Utah Employee News Form

Description

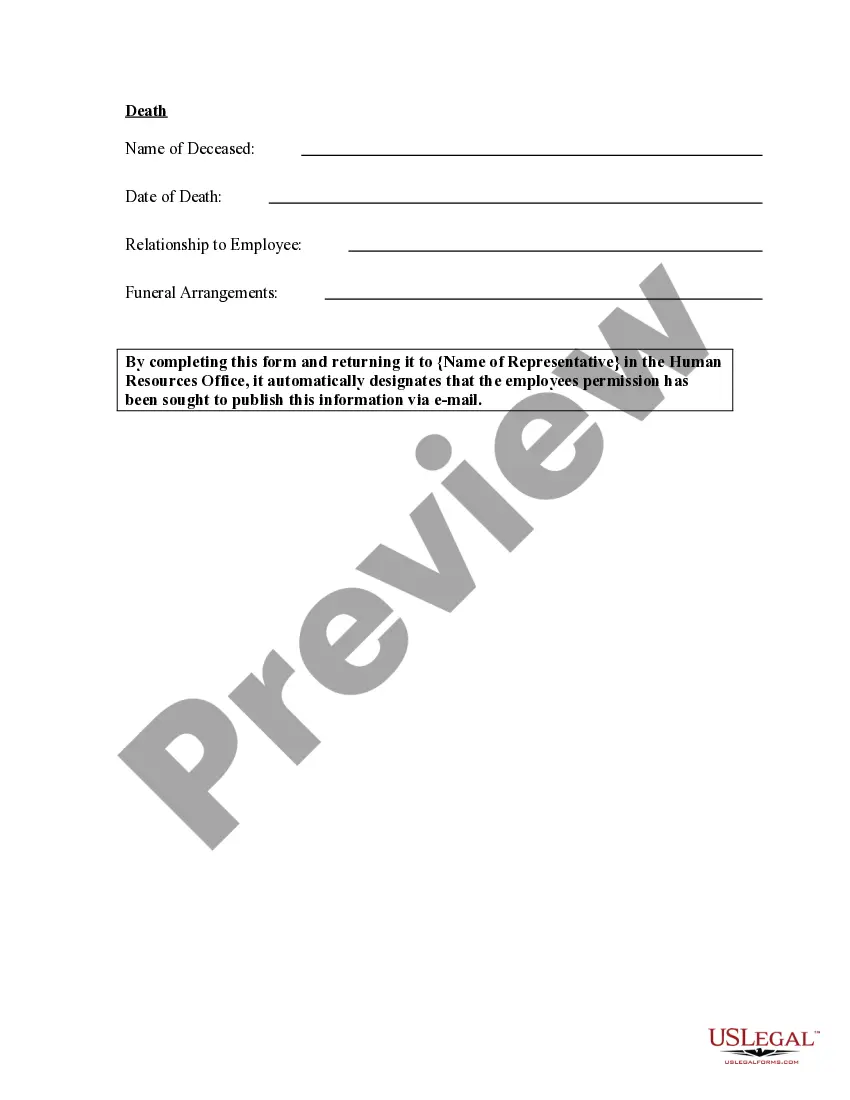

How to fill out Employee News Form?

You can dedicate multiple hours online searching for the legal document format that complies with the state and federal regulations you require.

US Legal Forms offers a vast array of legal templates that can be reviewed by experts.

You can conveniently download or print the Utah Employee News Form from the service.

Utilize professional and region-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Utah Employee News Form.

- Each legal document template you purchase is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents section and click the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for your selected county/city.

- Review the form details to confirm you've selected the appropriate form.

Form popularity

FAQ

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

9. Additional information. For questions about new hire reporting you can contact the Utah New Hire Registry by telephone between am and pm MST by dialing (801) 526-4361 or toll free at (800) 222-2857.

This form is used to report new hires by mail or fax. We strongly recommend entering new hire data on our web site at . Larger employers may consider submitting new hire information by CD or by uploading a file on our website.

You must have earned at least $4500 during your Base Period. Your total Base Period earnings must be at least 1 ½ times the highest quarter of wages during your Base Period. If you do not qualify using earnings in your Base Period, you may qualify under the same conditions by using an Alternate Base Period.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

To calculate your weekly benefit amount in Utah, divide your wages from the highest quarter of the base period by 26, then subtract $5. Currently, the most you can receive under Utah law each week is $661 per week; the minimum amount you can receive is $31 per week.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

If you work less than full-time and earn less than your weekly benefit amount during a given week, you may continue filing since you will be entitled to partial unemployment benefits if you are otherwise eligible. Workforce Services will apply a 30 percent earnings allowance to calculate your weekly benefit payment.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.