Utah Reclassification of Class B common stock into Class A common stock

Description

How to fill out Reclassification Of Class B Common Stock Into Class A Common Stock?

Are you currently in a position the place you need to have documents for both enterprise or individual functions almost every day time? There are plenty of legitimate papers templates accessible on the Internet, but locating kinds you can trust is not straightforward. US Legal Forms delivers a large number of kind templates, such as the Utah Reclassification of Class B common stock into Class A common stock, that happen to be composed to fulfill federal and state demands.

If you are presently familiar with US Legal Forms website and get your account, merely log in. Afterward, it is possible to acquire the Utah Reclassification of Class B common stock into Class A common stock web template.

If you do not have an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is for the proper city/state.

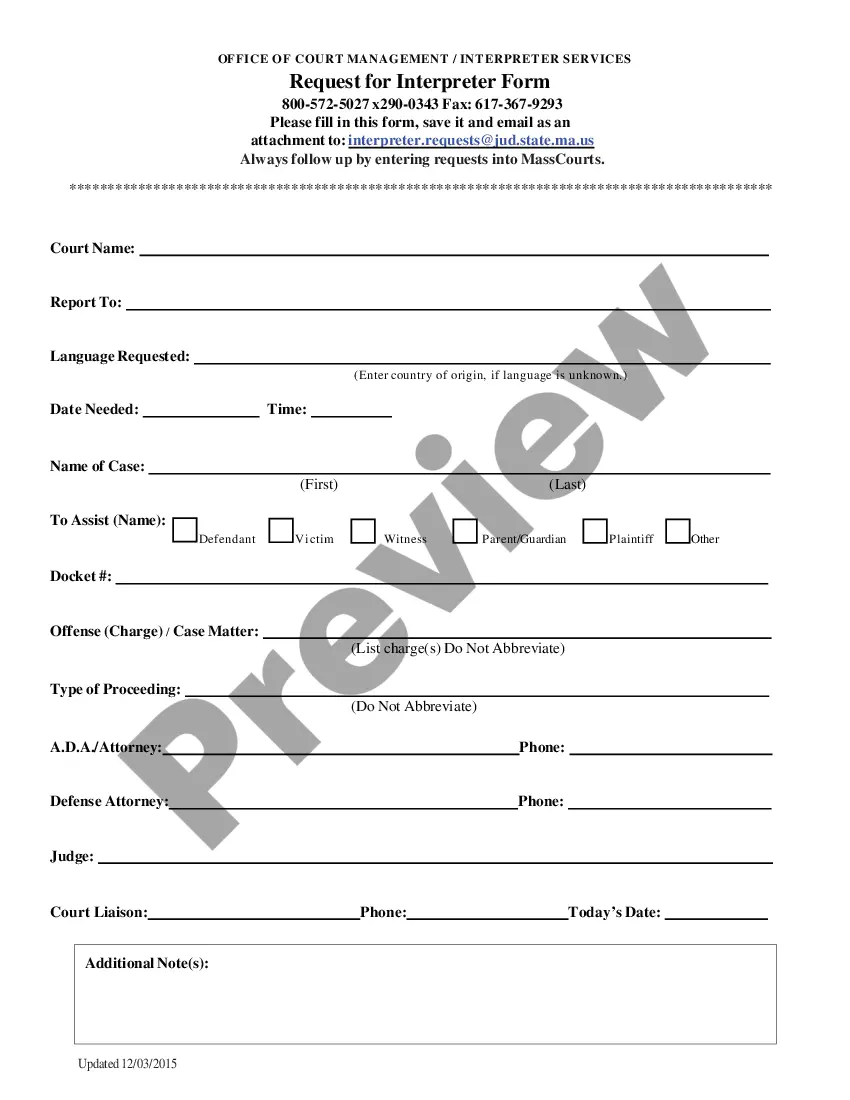

- Make use of the Preview option to examine the form.

- Read the explanation to ensure that you have selected the proper kind.

- In the event the kind is not what you`re seeking, use the Lookup area to discover the kind that meets your needs and demands.

- When you find the proper kind, click on Acquire now.

- Pick the costs prepare you would like, submit the necessary information and facts to produce your account, and purchase the transaction with your PayPal or charge card.

- Decide on a practical data file structure and acquire your duplicate.

Discover every one of the papers templates you may have purchased in the My Forms food selection. You can get a additional duplicate of Utah Reclassification of Class B common stock into Class A common stock at any time, if needed. Just click the needed kind to acquire or produce the papers web template.

Use US Legal Forms, probably the most substantial selection of legitimate forms, to save some time and stay away from faults. The support delivers skillfully manufactured legitimate papers templates that you can use for a range of functions. Generate your account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

A subdivision of a class of shares. If a corporation's articles permit shares of a class to be issued in one or more series, the directors may designate and assign characteristics to a series of shares that, subject to some limitations, may be different from shares of the same class in other series.

Most management actions are protected from judicial scrutiny by the business judgement rule: absent bad faith, fraud, or breach of a fiduciary duty, the judgement of the managers of a corporation is conclusive.

The Bottom Line. Class A and Class B shares differ in their availability, convertibility, and power as it relates to voting. One isn't necessarily better than the other, but Class A shares offer significant benefit in the event of a sale or when an outside force wants to obtain more voting power.

Purchasers of common stock are granted specific rights that may include the following: Voting at stockholder meetings. Selling or otherwise disposing of stock. Having the first opportunity to purchase additional shares of common stock issued by the corporation. Sharing dividends with other common stockholders.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

A series is a subset of a class of shares. If provided for in its articles, a corporation can issue a class of shares in one or more series. The articles may also authorize the directors to create and designate a class of shares in one or more series.

Key Takeaways Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public and also can't be traded by the holders of the shares.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.