Utah Determining Self-Employed Independent Contractor Status: A Detailed Overview In Utah, determining whether a worker is classified as a self-employed independent contractor or an employee is crucial for legal and tax purposes. Understanding the criteria used to make this determination is vital for both employers and workers. This article provides a detailed description of the factors considered by Utah authorities when evaluating self-employed independent contractor status and highlights different types of determinations relevant in the state. Key Factors Considered in Utah: 1. Behavioral Control: One crucial element is the level of control the employer has over how the work is performed. Factors such as instructions given to the worker, training provided, and degree of supervision influence this aspect. 2. Financial Control: Another critical factor is the degree of financial control the worker possesses. This includes aspects such as whether the worker has significant investment in tools, the method of payment (hourly or project-based), reimbursement of expenses, and the freedom to seek additional work opportunities. 3. Relationship Type: The nature and extent of the relationship between the employer and worker are assessed. Factors like written contracts, provision of employee benefits, the permanency of the relationship, and whether the work performed is a key aspect of the employer's business operations are evaluated. Types of Utah Determining Self-Employed Independent Contractor Status: 1. Common Law Test: Utah often relies on the traditional common law test to determine worker classification. This test primarily considers the employer's control over the worker and the worker's financial independence. It assesses the relationship's overall nature rather than relying solely on specific factors. 2. Economic Reality Test: In some circumstances, Utah courts may also use the Economic Reality Test, which emphasizes the economic dependence of the worker. This test evaluates whether the worker is genuinely in business for themselves or reliant on the employer for income. 3. Statutory Tests: Utah has several statutes that define specific criteria for classifying workers in certain industries. For instance, the Construction Services Licensing Act may establish independent contractor classifications for construction-related professions. Compliance with these statutes is vital for correctly determining self-employment status. Properly classifying workers is crucial as it impacts various legal obligations, such as tax withholding, workers' compensation coverage, and benefit eligibility. Employers and workers in Utah must be aware of the factors employed to assess self-employed independent contractor status to ensure compliance with state laws. Disclaimer: This article provides a general overview and should not be considered legal advice. It is crucial to consult with an employment law professional or the Utah Labor Commission for specific guidance on worker classification issues within the state.

Utah Determining Self-Employed Independent Contractor Status

Description

How to fill out Utah Determining Self-Employed Independent Contractor Status?

US Legal Forms - one of several biggest libraries of lawful varieties in the States - delivers a wide range of lawful file themes you are able to download or printing. Making use of the web site, you may get 1000s of varieties for business and specific purposes, categorized by classes, suggests, or key phrases.You will discover the most up-to-date models of varieties much like the Utah Determining Self-Employed Independent Contractor Status in seconds.

If you already possess a membership, log in and download Utah Determining Self-Employed Independent Contractor Status from the US Legal Forms collection. The Download option will show up on every single kind you look at. You have access to all formerly downloaded varieties inside the My Forms tab of the profile.

If you would like use US Legal Forms for the first time, allow me to share straightforward instructions to help you started out:

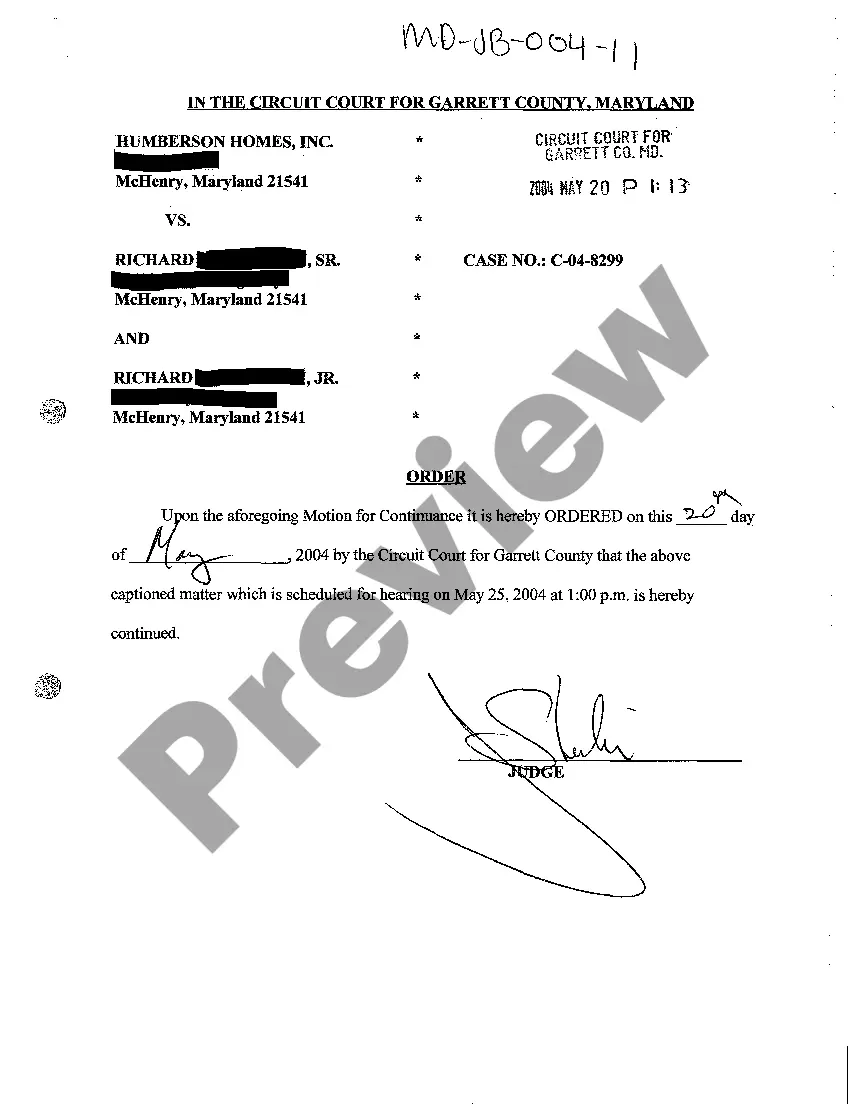

- Ensure you have selected the right kind for the area/county. Select the Review option to check the form`s articles. See the kind explanation to actually have selected the proper kind.

- In the event the kind does not match your needs, use the Search discipline near the top of the screen to find the one who does.

- In case you are content with the form, verify your choice by clicking on the Purchase now option. Then, pick the prices plan you favor and offer your credentials to register to have an profile.

- Procedure the transaction. Make use of your bank card or PayPal profile to accomplish the transaction.

- Select the file format and download the form on your own device.

- Make alterations. Complete, change and printing and sign the downloaded Utah Determining Self-Employed Independent Contractor Status.

Each format you added to your bank account lacks an expiry particular date and is also your own property for a long time. So, in order to download or printing another duplicate, just go to the My Forms segment and then click around the kind you want.

Get access to the Utah Determining Self-Employed Independent Contractor Status with US Legal Forms, by far the most comprehensive collection of lawful file themes. Use 1000s of skilled and state-certain themes that fulfill your organization or specific needs and needs.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.