Utah Memo — Using Self-Employed Independent Contractors Description: The Utah Memo on Using Self-Employed Independent Contractors provides important guidelines and regulations pertaining to the classification and treatment of self-employed individuals working as independent contractors within the state of Utah. This memo aims to inform employers, contractors, and relevant stakeholders about the various legal aspects associated with engaging self-employed individuals for work purposes. By following these guidelines, employers can ensure compliance with Utah's labor laws, avoid potential legal complications, and establish a fair and transparent working relationship with independent contractors. Keywords: 1. Utah's self-employment regulations 2. Independent contractor classification 3. Self-employment guidelines in Utah 4. Utah contractor labor laws 5. Engaging self-employed individuals in Utah 6. Utah Memo on independent contractors 7. Classification of independent contractors in Utah 8. Labor regulations for self-employed individuals in Utah 9. Legal considerations for Utah independent contractors 10. Contractor rights and responsibilities in Utah Types of Utah Memo — Using Self-Employed Independent Contractors: 1. Classification and Eligibility: This section of the Utah Memo delves into the criteria used to determine if a worker qualifies as an independent contractor, emphasizing factors such as control, financial independence, and the nature of the work relationship. It highlights the importance of accurately classifying workers to ensure compliance with state labor laws. 2. Rights and Protections: This segment addresses the rights and protections afforded to self-employed independent contractors in Utah. It outlines the scope of legal protection regarding payment, non-discrimination, workplace safety, and other relevant areas ensuring fair treatment and opportunities for contractors. 3. Obligations of Employers: This part of the Utah Memo elucidates the responsibilities and obligations of employers when engaging independent contractors. It covers areas such as payment obligations, contract terms, insurance requirements, and record-keeping obligations to ensure fair treatment and protection of both parties involved. 4. Contractor Misclassification: This section explores the consequences and potential liabilities associated with misclassifying workers as independent contractors when they should be considered employees under Utah law. It emphasizes the importance of correctly categorizing workers to prevent legal challenges and unfair treatment. 5. Dispute Resolution: This segment focuses on alternative dispute resolution mechanisms available to both employers and self-employed independent contractors in Utah. It explains processes such as mediation and arbitration as means of resolving conflicts without resorting to costly litigation. 6. Penalties and Enforcement: This part outlines the penalties and enforcement measures that employers may face if found in violation of Utah's independent contractor regulations. It explores fines, damages, and legal actions that can be taken to rectify any misconduct and protect the rights of self-employed workers. By adhering to the guidelines provided in the Utah Memo — Using Self-Employed Independent Contractors, employers can maintain a legally compliant and mutually beneficial relationship with independent contractors, ensuring fair treatment, and avoiding potential legal complications.

Utah Memo - Using Self-Employed Independent Contractors

Description

How to fill out Utah Memo - Using Self-Employed Independent Contractors?

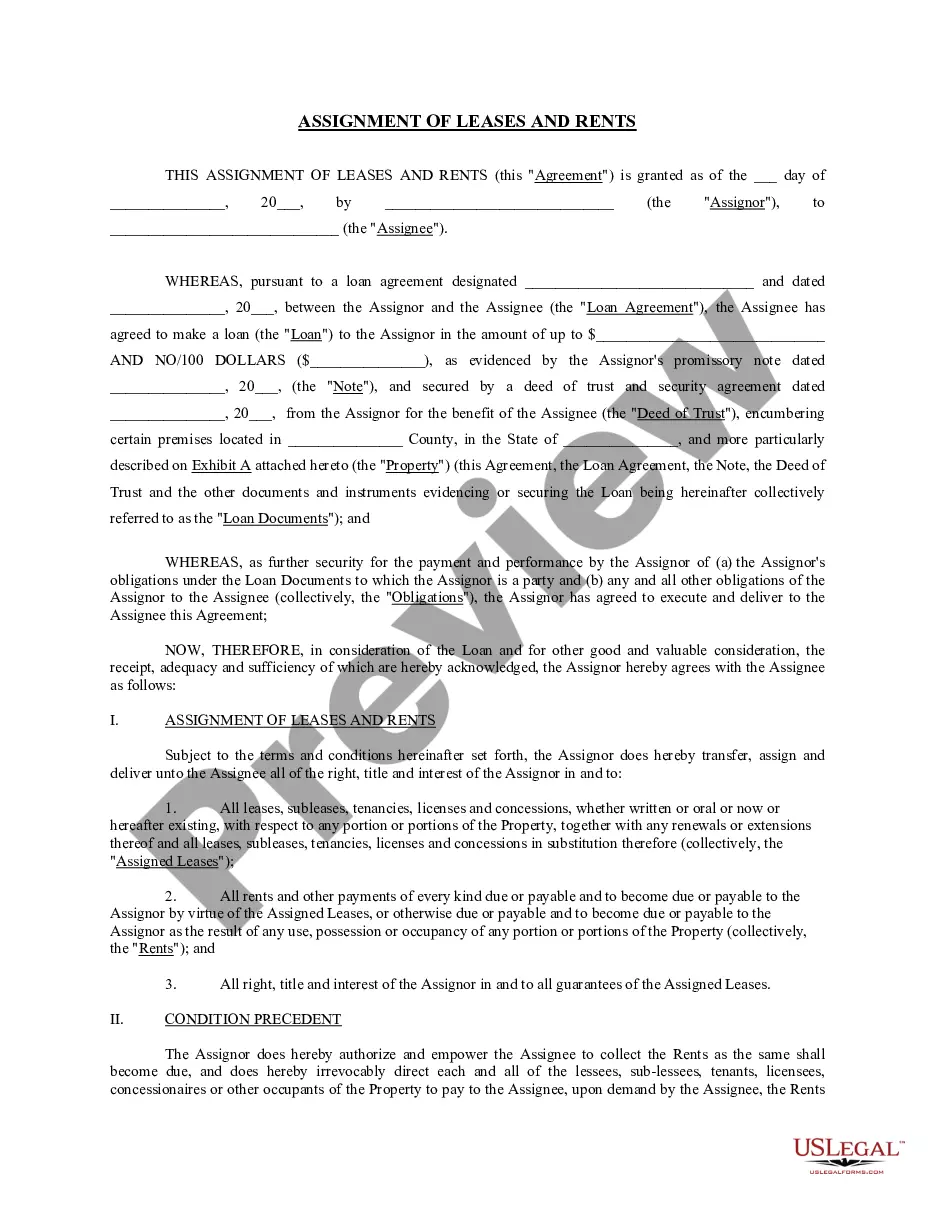

Are you presently inside a position in which you will need documents for either enterprise or personal functions just about every day time? There are a variety of authorized record web templates available on the net, but locating versions you can rely is not effortless. US Legal Forms provides a large number of type web templates, such as the Utah Memo - Using Self-Employed Independent Contractors, that are created to satisfy state and federal requirements.

Should you be currently knowledgeable about US Legal Forms site and possess a free account, just log in. Following that, it is possible to obtain the Utah Memo - Using Self-Employed Independent Contractors web template.

Unless you offer an accounts and wish to start using US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is for that right town/region.

- Utilize the Review option to review the shape.

- Look at the explanation to ensure that you have selected the proper type.

- When the type is not what you are searching for, use the Lookup area to obtain the type that suits you and requirements.

- Whenever you find the right type, simply click Acquire now.

- Select the rates strategy you would like, submit the required information and facts to create your account, and pay money for the transaction making use of your PayPal or bank card.

- Select a convenient file formatting and obtain your duplicate.

Locate all of the record web templates you might have bought in the My Forms food list. You can aquire a further duplicate of Utah Memo - Using Self-Employed Independent Contractors anytime, if needed. Just click on the necessary type to obtain or print the record web template.

Use US Legal Forms, probably the most comprehensive collection of authorized types, to conserve time as well as steer clear of blunders. The service provides appropriately made authorized record web templates that you can use for a range of functions. Make a free account on US Legal Forms and commence creating your lifestyle a little easier.