Utah Property Claimed as Exempt — Schedule — - Form 6C - Post 2005 is a legal document used in Utah to identify and protect certain types of property from creditor claims in bankruptcy cases. This form consists of a detailed list of exempt property categories that debtors can claim as exempt, meaning these assets cannot be seized by creditors to satisfy outstanding debts. The purpose of the Utah Property Claimed as Exempt — Schedule — - Form 6C - Post 2005 is to provide a comprehensive inventory of the debtor's property and indicate which items are protected under Utah state law. By completing this form, debtors disclose their exempt property to the court, allowing them to retain possession of these assets while still seeking relief from their debts. The following are some examples of different types of property that can be claimed as exempt on Schedule C — Form 6— - Post 2005 in Utah: 1. Homestead Exemption: This includes the debtor's primary residence and the land it sits on, up to a certain value determined by the state. The homestead exemption aims to protect the debtor's right to a secure and stable home. 2. Personal Property: This category encompasses various items such as household goods, furniture, appliances, clothing, and jewelry, up to specific monetary limits set by Utah law. Debtors can claim exemptions for necessary personal items to ensure they can maintain a basic standard of living. 3. Tools of the Trade: Utah law provides exemptions for tools, equipment, and materials required for the debtor's occupation or trade. This exemption recognizes the importance of allowing individuals to continue earning a living. 4. Motor Vehicles: Debtors can claim an exemption for one or more vehicles up to a certain value. This exemption ensures that debtors can still maintain transportation for employment and daily activities. 5. Retirement Plans: Qualified retirement plans, such as IRAs, 401(k)s, and pensions, are generally protected under Utah law, safeguarding the debtor's future financial security. 6. Public Benefits: Exemptions can also be claimed for certain public benefits, including social security, unemployment compensation, disability payments, and public assistance. These exemptions exist to prevent debtors from losing necessary financial support. 7. Insurance Proceeds: Depending on the circumstances, certain insurance proceeds, such as life insurance or disability benefits, may be protected from creditors. It is essential for debtors to accurately complete Utah Property Claimed as Exempt — Schedule — - Form 6C - Post 2005, listing all relevant property exemptions based on the applicable Utah laws. Failure to list exempt property properly can result in the loss of protection and may enable creditors to seize the assets. Please note that this content serves as a general overview and is not legal advice. It is always advisable to consult with a qualified attorney or bankruptcy professional for specific guidance regarding individual circumstances.

Utah Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Utah Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

US Legal Forms - one of several largest libraries of legal types in the USA - provides a variety of legal record web templates it is possible to acquire or produce. Utilizing the website, you may get a large number of types for company and personal uses, sorted by groups, states, or search phrases.You will find the most up-to-date models of types much like the Utah Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in seconds.

If you already possess a registration, log in and acquire Utah Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in the US Legal Forms catalogue. The Acquire option can look on each kind you see. You have access to all previously saved types in the My Forms tab of your account.

In order to use US Legal Forms the first time, listed here are straightforward guidelines to obtain started off:

- Make sure you have picked the proper kind for your area/county. Click on the Review option to analyze the form`s information. Browse the kind description to actually have chosen the right kind.

- In case the kind doesn`t satisfy your requirements, take advantage of the Search discipline on top of the screen to get the one who does.

- In case you are happy with the form, verify your choice by visiting the Purchase now option. Then, select the rates strategy you prefer and supply your qualifications to sign up on an account.

- Approach the financial transaction. Use your credit card or PayPal account to accomplish the financial transaction.

- Select the structure and acquire the form in your device.

- Make modifications. Fill up, edit and produce and indicator the saved Utah Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every template you put into your account does not have an expiry time and it is your own eternally. So, if you would like acquire or produce an additional copy, just proceed to the My Forms portion and then click around the kind you need.

Obtain access to the Utah Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms, the most comprehensive catalogue of legal record web templates. Use a large number of specialist and status-certain web templates that satisfy your company or personal requires and requirements.

Form popularity

FAQ

In Utah, single bankruptcy filers can exempt up to $3,000 of the equity in a single motor vehicle. For married couples who file joint Chapter 7 petitions, that amount doubles to $6,000. If you have less in equity than the applicable exemption amount, you should be able to keep your vehicle.

Utah Bankruptcy Motor Vehicle Exemption When you file for Chapter 7 in Utah, the state allows you to exempt up to $5,000 ? or $10,000, if you file a joint bankruptcy petition with your spouse ? of the equity of a single vehicle. However, you cannot protect a vehicle that is primarily used for recreational purposes.

Utah Tools of the Trade Bankruptcy Exemption In Utah, the tools of the trade exemption allows you to safeguard up to $5,000 of equity in property used for your principal profession or business when you file for Chapter 7 bankruptcy.

The Utah Bankruptcy Homestead Exemption Married couples who file joint Chapter 7 or Chapter 13 bankruptcy petitions in Utah can protect twice as much home equity ? up to $60,000 in value ? as the homestead exemption amounts double.

Utah exemption law allows bankruptcy debtors to exempt much of their personal property, including a vehicle up to $3,000 per person, furnishings, guns, heirlooms, retirement accounts, certain insurance proceeds, medical devices, and many more.

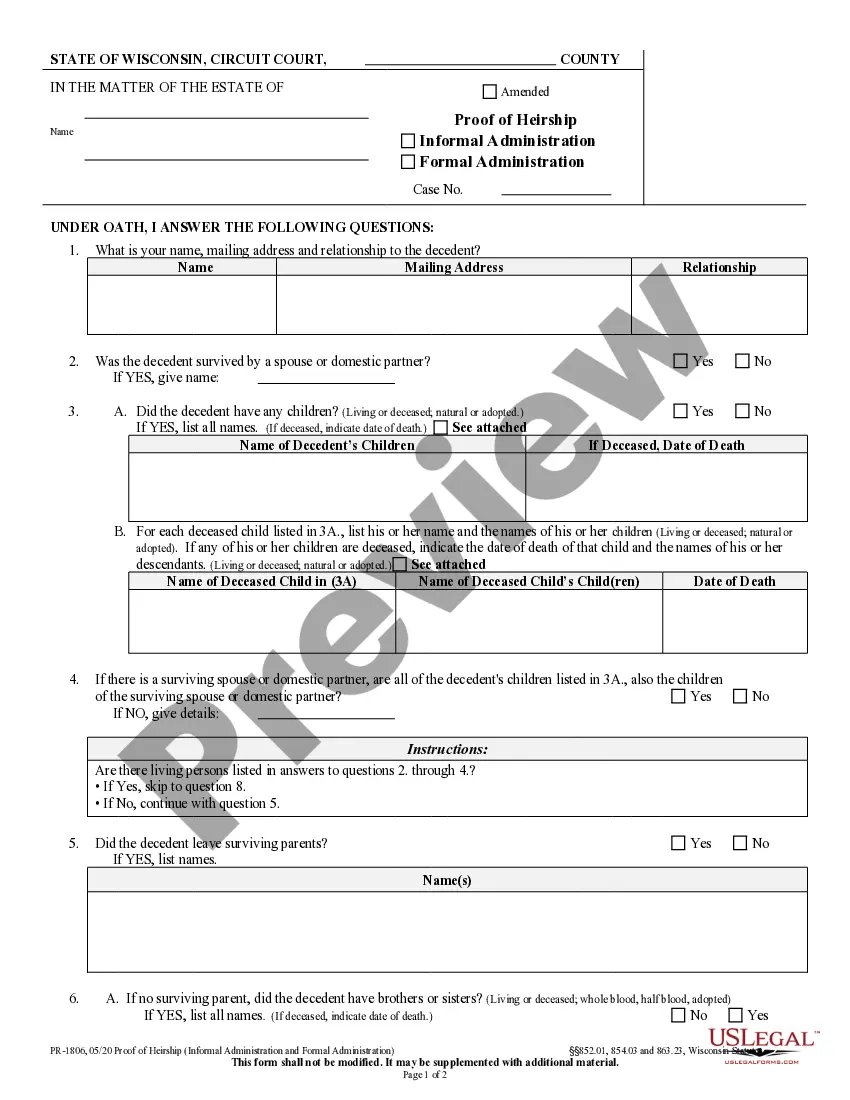

Here's the information you'll need to provide: Exemption system you're using. ... Description of property. ... Schedule A/B line number. ... Current value of the portion you own. ... Amount of exemption you claim. ... Specific laws that allow the exemption. ... Claiming a homestead exemption more than $189,050.

Under the Utah exemption system, homeowners can exempt up to $45,100 of their home or other property covered by the homestead exemption, such as a mobile home. You can use the homestead exemption to protect more than one parcel of land, but you can protect only up to one acre total. (Utah Code Ann. § 78B-5-504.)