The Utah Agreement and Plan of Merger, involving Gel co Corp. and Grossman Corp., is a significant legal document outlining the terms and conditions of the merger between the two companies. This agreement encompasses various aspects of the merger process, ensuring a smooth transition and aligning the interests of both parties involved. Keywords: Utah Agreement and Plan of Merger, Gel co Corp., Grossman Corp., merger process, terms and conditions, legal document, transition, interests. This type of agreement is commonly used within the corporate landscape to formalize the merger of two entities. The Utah Agreement and Plan of Merger can take different forms, depending on the specific requirements and circumstances of the merging companies. Some potential types include: 1. Statutory Merger: This type of merger involves one company (the target company) merging with another (the acquiring company). The target company's assets, liabilities, and operations are integrated into the acquiring company, resulting in a single surviving entity. 2. Stock-for-Stock Merger: In this form of merger, the shares of one company are exchanged directly for shares of the other company. The shareholder of the target company receives shares in the acquiring company, and the target company ceases to exist as a separate entity. 3. Asset Acquisition: Unlike the previous types, an asset acquisition involves purchasing specific assets and liabilities of a company rather than merging with the entire entity. This allows the acquiring company to select certain assets while leaving behind any unwanted liabilities. 4. Consolidation: This type of merger combines multiple companies into a new entity. The Utah Agreement and Plan of Merger outlining consolidation would outline the terms and conditions for the formation of the new corporate entity, addressing issues such as governance, equity distribution, and management structure. Regardless of the type, the Utah Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. is designed to protect the interests of both entities, ensure compliance with applicable laws and regulations, and provide a clear roadmap for the merger process.

Utah Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

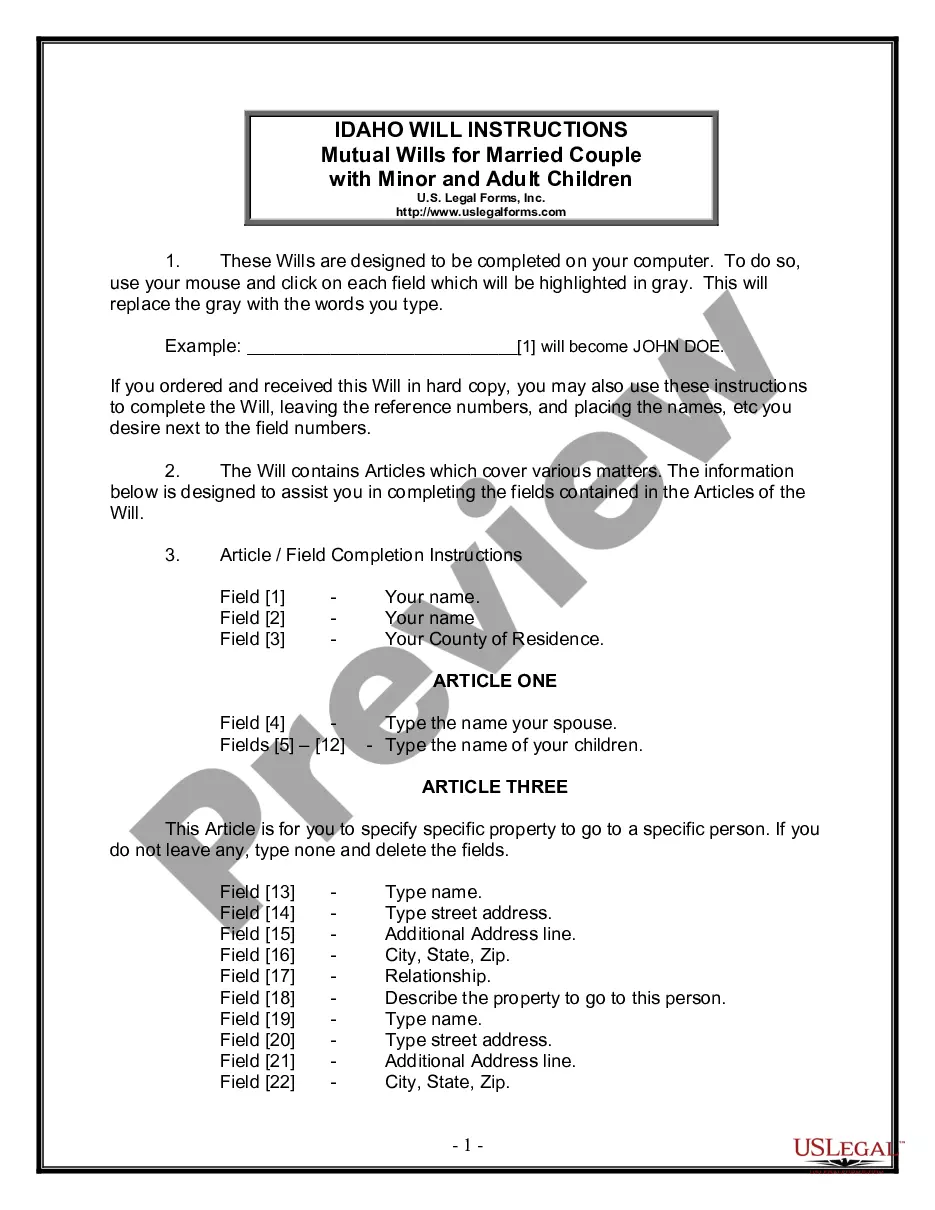

How to fill out Utah Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

If you have to total, down load, or produce authorized papers web templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on the web. Make use of the site`s simple and easy practical search to obtain the paperwork you want. Various web templates for company and personal functions are sorted by categories and claims, or key phrases. Use US Legal Forms to obtain the Utah Agreement and plan of merger by Gelco Corp. and Grossman Corp. in a couple of click throughs.

Should you be presently a US Legal Forms consumer, log in for your bank account and then click the Acquire key to obtain the Utah Agreement and plan of merger by Gelco Corp. and Grossman Corp.. You may also access forms you formerly downloaded within the My Forms tab of your own bank account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for your correct area/region.

- Step 2. Use the Preview choice to check out the form`s information. Do not forget to see the information.

- Step 3. Should you be unhappy with the type, take advantage of the Look for discipline near the top of the monitor to get other variations from the authorized type format.

- Step 4. Upon having found the shape you want, select the Get now key. Select the pricing plan you like and include your references to register on an bank account.

- Step 5. Method the purchase. You should use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Find the formatting from the authorized type and down load it on your own product.

- Step 7. Complete, edit and produce or sign the Utah Agreement and plan of merger by Gelco Corp. and Grossman Corp..

Every single authorized papers format you buy is your own property forever. You have acces to every type you downloaded in your acccount. Click on the My Forms segment and pick a type to produce or down load once more.

Be competitive and down load, and produce the Utah Agreement and plan of merger by Gelco Corp. and Grossman Corp. with US Legal Forms. There are many skilled and state-specific forms you can use for the company or personal requires.