Utah Stock Option and Stock Award Plan of American Stores Company

Description

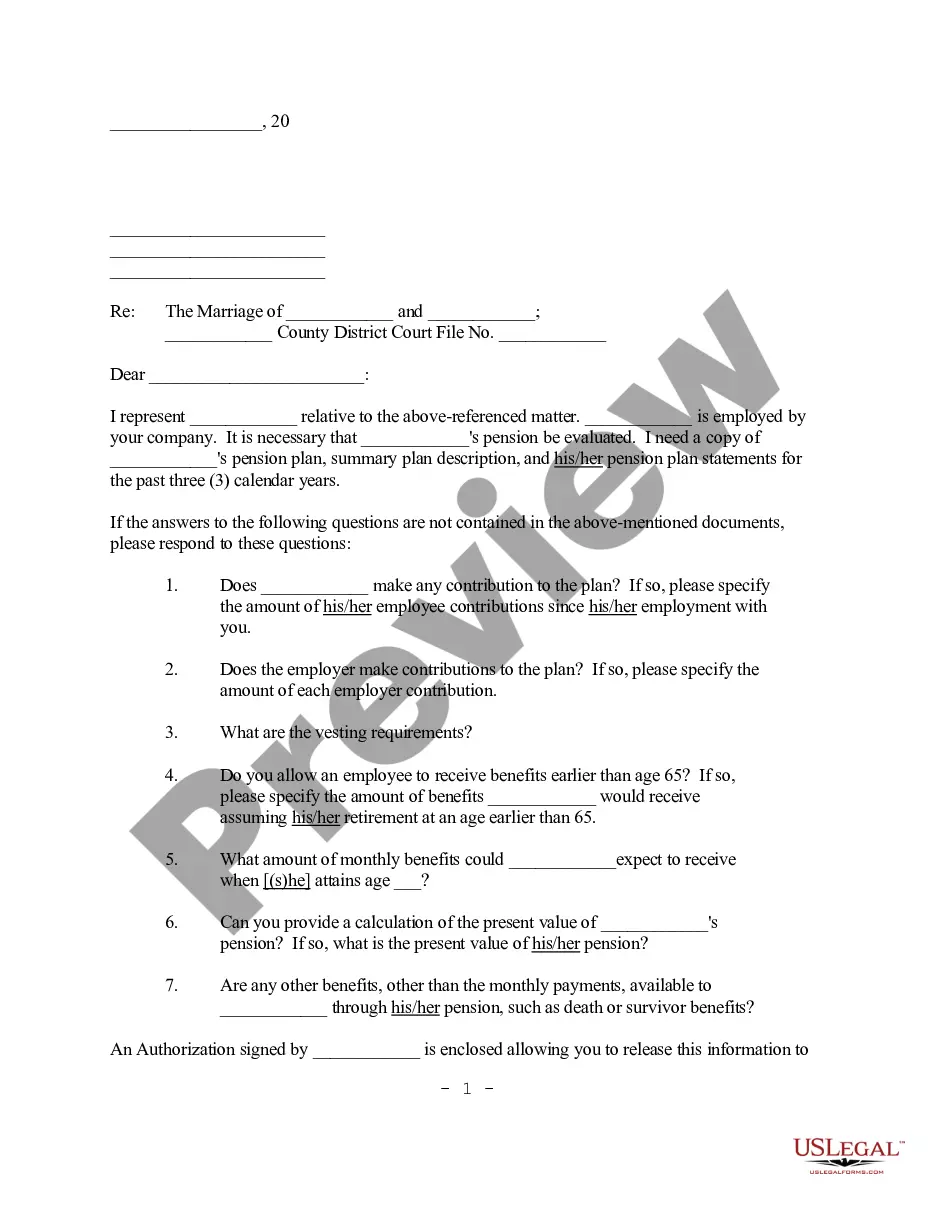

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

Discovering the right lawful file design can be quite a have difficulties. Of course, there are plenty of templates available on the net, but how would you obtain the lawful develop you will need? Take advantage of the US Legal Forms website. The services gives thousands of templates, like the Utah Stock Option and Stock Award Plan of American Stores Company, which can be used for enterprise and personal requires. All of the types are inspected by pros and fulfill state and federal specifications.

When you are already registered, log in to your profile and then click the Download switch to obtain the Utah Stock Option and Stock Award Plan of American Stores Company. Make use of your profile to search throughout the lawful types you have acquired in the past. Proceed to the My Forms tab of your respective profile and acquire yet another backup in the file you will need.

When you are a whole new customer of US Legal Forms, allow me to share easy instructions for you to comply with:

- Initially, ensure you have selected the right develop for the town/area. You can look through the shape making use of the Preview switch and study the shape outline to make sure it will be the right one for you.

- In the event the develop will not fulfill your needs, use the Seach discipline to get the proper develop.

- When you are sure that the shape is acceptable, go through the Acquire now switch to obtain the develop.

- Select the costs program you desire and type in the necessary info. Make your profile and purchase an order utilizing your PayPal profile or credit card.

- Pick the document format and obtain the lawful file design to your device.

- Full, change and produce and signal the acquired Utah Stock Option and Stock Award Plan of American Stores Company.

US Legal Forms is definitely the largest library of lawful types where you can see different file templates. Take advantage of the service to obtain expertly-produced paperwork that comply with state specifications.

Form popularity

FAQ

Generally speaking, stock options are only taxed after they're exercised. The specific tax rates you'll pay after exercising your options, however, may differ depending on the type of option. When exercising stock options, you'll likely pay either ordinary income tax or capital gains tax (or both).

Once the grant has vested, they still don't own anything in the company. Rather, they now own the option to purchase these shares. The jargon for actually buying these shares is termed ?exercising options.? When it comes to exercising options, employees need to spend some money before they can actually make some money.

A stock option award is a type of compensation contract that companies use to incentivize employees. This contract is an agreement between the company and employee that gives them the right, but not the obligation, to purchase shares of company stock at a set price in the future (usually for pennies on the dollar).

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.

In US companies, an option grant is typically awarded to an employee, advisor or other individual who performs services for the company, and the option can be exercised during the term of service to the company and for a finite period of time following cessation of services.