Utah Separation Notice for 1099 Employees: A Comprehensive Guide The Utah Separation Notice for 1099 Employees is a vital document that serves to notify the Utah Department of Workforce Services and other relevant authorities about the ending of a working relationship between a business entity and its independent contractor or 1099 employees. This notice is essential for both the employer and the employee to ensure proper compliance with state regulations and to prevent potential legal issues. Keywords: Utah Separation Notice, 1099 employees, Utah Department of Workforce Services, independent contractor, working relationship, compliance, legal issues. Different Types of Utah Separation Notice for 1099 Employees: 1. Voluntary Separation Notice: This type of separation notice is used when an independent contractor or 1099 employees decides to terminate their relationship with the business voluntarily. It includes details such as the reason for separation, effective date, and any additional relevant information. 2. Involuntary Separation Notice: When a business entity decides to terminate the services of an independent contractor against their will, an involuntary separation notice is used. It includes information regarding the reason for termination, effective date, and any legal obligations the business may have towards the employee. 3. Temporary Separation Notice: Sometimes, an independent contractor may require a temporary break from their duties due to personal reasons or other circumstances. A temporary separation notice is utilized in these situations, outlining the expected duration of the break and ensuring proper documentation of the absence. 4. Permanent Separation Notice: In situations where the working relationship between a business and an independent contractor ceases permanently, a permanent separation notice is employed. This notice provides information on the reasons for the permanent separation, effective date, and any necessary steps that both parties need to take. 5. Mutual Separation Notice: Occasionally, both the business entity and the 1099 employee may come to an agreement to end their working relationship mutually. A mutual separation notice is used to document this agreement, including details such as the reasons for the separation, terms of the agreement, and any further obligations to be fulfilled. Ensuring Proper Completion and Submission: It is crucial for both employers and 1099 employees to complete the separation notice accurately and submit it promptly to the Utah Department of Workforce Services as specified in the state regulations. Failure to comply with these requirements could lead to potential penalties or legal complications. To properly complete the separation notice, include essential details such as the employee's full name, address, social security number or employee identification number, and contact information. Provide accurate dates for the separation and indicate the reason, whether voluntary, involuntary, temporary, permanent, or mutual. By accurately completing and submitting the Utah Separation Notice for 1099 Employees, both the employer and the employee can ensure compliance with state laws, maintain clear records, and avoid potential legal issues. It is advisable to consult legal counsel or the Utah Department of Workforce Services for specific guidance and to understand any additional requirements based on individual circumstances.

Utah Separation Notice for 1099 Employee

Description

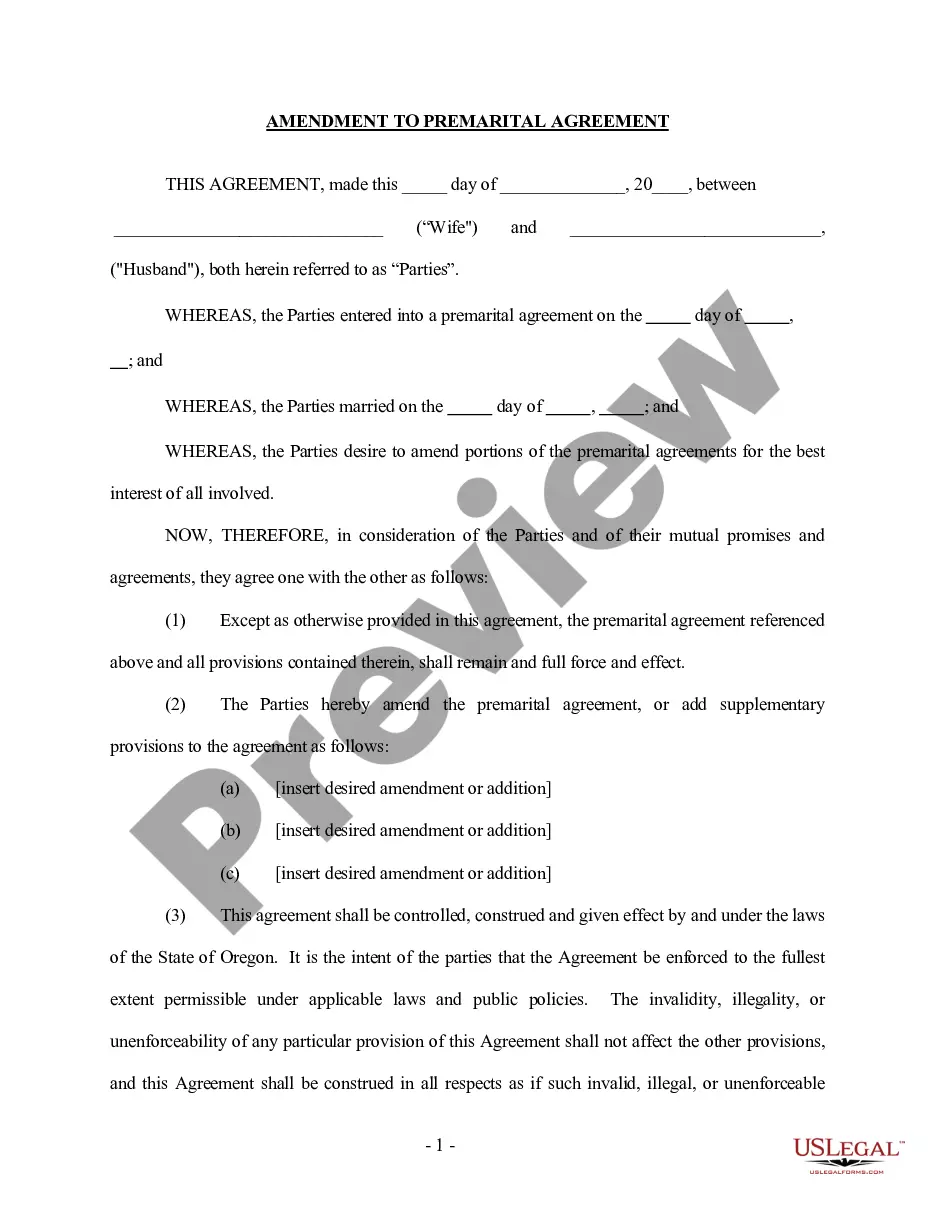

How to fill out Utah Separation Notice For 1099 Employee?

Discovering the right legitimate document template could be a have difficulties. Of course, there are a variety of themes available on the Internet, but how can you get the legitimate develop you want? Make use of the US Legal Forms site. The support provides a huge number of themes, including the Utah Separation Notice for 1099 Employee, that can be used for organization and private needs. All the types are examined by specialists and meet state and federal requirements.

In case you are currently listed, log in for your account and click on the Download option to obtain the Utah Separation Notice for 1099 Employee. Make use of your account to check with the legitimate types you may have ordered in the past. Go to the My Forms tab of the account and obtain yet another version of the document you want.

In case you are a whole new end user of US Legal Forms, listed below are straightforward directions that you should follow:

- Very first, ensure you have selected the correct develop for the area/area. You are able to examine the shape utilizing the Preview option and browse the shape information to ensure it is the right one for you.

- When the develop fails to meet your expectations, make use of the Seach discipline to discover the right develop.

- When you are certain the shape is acceptable, go through the Purchase now option to obtain the develop.

- Opt for the pricing strategy you need and enter the required information and facts. Build your account and pay for the order making use of your PayPal account or Visa or Mastercard.

- Choose the data file formatting and down load the legitimate document template for your gadget.

- Total, revise and printing and sign the attained Utah Separation Notice for 1099 Employee.

US Legal Forms is the most significant library of legitimate types where you can see numerous document themes. Make use of the service to down load expertly-created paperwork that follow condition requirements.

Form popularity

FAQ

Because payroll taxes are taxes paid on the wages and salaries of employees, employers only pay payroll tax on their W-2 employees not on their 1099 workers, freelancers, or independent contractors.

Independent contractors are not covered by the Utah Workers' Com- pensation Act, so employees do not need to obtain workers' compen- sation coverage for independent contractors. Independent contrac- tors are not eligible to receive or file workers' compensation claims.

Corporations that do not contract their work and have no employees except directors and/or officers can file a notice to exclude themselves from workers' compensation benefits. This exclusion is limited to no more than five directors/officers. Please see our Corporate Exclusion section for additional information.

You must have earned at least $4500 during your Base Period. Your total Base Period earnings must be at least 1 ½ times the highest quarter of wages during your Base Period. If you do not qualify using earnings in your Base Period, you may qualify under the same conditions by using an Alternate Base Period.

Generally, fired employees can only get unemployment benefits if they can prove your termination was wrongful or against labor laws. In many cases, you'll have to prove your case during a claims investigation or appeals process.

Your employer cannot simply call you an independent contractor to avoid federal and state legal requirements if the characteristics of your job resemble those of an employee, then your employer must treat you as an employee. An independent contractor's job is characterized by independence.

If an independent contractor can show that his employer's negligence caused his injuries, he would be entitled to the same compensation as an employee working for the non-subscriber employer. This includes damages for his medical bills, lost wages, and pain and suffering.

With few exceptions, Utah employers are required to maintain workers' compensation insurance coverage. Coverage is available from a large number of insurance companies.

Utah is an employment-at-will state. This means that an employer may generally terminate an employee at any time and for any reason, unless a law or contract provides otherwise.

If you work less than full-time and earn less than your weekly benefit amount during a given week, you may continue filing since you will be entitled to partial unemployment benefits if you are otherwise eligible. Workforce Services will apply a 30 percent earnings allowance to calculate your weekly benefit payment.