Title: Utah Approval of Amendment to Articles of Incorporation Allowing Distributions from Capital Surplus for Specific Purposes Introduction: In the corporate landscape, organizations occasionally require flexibility in utilizing their capital surplus to achieve specific objectives, such as charitable endeavors, acquisitions, or capital improvements. The state of Utah grants corporations the option to seek approval for amendments to their articles of incorporation regarding the utilization of distributions from capital surplus. This article aims to provide a detailed description of the process and potential types of Utah Approval of amendment to articles of incorporation permitting certain uses of distributions from capital surplus. Keywords: Utah, approval, amendment, articles of incorporation, distributions, capital surplus, permit, specific uses. 1. Understanding Utah Approval of Amendment to Articles of Incorporation: In Utah, corporations are guided by the state's laws and regulations, including those governing the utilization of capital surplus. If a corporation seeks to deviate from the default allowances outlined in its articles of incorporation, an amendment must be pursued and approved. 2. Purpose and Significance of Amendments Permitting Certain Uses of Distributions: By seeking approval for amendments, corporations can leverage their capital surplus to accomplish specific objectives in line with their strategic plans. These can encompass a range of purposes, such as: a) Funding Charitable Initiatives: With necessary approvals, corporations can channel distributions from capital surplus towards charitable or philanthropic activities, contributing to social causes and community development. b) Financing Acquisitions: Through amendments, corporations can utilize capital surplus to finance mergers, acquisitions, or equity investments, enabling growth opportunities and expanding their market presence. c) Investing in Capital Improvements: By obtaining Utah Approval of amendment to articles of incorporation, corporations can allocate surplus funds for infrastructure development, upgrades, or technological advancements, fostering operational efficiency and competitiveness. 3. Navigating the Utah Approval Process: To obtain Utah Approval of amendment to articles of incorporation for utilizing distributions from capital surplus, corporations should adhere to these steps: a) Board Approval: The corporation's board of directors must propose and approve the intended amendment, accompanied by a clear rationale justifying the significance and benefits of the proposed utilization for distribution. b) Shareholder Notification: Shareholders should be informed about the proposed amendment, typically through a specially convened meeting or written notice, enabling them to voice their concerns, if any. c) Filing Documentation: The corporation must prepare and file relevant paperwork, including the amendment document itself and a cover letter explaining the requested changes. These should be submitted to the Utah Division of Corporations and Commercial Code. d) Utah Approval Decision: Upon receiving the filing, the Utah Division of Corporations and Commercial Code will review the proposed amendment, ensuring compliance with state laws. If approved, the division will issue a certificate of amendment to the corporation. Conclusion: The availability of Utah Approval of amendment to articles of incorporation empowers corporations to adapt and utilize their capital surplus for specific purposes beyond the traditional restrictions. By seeking proper approval, corporations can steer their surplus funds towards initiatives such as charitable endeavors, acquisitions, or capital improvements, contributing to their growth, societal impact, and competitiveness in the market.

Utah Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

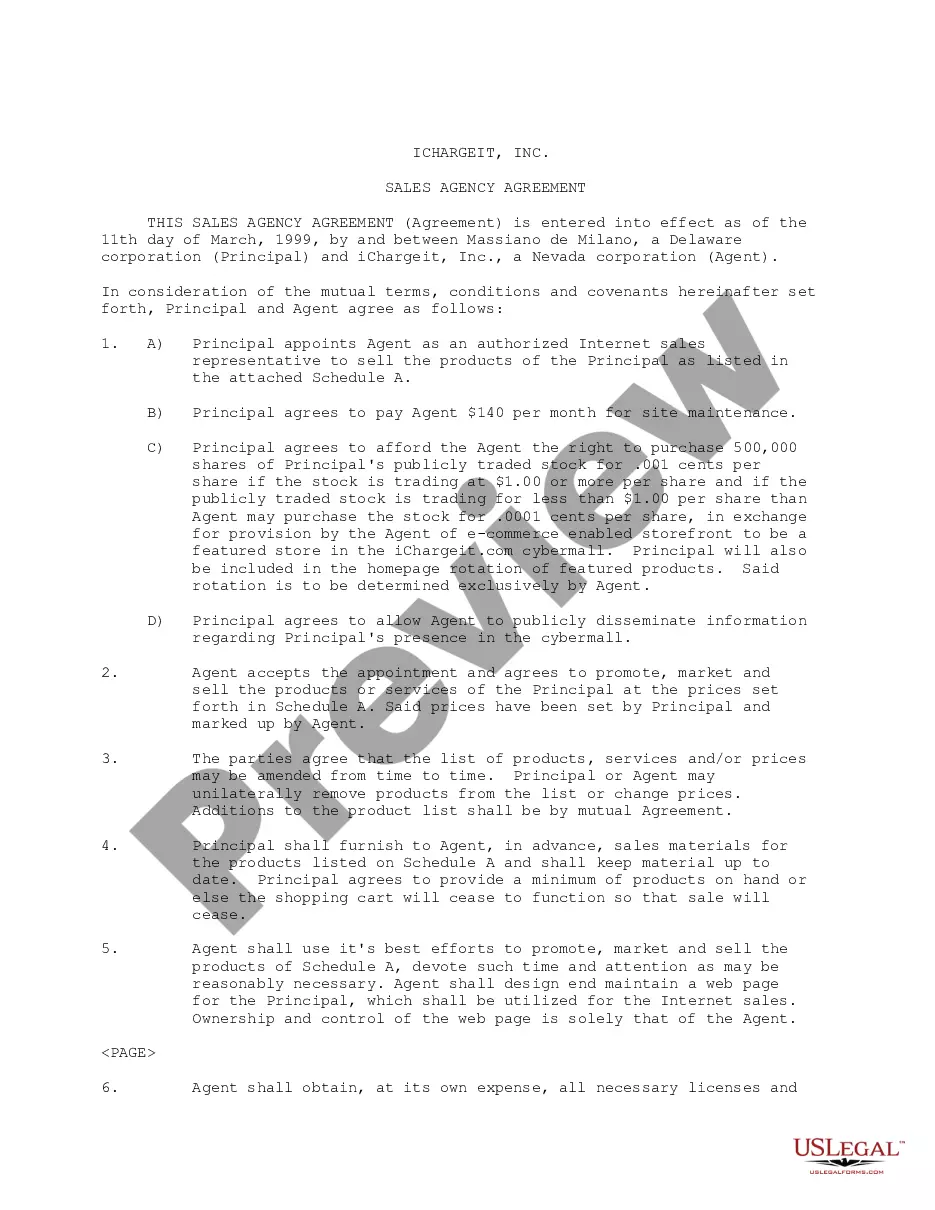

How to fill out Utah Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

If you want to complete, acquire, or print out legal document web templates, use US Legal Forms, the biggest selection of legal forms, which can be found on the web. Use the site`s easy and convenient look for to discover the papers you will need. Different web templates for company and individual reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Utah Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus within a few mouse clicks.

If you are presently a US Legal Forms customer, log in to the accounts and then click the Down load option to have the Utah Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. You can even entry forms you earlier downloaded within the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for your proper area/country.

- Step 2. Take advantage of the Review choice to look over the form`s content. Never overlook to learn the explanation.

- Step 3. If you are not happy using the kind, use the Look for field near the top of the monitor to find other models of your legal kind design.

- Step 4. Once you have found the shape you will need, select the Buy now option. Choose the costs plan you favor and add your qualifications to sign up for the accounts.

- Step 5. Procedure the purchase. You can use your bank card or PayPal accounts to finish the purchase.

- Step 6. Pick the formatting of your legal kind and acquire it on your device.

- Step 7. Complete, revise and print out or indication the Utah Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Each legal document design you purchase is your own permanently. You possess acces to every single kind you downloaded within your acccount. Go through the My Forms portion and select a kind to print out or acquire once again.

Contend and acquire, and print out the Utah Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus with US Legal Forms. There are thousands of professional and condition-particular forms you can utilize to your company or individual demands.