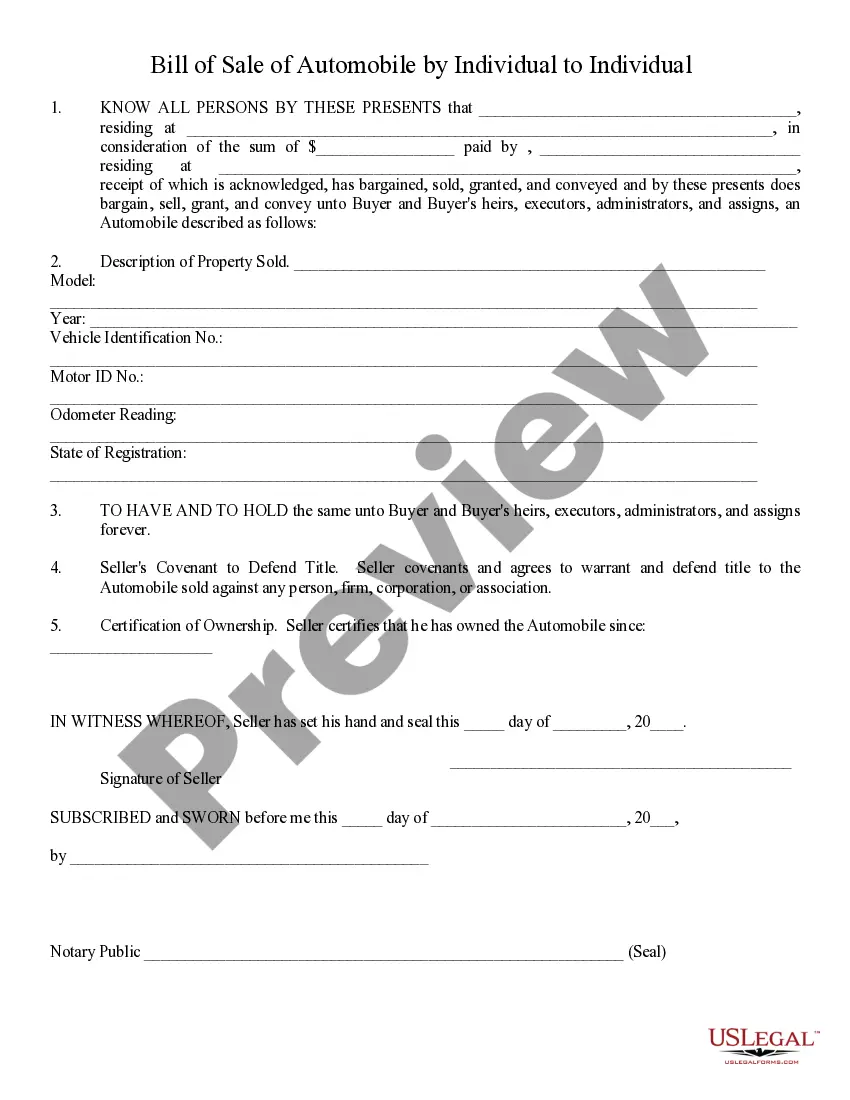

How to fill out Petty Cash Form?

If you need to thorough, obtain, or print official document templates, utilize US Legal Forms, the largest variety of legal forms, available online.

Employ the site’s straightforward and efficient search to locate the documents you require.

Various templates for professional and personal purposes are sorted by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to retrieve the Utah Petty Cash Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and tap the Download button to get the Utah Petty Cash Form.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review feature to examine the form’s contents. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A petty request is a small cash withdrawal made by an employee for minor business expenses. This typically involves costs that are too minor for formal purchasing processes, such as office supplies or refreshments. In the context of the Utah Petty Cash Form, this request ensures proper documentation and management of petty cash transactions. Using this form streamlines the process, making it easier for employees to access funds while keeping financial records organized.

To set up a petty cash account, first designate a specific amount for the fund based on your business needs. Choose a reliable custodian to manage the account, and develop a clear policy for the fund's use. Lastly, implement a Utah Petty Cash Form to streamline record-keeping and ensure all transactions are accounted for effectively, simplifying your accounting process.

Yes, tracking petty cash is essential for maintaining accurate financial records. Without proper tracking, it becomes challenging to identify discrepancies or misuse of funds. By utilizing a Utah Petty Cash Form, you can systematically record every transaction, ensuring accountability and clarity in your financial management.

A good amount to keep in petty cash typically ranges between $100 to $500, depending on your business size and frequency of minor expenses. It's crucial to assess your average monthly spending on small purchases to determine the optimal amount. Maintaining a proper balance prevents cash flow issues and allows for efficient transactions, which you can easily manage with a Utah Petty Cash Form.

Setting up your petty cash fund involves seven key steps. Start by defining the purpose of the fund, then determine the amount you want to allocate. Next, set up the cash box, establish a record-keeping system, and designate a custodian responsible for the fund. After that, create a petty cash log to track expenses, establish replenishment procedures, and regularly review the fund for accuracy. Utilizing a Utah Petty Cash Form will ensure all transactions are documented and compliant.

To establish a petty cash account, begin by determining the initial amount you need, which depends on your organization's cash flow and expense patterns. You will also need to create a petty cash policy outlining procedures for handling the cash, approvals for withdrawals, and documentation requirements. Using a Utah Petty Cash Form, you can easily document transactions and maintain transparency in your accounting.

A petty cash form is a document used to request and record small cash expenses. It allows businesses to manage minor costs efficiently and track cash flow effectively. Utilizing a Utah Petty Cash Form helps streamline the reimbursement process and ensures that all expenditures align with company policies.

When filling a petty cash form, begin with the necessary information, such as your name, department, and date. Clearly itemize the expenses you plan to cover, providing a brief description for each expense. This organized approach ensures that your use of the Utah Petty Cash Form remains compliant and effective.

To complete petty cash procedures, first, ensure you understand the guidelines outlined in the Utah Petty Cash Form. Disburse cash only for small, incidental expenses, and always document each transaction accurately. Return any unused cash and present a detailed report of expenditures to maintain transparency and accountability.

Filling out a petty cash form involves clearly stating the purpose of the cash request, the date, and the amount needed. Ensure you include a breakdown of anticipated expenses and attach receipts or invoices when applicable. This clarity helps in tracking cash flow and maintains compliance with accounting standards, especially regarding the Utah Petty Cash Form.