Utah Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

Have you ever found yourself in a situation where you need documents for both professional and personal purposes almost daily.

There are numerous legal document templates accessible online, but locating reliable ones isn't easy.

US Legal Forms offers a vast selection of form templates, such as the Utah Self-Employed Independent Contractor Agreement, which are drafted to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Self-Employed Independent Contractor Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/state.

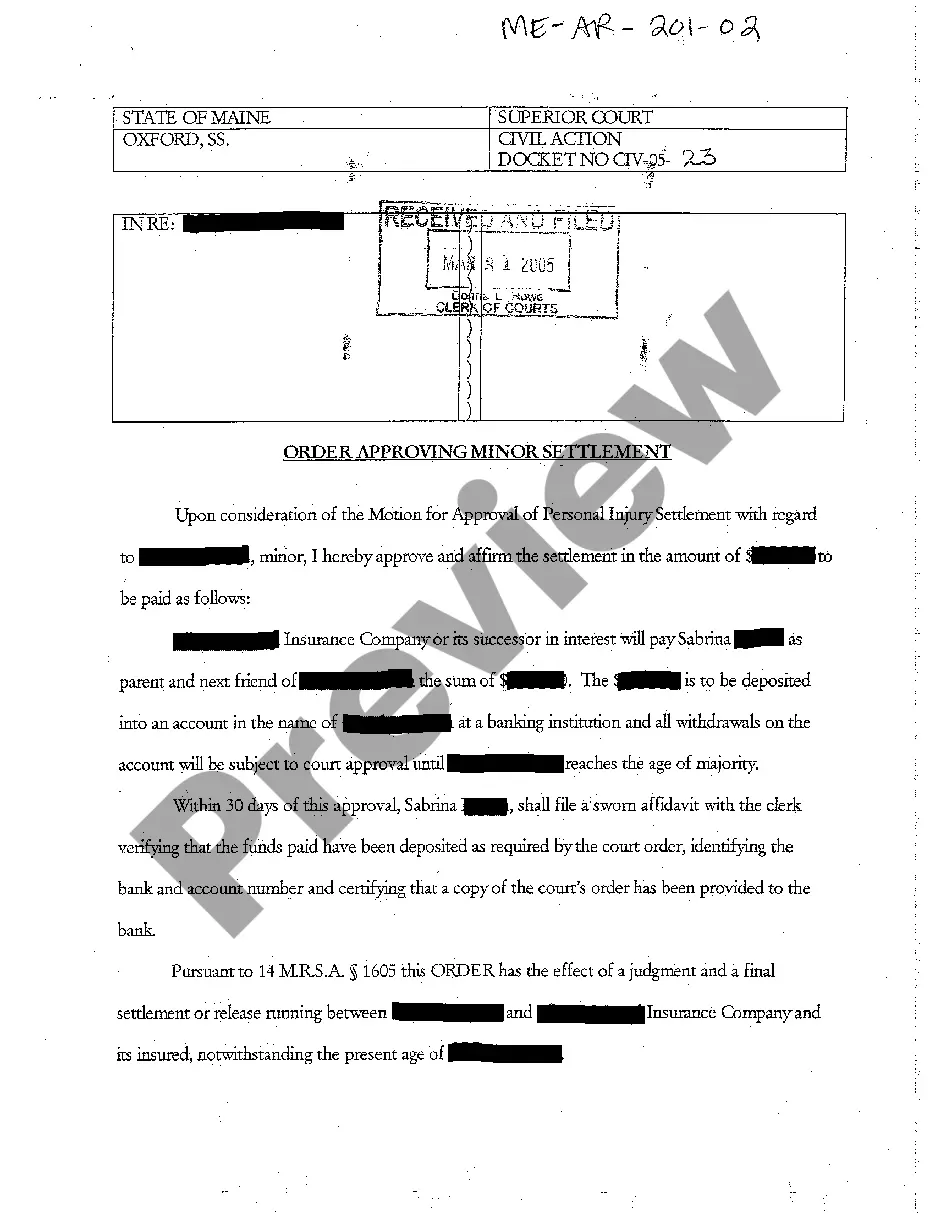

- Utilize the Preview option to review the document.

- Check the details to ensure you have chosen the correct form.

- If the form isn't what you're looking for, use the Lookup field to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The HMRC recommends that you register your business as soon as it is possible for you to do so. However, there is a cut off involved with registering your business, and it is 5 October after the end of the tax year that you began your self-employment.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged