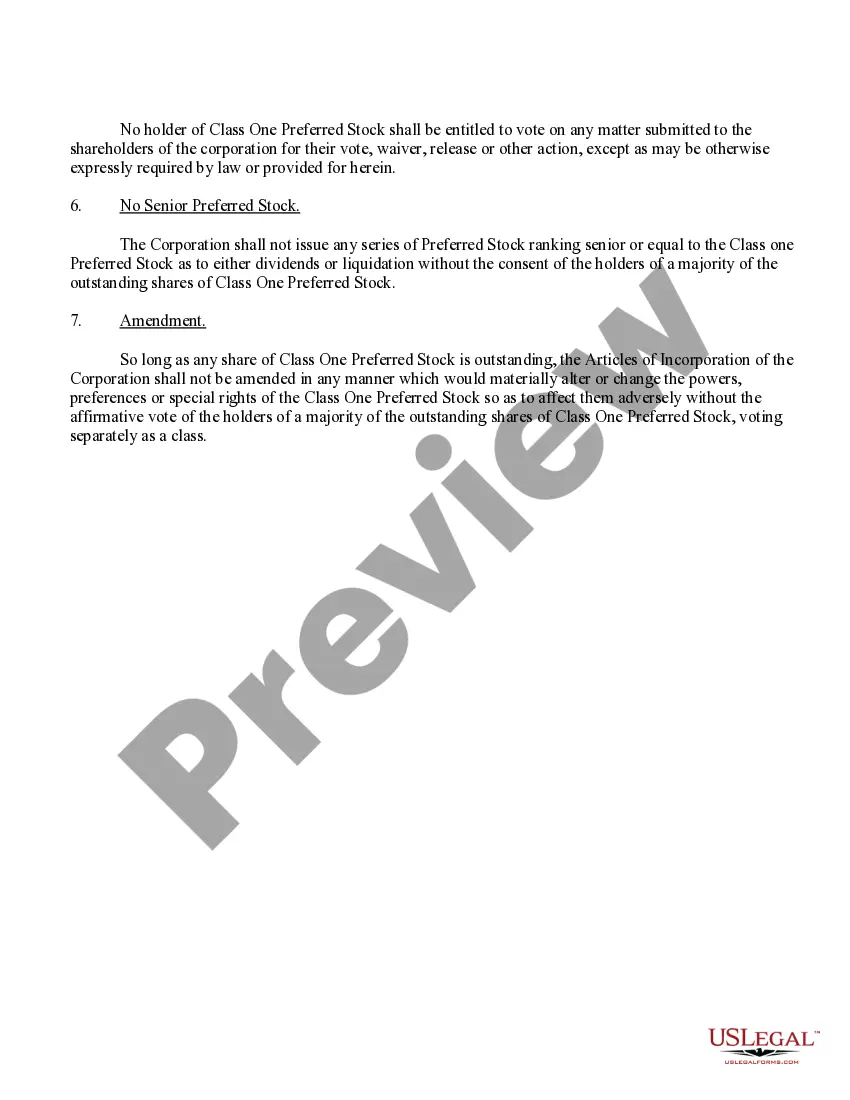

Utah Terms of Class One Preferred Stock

Description

How to fill out Terms Of Class One Preferred Stock?

Discovering the right lawful document design could be a battle. Obviously, there are tons of templates available on the net, but how can you get the lawful develop you will need? Utilize the US Legal Forms website. The services provides a large number of templates, like the Utah Terms of Class One Preferred Stock, which can be used for enterprise and private requires. Each of the types are examined by experts and meet federal and state needs.

In case you are currently listed, log in to the profile and then click the Down load option to find the Utah Terms of Class One Preferred Stock. Utilize your profile to search through the lawful types you may have acquired formerly. Go to the My Forms tab of your respective profile and acquire another duplicate of your document you will need.

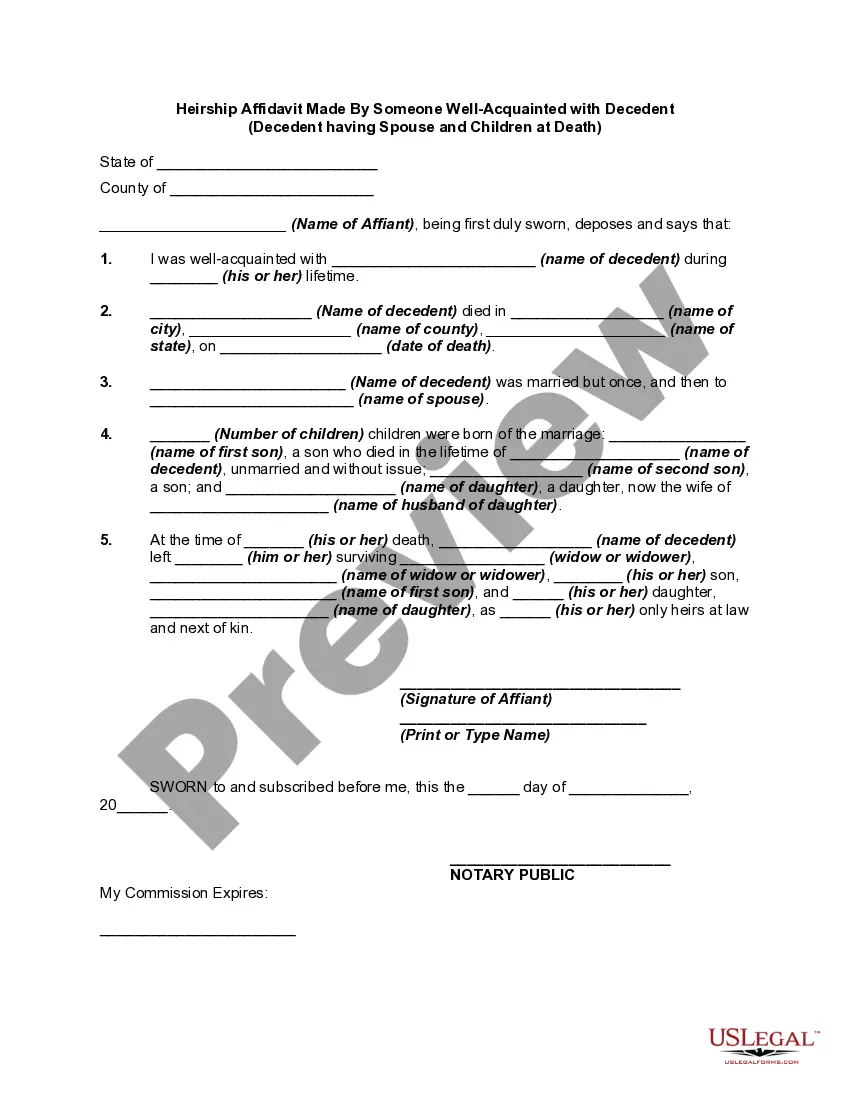

In case you are a whole new consumer of US Legal Forms, allow me to share simple instructions for you to follow:

- Initial, make certain you have chosen the correct develop for your personal metropolis/region. You are able to check out the shape while using Review option and study the shape information to make certain this is the right one for you.

- In case the develop fails to meet your needs, utilize the Seach industry to find the correct develop.

- When you are positive that the shape would work, go through the Acquire now option to find the develop.

- Opt for the costs program you want and enter in the essential details. Design your profile and buy the transaction making use of your PayPal profile or Visa or Mastercard.

- Pick the file file format and download the lawful document design to the device.

- Full, modify and produce and indication the acquired Utah Terms of Class One Preferred Stock.

US Legal Forms is definitely the largest collection of lawful types where you can discover a variety of document templates. Utilize the service to download appropriately-made papers that follow condition needs.

Form popularity

FAQ

What Is Cumulative Preferred Stock? Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

The one-class-of-stock rule prevents the corporation from having the complexity related to allocating earnings to multiple classes of owners. A corporation has only one class of stock if all outstanding shares provide for identical rights to stockholders regarding distribution and liquidation proceeds.

Preference Shares2 can be cumulative or non-cumulative. The former gives shareholders the right to receive cumulative dividend payouts from the company even if they are not profitable. That dividend payout can be made at some later point of time.

Cumulative preferred stock provides consistent income to shareholders. It ensures that if dividends are not paid in a particular period, they accumulate and must be paid in the future. This feature can attract risk-averse investors who seek reliable dividend payments and a degree of security.

Whether a preferred stock is cumulative or straight (non-cumulative) determines if the issuer must make up skipped payments. If it's cumulative, the issuer must pay missed dividends to preferred stockholders at some point. If it's straight, the issuer will not make up skipped dividends.

When preferred stock is cumulative and the directors either do not declare a dividend to preferred stockholders or declare one that does not cover the total amount of cumulative dividend, the unpaid dividend amount is called dividend in arrears.

16-10a-601 Authorized shares. All shares of a class shall have preferences, limitations, and relative rights identical with those of other shares of the same class except to the extent otherwise permitted by this section and Section 16-10a-602.

There are four general types of Preferred Stock: Non-Cumulative Shares: No back payment of deferred dividend payments. Participating: Offer higher-than-normal dividends when profits are higher-than-normal. Convertible: Option to convert shares into Common Stock if desired.