Utah Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

You can devote several hours on the Internet searching for the legal document format which fits the state and federal demands you require. US Legal Forms provides a large number of legal kinds which are reviewed by professionals. You can actually obtain or print the Utah Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. from my support.

If you already possess a US Legal Forms bank account, you may log in and then click the Obtain option. Next, you may comprehensive, revise, print, or indication the Utah Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.. Each and every legal document format you buy is your own property for a long time. To obtain another copy associated with a bought develop, proceed to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms site for the first time, stick to the basic directions listed below:

- Initial, make sure that you have chosen the right document format for the county/area of your choosing. Read the develop explanation to ensure you have picked out the proper develop. If available, take advantage of the Review option to check throughout the document format also.

- If you would like find another version in the develop, take advantage of the Lookup field to discover the format that fits your needs and demands.

- Upon having located the format you would like, click on Get now to proceed.

- Select the costs strategy you would like, type in your references, and register for your account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to fund the legal develop.

- Select the format in the document and obtain it to the system.

- Make alterations to the document if required. You can comprehensive, revise and indication and print Utah Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

Obtain and print a large number of document layouts utilizing the US Legal Forms website, which provides the largest collection of legal kinds. Use skilled and state-distinct layouts to deal with your company or specific requirements.

Form popularity

FAQ

Nature ? Employee stock ownership plan (ESOP) is an employee benefit plan that provides employees with shares of stock that represent ownership in the business. Contrastingly SARs are a sort of employee remuneration that is based on the stock price of the company over a predetermined period.

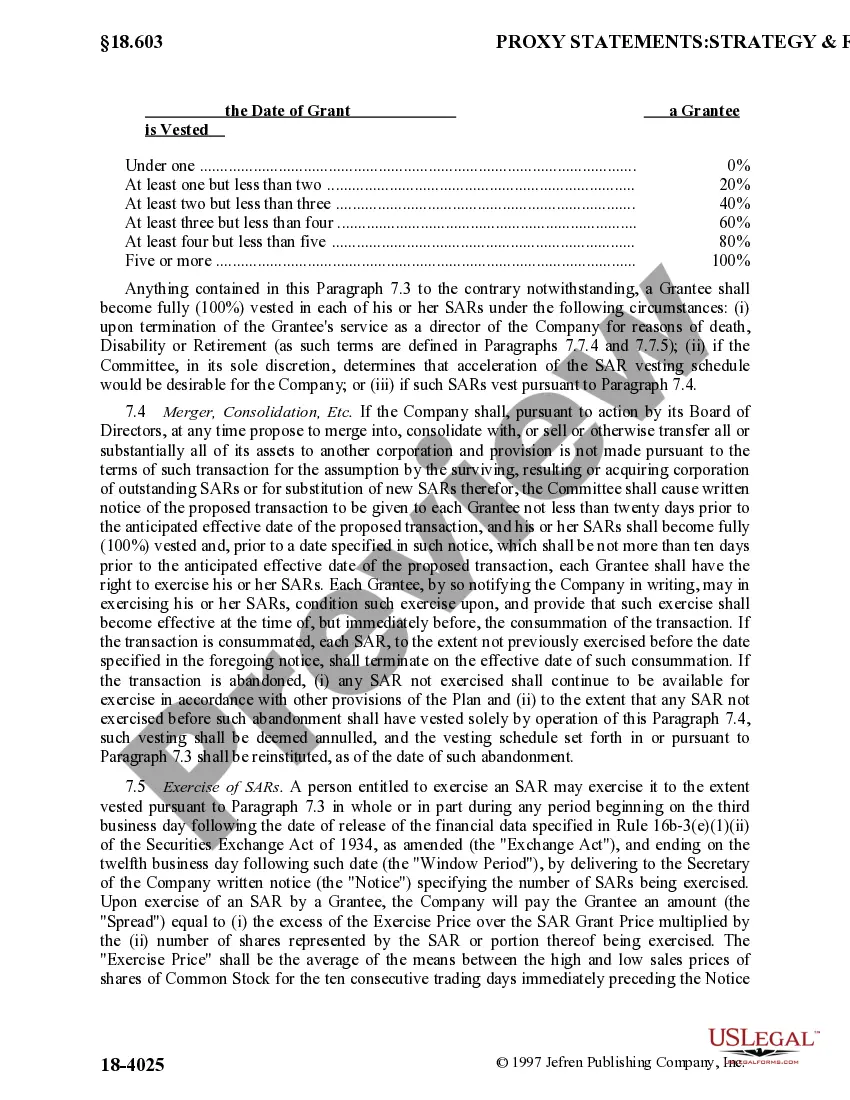

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.