Title: Understanding the Utah Agreement and Plan of Reorganization by Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. Introduction: The Utah Agreement and Plan of Reorganization refers to a specific legal arrangement between Wedge stone Realty Investors Trust (WRIT) and Wedge stone Advisory Corp. (WAC) in the state of Utah. This detailed description aims to provide an overview of this agreement, its purpose, and possible variations that might exist within the arrangement. Overview of Utah Agreement and Plan of Reorganization: The Utah Agreement and Plan of Reorganization is a legally binding contract that outlines the terms and conditions under which WRIT and WAC will merge, restructure, or consolidate their respective real estate investment activities. Such arrangements are common within the business world, enabling companies to streamline operations, increase efficiency, achieve synergies, or pursue growth opportunities. Key Terms and Provisions: 1. Merger or Consolidation: This type of agreement often involves the merger or consolidation of WRIT and WAC, where both entities combine their assets, resources, and operations to form a new single entity. This agreement outlines the ownership and management structure of the new entity. 2. Transfer of Assets: The agreement may also involve the transfer of certain assets, such as real estate properties, intellectual property, contracts, or financial instruments, from one entity to another. The specifics of these asset transfers are usually outlined in detail within the agreement. 3. Shareholder and Stakeholder Considerations: The Utah Agreement and Plan of Reorganization may provide guidance on the treatment of WRIT and WAC shareholders and stakeholders during and after the reorganization process. This includes aspects such as voting rights, stock conversions, dividend considerations, and any other relevant financial considerations. 4. Governance and Management Structure: The agreement typically defines the governance and management framework of the newly reorganized entity. It specifies the roles, responsibilities, and decision-making authority of board members, executives, or other relevant stakeholders. 5. Legal and Regulatory Requirements: The agreement ensures compliance with Utah's legal and regulatory framework governing such reorganization processes. It addresses the necessary approvals, notifications, and any other procedural requirements that must be fulfilled to complete the reorganization. Other Possible Types of Utah Agreement and Plan of Reorganization: While the specifics of the Utah Agreement and Plan of Reorganization by WRIT and WAC may vary depending on their strategic goals, some common variations may include: 1. Horizontal Merger: This type of reorganization involves the combination of two entities operating within the same industry or sector. Here, WRIT and WAC might merge their real estate investment portfolios to increase market share and gain a competitive edge. 2. Vertical Merger: In a vertical merger, WRIT and WAC might combine their operations vertically along the supply chain, such as a real estate development company merging with a property management company. This integration allows for increased efficiency, cost savings, and control over the entire value chain. 3. Conglomerate Merger: This type of merger involves entities from unrelated industries. In this scenario, WRIT and WAC might merge to diversify their investment portfolios, gain new revenue streams, or expand into new markets. Conclusion: The Utah Agreement and Plan of Reorganization between Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. is a crucial legal document that governs the merger or consolidation of these entities' real estate investment activities. By adhering to the agreed-upon terms and provisions, the reorganization aims to create a more robust, efficient, and competitive entity better positioned to meet the challenges of the industry.

Utah Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Utah Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

If you need to total, obtain, or print out lawful papers layouts, use US Legal Forms, the greatest variety of lawful kinds, which can be found online. Utilize the site`s simple and convenient research to find the papers you will need. Various layouts for enterprise and personal reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to find the Utah Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. in just a number of click throughs.

When you are currently a US Legal Forms consumer, log in in your bank account and then click the Download key to obtain the Utah Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.. Also you can entry kinds you previously downloaded from the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, follow the instructions below:

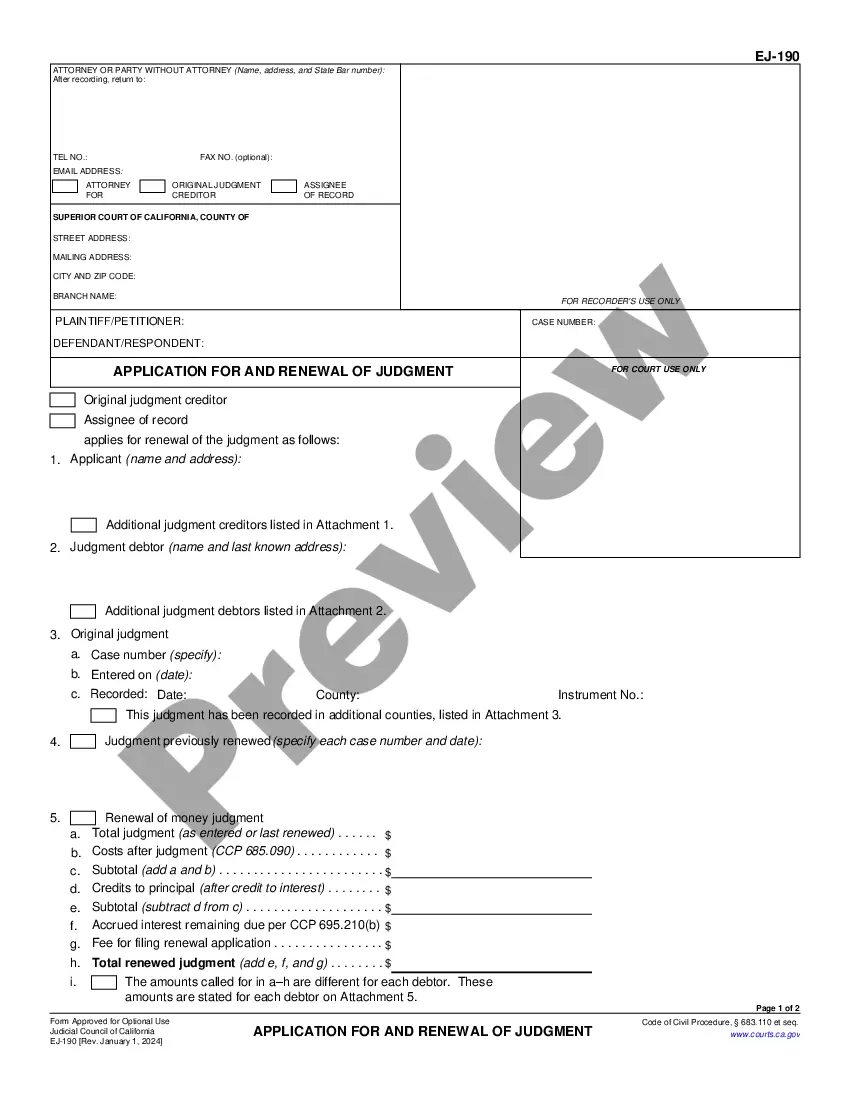

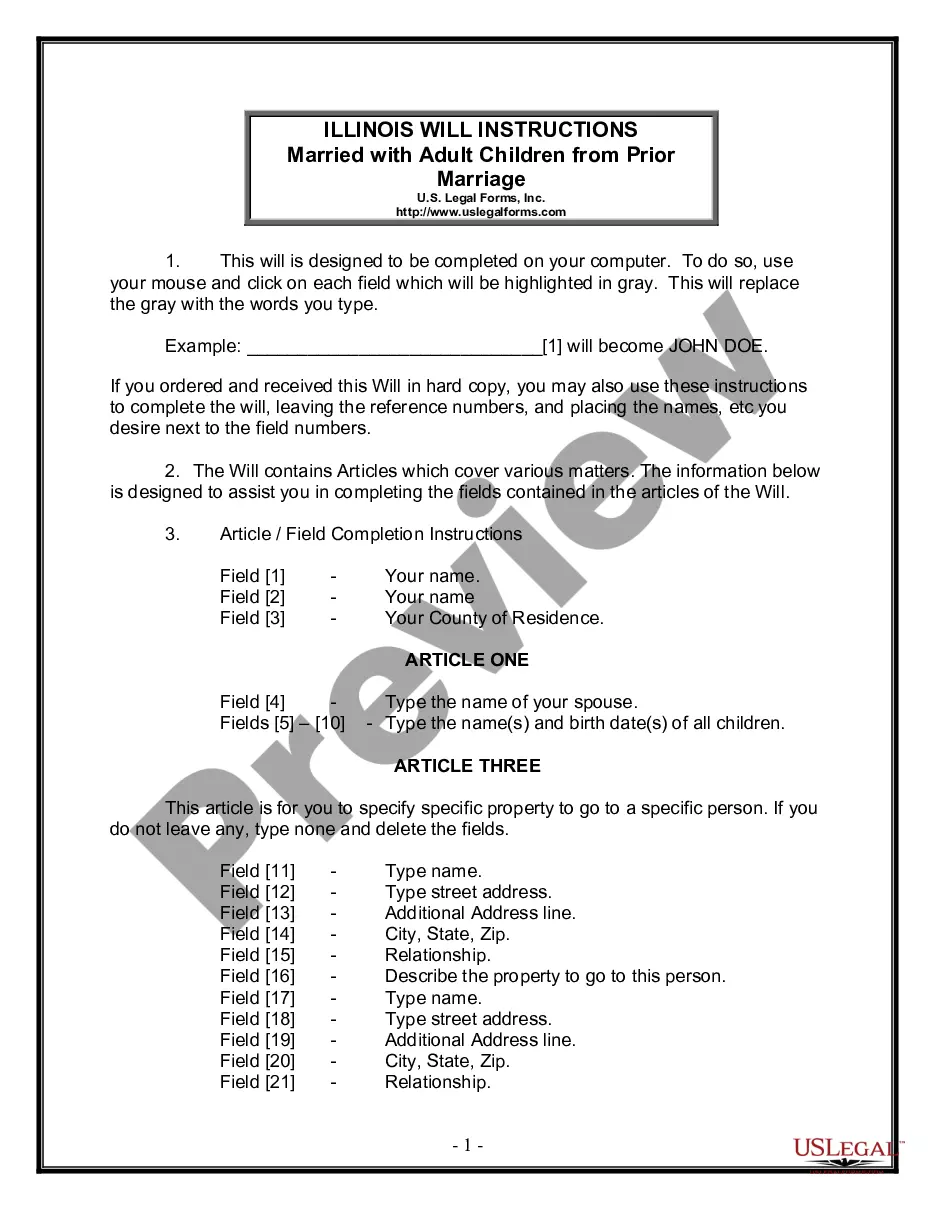

- Step 1. Be sure you have selected the shape for that proper area/nation.

- Step 2. Take advantage of the Review solution to look over the form`s content material. Never overlook to learn the information.

- Step 3. When you are unsatisfied with all the form, make use of the Lookup area near the top of the screen to find other types in the lawful form design.

- Step 4. After you have located the shape you will need, select the Get now key. Choose the rates strategy you prefer and put your accreditations to sign up on an bank account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the formatting in the lawful form and obtain it in your gadget.

- Step 7. Full, modify and print out or sign the Utah Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp..

Every lawful papers design you get is the one you have forever. You have acces to each form you downloaded within your acccount. Select the My Forms section and pick a form to print out or obtain again.

Contend and obtain, and print out the Utah Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. with US Legal Forms. There are many professional and state-distinct kinds you can use for your personal enterprise or personal requirements.