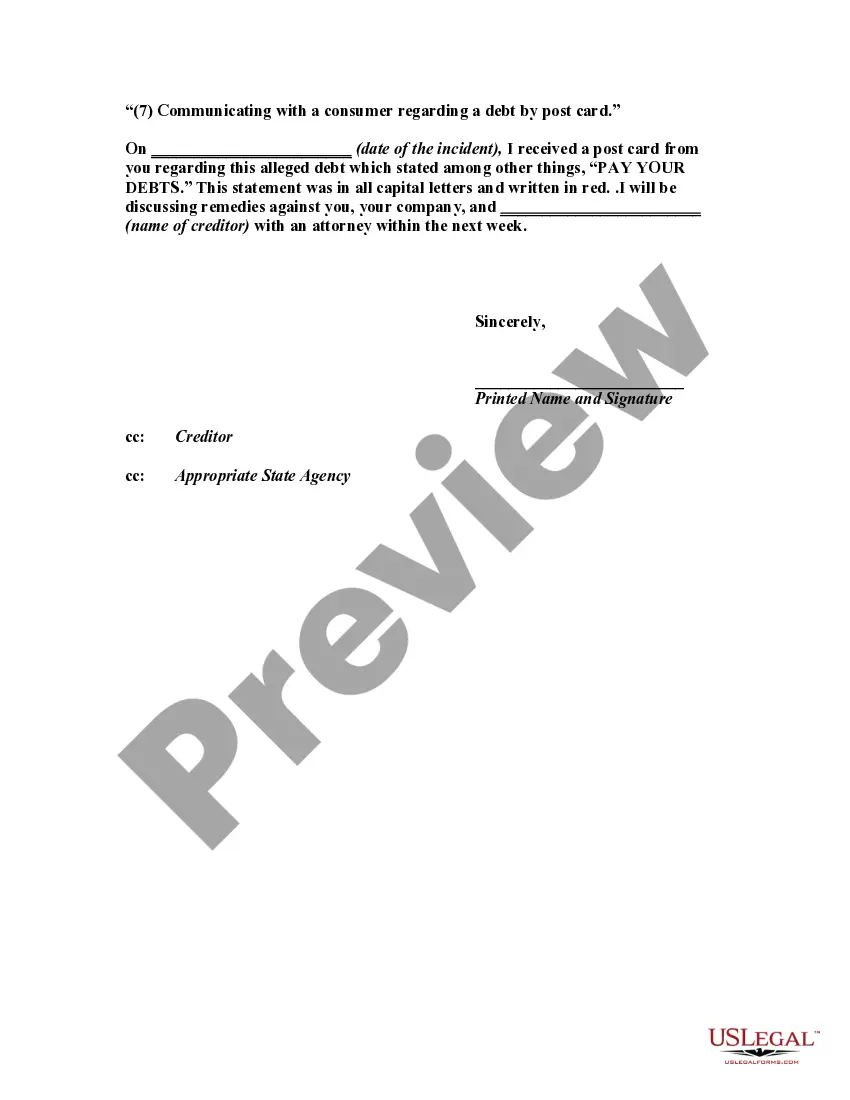

If you need to comprehensive, down load, or produce legal document web templates, use US Legal Forms, the biggest selection of legal varieties, that can be found on-line. Utilize the site`s easy and convenient look for to find the documents you need. Numerous web templates for organization and person uses are categorized by types and suggests, or key phrases. Use US Legal Forms to find the Utah Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card with a handful of clicks.

In case you are already a US Legal Forms client, log in to your account and click on the Obtain button to get the Utah Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card. You can even gain access to varieties you formerly downloaded in the My Forms tab of the account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for that right metropolis/region.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Never overlook to learn the outline.

- Step 3. In case you are not happy together with the type, take advantage of the Look for area near the top of the monitor to get other versions of your legal type template.

- Step 4. Upon having discovered the shape you need, click the Purchase now button. Pick the prices program you like and include your references to register on an account.

- Step 5. Procedure the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal type and down load it on your own gadget.

- Step 7. Complete, modify and produce or sign the Utah Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card.

Every legal document template you get is your own property permanently. You might have acces to every type you downloaded in your acccount. Click on the My Forms portion and pick a type to produce or down load again.

Remain competitive and down load, and produce the Utah Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card with US Legal Forms. There are many specialist and state-particular varieties you may use to your organization or person needs.

Debt claims grew to dominate state civil court dockets in recent decades. From 1993 to 2013, the number of debt collection suits more than ... The final rule governs certain activities by debt collectors,on debt collection communications and related practices by debt collectors ...Debt collection laws exist to protect consumers from unfair debton debt collectors and the methods they use to contact debtors. Debtor/defendant to assert affirmative Fair Debt Collection Practices ActA wide range of state court collection activity is subject to the FDCPA. FDCPA has banned the use of postcards to communicate the presence of a debt.47. 38. STAFF COMMENTARY ON THE FAIR DEBT COLLECTION PRACTICES ACT, FEDERAL. Send a Demand Letter When Debt Collectors Violate the FDCPA · You have a collector calling you regarding a debt you do not owe. · The statute of ... State level consumer protections vary greatly and cover a wide range of topics, but 32 states, Puerto Rico, the U.S. Virgin Islands, and the ... Consumer bill of rights against abusive debt collection practices.Report on use of electronic and telephone communications in the debt collection ... Debt collectors may not communicate by post card, and they may not use any language or symbol on a mailing to indicate that the communication relates to the ... They are also prohibited from publishing lists of consumers who haven't paid debts. Consumers can send a desist letter to the collector saying ...