The Utah Supplemental Retirement Plan (USP) is a retirement savings program available to employees in the state of Utah. It is designed to complement the primary retirement plan offered by the Utah Retirement Systems (URS) and provide additional benefits to help ensure a secure financial future for participants. USP encourages employees to save more for their retirement by offering tax advantages and various investment options. One type of Utah Supplemental Retirement Plan is the 401(k) plan, which allows employees to contribute a portion of their pre-tax income towards their retirement savings. The contributions are deducted directly from the employee's paycheck, reducing their taxable income. Employers may also choose to match a portion of the employee's contributions, further enhancing their retirement savings. Another type of Utah Supplemental Retirement Plan is the 457(b) plan, which is available exclusively to government and certain non-profit employees. Similar to the 401(k) plan, it allows participants to contribute a portion of their pre-tax income towards retirement savings. However, the major distinction is that the 457(b) plan has no early withdrawal penalty if the employee leaves their employer before reaching the typical retirement age. Participants in the Utah Supplemental Retirement Plan have the flexibility to choose from a range of investment options, including mutual funds, target-date funds, and fixed-interest funds. These options allow individuals to diversify their investments based on their risk tolerance and financial goals. The plan also offers various educational resources and tools to help participants make informed decisions about their retirement savings. Contributions made to the Utah Supplemental Retirement Plan grow tax-deferred, meaning that participants only pay taxes when they withdraw the funds during retirement. This tax advantage allows individuals to potentially accumulate more savings over time, as their investments can grow without being hindered by immediate tax obligations. In summary, the Utah Supplemental Retirement Plan (USP) is an additional retirement savings program available to employees in Utah. It offers tax advantages, various investment options, and education resources to help individuals save for a secure financial future. The main types of USP are the 401(k) and 457(b) plans, which provide different features and eligibility criteria. By participating in USP, individuals can enhance their retirement savings and work towards achieving their long-term financial goals.

Utah Supplemental Retirement Plan

Description

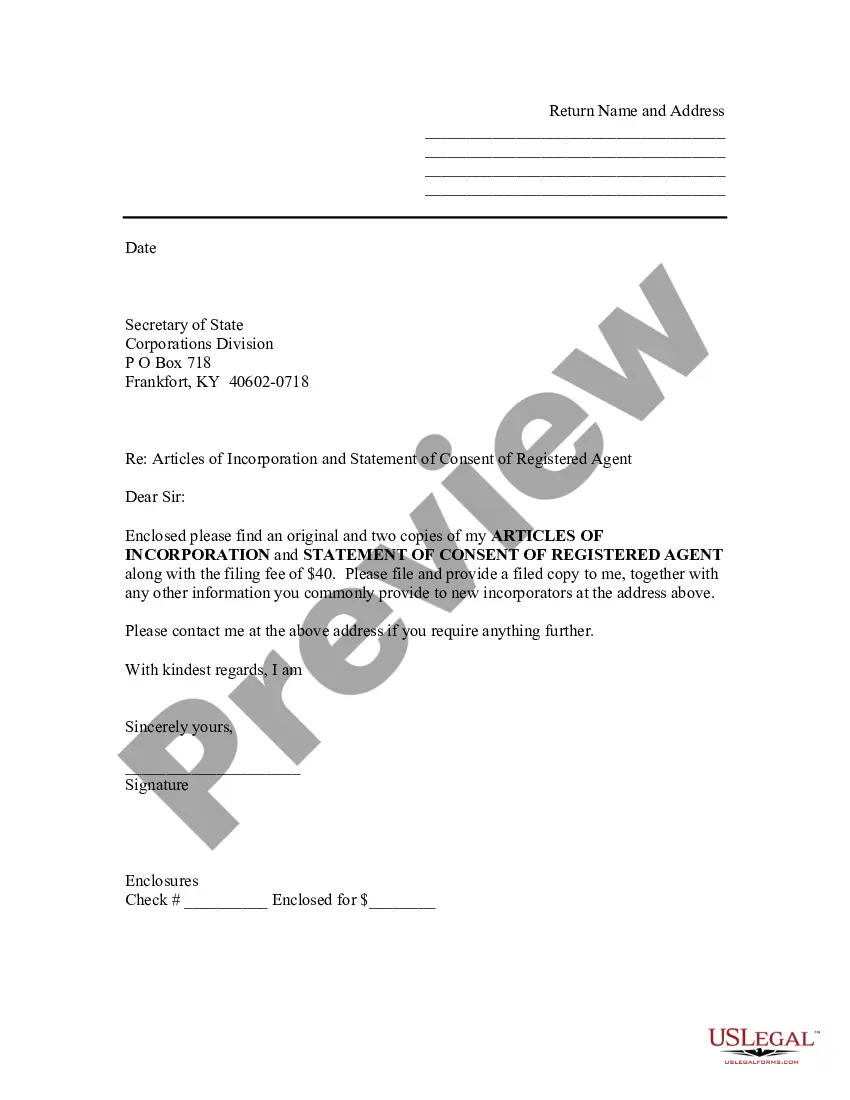

How to fill out Utah Supplemental Retirement Plan?

You can devote time on the Internet trying to find the legal papers design which fits the federal and state needs you will need. US Legal Forms offers 1000s of legal kinds that happen to be evaluated by specialists. You can actually acquire or printing the Utah Supplemental Retirement Plan from the service.

If you already have a US Legal Forms account, it is possible to log in and click the Down load key. Afterward, it is possible to complete, change, printing, or sign the Utah Supplemental Retirement Plan. Each legal papers design you get is the one you have for a long time. To acquire another copy of any obtained kind, go to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms web site the very first time, stick to the straightforward directions below:

- Initially, make sure that you have selected the proper papers design for the state/town of your liking. Browse the kind information to ensure you have picked the correct kind. If readily available, make use of the Review key to search through the papers design as well.

- If you wish to locate another edition of the kind, make use of the Research area to get the design that suits you and needs.

- After you have discovered the design you would like, simply click Buy now to carry on.

- Select the prices plan you would like, enter your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal account to pay for the legal kind.

- Select the formatting of the papers and acquire it in your system.

- Make modifications in your papers if possible. You can complete, change and sign and printing Utah Supplemental Retirement Plan.

Down load and printing 1000s of papers templates using the US Legal Forms website, that offers the largest assortment of legal kinds. Use specialist and condition-distinct templates to deal with your company or person demands.

Form popularity

FAQ

The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy. Once the employee receives income in retirement, that benefit is taxable. At that point, the employer receives a tax deduction.

The basic limit on elective deferrals is $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100% of the employee's compensation, whichever is less. The elective deferral limit for SIMPLE plans is 100% of compensation or $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021.

The maximum Social Security benefit in 2023 is $3,627 at full retirement age. It's $4,555 per month if retiring at age 70 and $2,572 if retiring at age 62. A person's benefit amount depends on earnings, full retirement age and when they take benefits.

The basic limit on elective deferrals is $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100% of the employee's compensation, whichever is less. The elective deferral limit for SIMPLE plans is 100% of compensation or $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021.

It's a lump-sum cash award, designed to offset the effects of your reduced pension contributions due to your service-related disability.

Supplemental contributions Type of limit2023403b under age 50$22,500403b age 50 and over$30,000Compensation limit (employer's matched retirement contributions are limited to matches made on this amount of salary)$330,000