Utah Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company

Description

How to fill out Certificate Of Designation, Preferences And Rights Of Series B Junior Cumulative Convertible Preference Stock Of Oryx Energy Company?

Are you currently in a placement in which you will need documents for sometimes business or individual uses nearly every working day? There are plenty of lawful papers layouts accessible on the Internet, but discovering versions you can trust is not easy. US Legal Forms offers a large number of type layouts, just like the Utah Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company, that are published to satisfy federal and state specifications.

If you are presently acquainted with US Legal Forms internet site and also have a merchant account, basically log in. Following that, it is possible to down load the Utah Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company template.

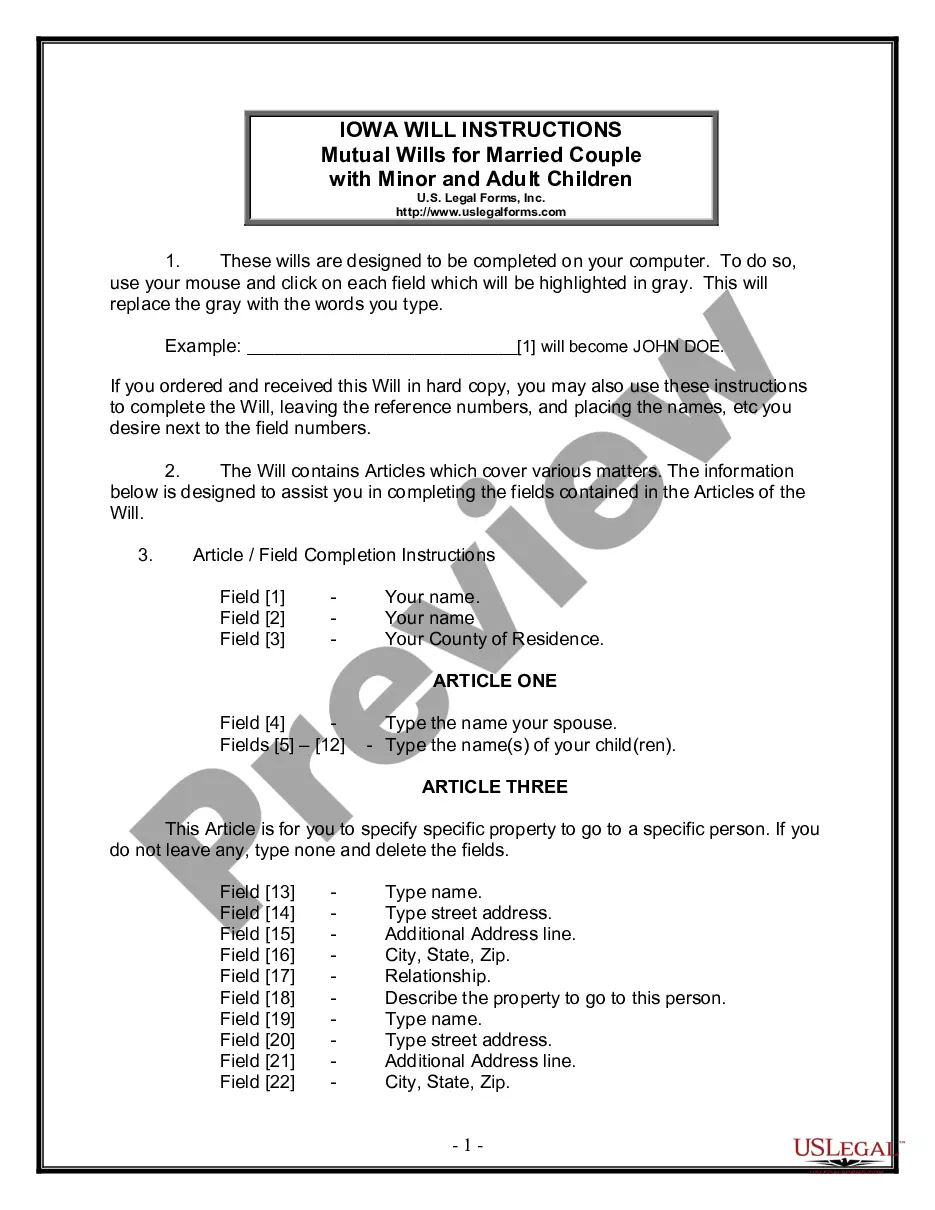

Unless you have an bank account and want to start using US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for the proper city/region.

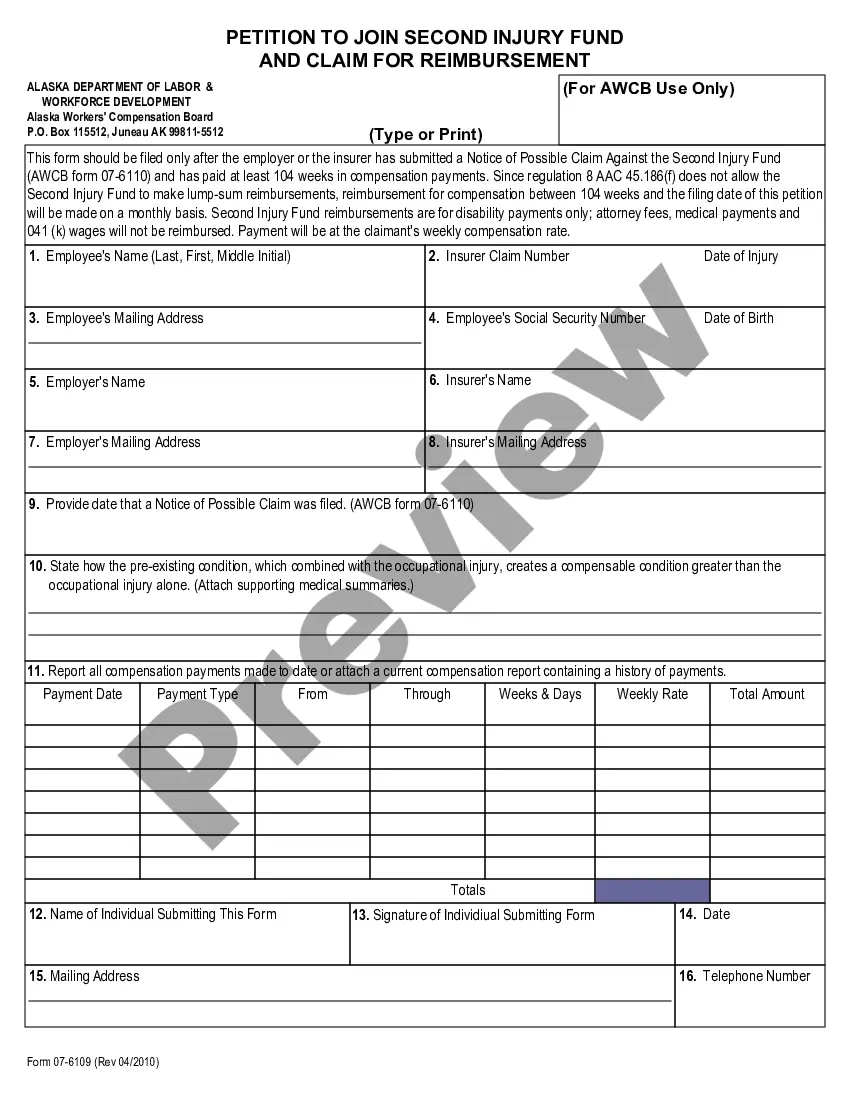

- Make use of the Preview button to check the shape.

- Read the explanation to ensure that you have chosen the correct type.

- In case the type is not what you`re seeking, utilize the Research industry to find the type that meets your requirements and specifications.

- When you get the proper type, just click Get now.

- Opt for the rates prepare you want, submit the specified details to create your account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Select a handy paper file format and down load your copy.

Discover each of the papers layouts you have bought in the My Forms food list. You can obtain a additional copy of Utah Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company whenever, if possible. Just go through the essential type to down load or printing the papers template.

Use US Legal Forms, by far the most considerable assortment of lawful forms, to save lots of time and prevent blunders. The support offers professionally made lawful papers layouts that you can use for a range of uses. Generate a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner. At that point, you can sell the stock through the transfer agent or via a stockbroker.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

In the digital age, you can prove stock ownership without holding a physical certificate. However, if an investor wants a stock certificate, he can request that his brokerage house issue a certificate, or they can contact the company that issued the stocks.

Details to be provided in a Share Certificate Name of issuing Company. CIN no. ... Address of the company's registered office. Name of owners of such shares. Folio number of member. Number of shares which is represented by such share certificate. An amount which is paid on such shares. Distinct number of the shares.

A stock certificate is a physical piece of paper that represents a shareholder's ownership in a company. Stock certificates include information such as the number of shares owned, the date of purchase, an identification number, usually a corporate seal, and signatures.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.