A Utah Letter to Debt Collector — Only Contact My Attorney is a legal document that can be used to assert the rights of an individual in Utah who may be facing debt collection efforts. This letter serves as a powerful tool to protect consumers from harassment or unfair practices of debt collectors. By specifically instructing the debt collector to refrain from contacting the debtor directly and instead only communicate through their attorney, this document aims to provide individuals with the necessary legal protection and professional representation. Utah Debt Collection Laws: It is crucial to understand the relevant laws and regulations concerning debt collection in Utah. Familiarize yourself with the Fair Debt Collection Practices Act (FD CPA) and the Utah Fair Debt Collection Practices Act (UFD CPA) before preparing or sending any correspondence to debt collectors. Different Types of Utah Letter to Debt Collector — Only Contact My Attorney: 1. General Utah Letter to Debt Collector — Only Contact My Attorney: This type of letter is a comprehensive document that can be used in various debt collection situations. It explicitly states that the debtor refuses any direct interaction with the collectors and requests all communications and correspondences to go exclusively through their attorney. 2. Utah Letter to Debt Collector — Legal Representation Already Obtained: This variation of the letter is specifically designed for individuals who have already secured legal representation. It reaffirms their choice to only communicate through their attorney and instructs the debt collector to reach out solely to their legal counsel. 3. Utah Letter to Debt Collector — Required Validation of Debt: In some cases, the debtor may find it necessary to request validation of the debt from the collector. This particular Utah letter emphasizes the debtor's rights to receive proof of the alleged debt, along with a demand for the collector to adhere to all necessary validations and verification procedures mandated by law. 4. Utah Letter to Debt Collector — Dispute of Debt and Cease Communications: This type of letter is suitable for individuals who dispute the validity of the debt being claimed against them. The letter formally disputes the debt while instructing the collector to cease any further communications until the validity is proven. It further emphasizes that any attempts or failure to provide the requested proof will result in legal action. 5. Utah Letter to Debt Collector — Cease and Desist Harassment: When facing harassment by a debt collector, this letter serves as a powerful tool for asserting one's rights. It clearly instructs the collector to immediately stop any contact or communication attempts and warns that failure to comply will result in legal consequences. Remember, it is crucial to consult with an attorney before sending any Utah Letter to Debt Collector — Only Contact My Attorney to ensure that your specific situation, rights, and legal options are properly addressed.

Utah Letter to Debt Collector - Only Contact My Attorney

Description

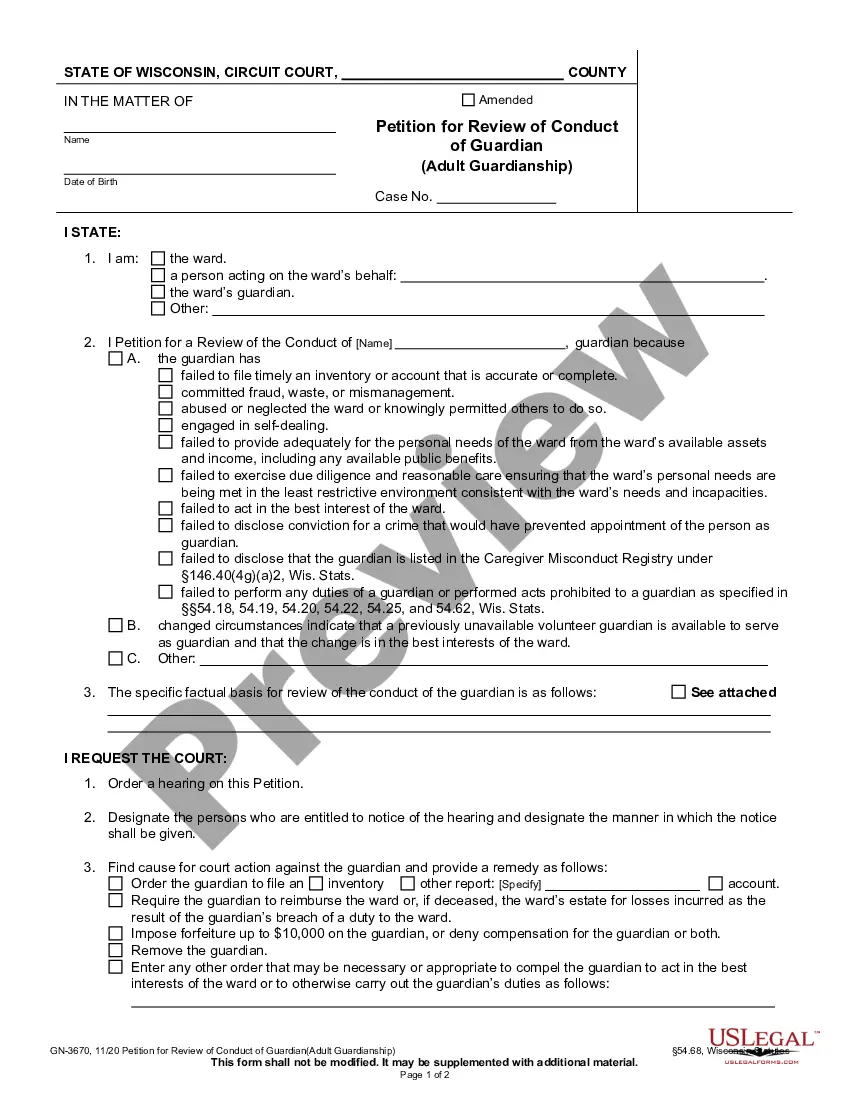

How to fill out Utah Letter To Debt Collector - Only Contact My Attorney?

You may commit hours on-line trying to find the lawful document format that meets the federal and state needs you will need. US Legal Forms supplies 1000s of lawful varieties which are reviewed by pros. You can easily down load or print the Utah Letter to Debt Collector - Only Contact My Attorney from your service.

If you have a US Legal Forms accounts, it is possible to log in and then click the Obtain key. Afterward, it is possible to complete, revise, print, or signal the Utah Letter to Debt Collector - Only Contact My Attorney. Every lawful document format you acquire is yours eternally. To obtain yet another backup associated with a purchased type, proceed to the My Forms tab and then click the related key.

If you use the US Legal Forms website initially, follow the straightforward guidelines under:

- First, be sure that you have chosen the right document format to the area/area of your liking. See the type explanation to ensure you have picked out the right type. If accessible, use the Review key to search with the document format too.

- If you want to discover yet another edition of the type, use the Search area to get the format that suits you and needs.

- When you have found the format you would like, click on Purchase now to proceed.

- Find the costs prepare you would like, enter your credentials, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal accounts to pay for the lawful type.

- Find the file format of the document and down load it in your device.

- Make changes in your document if possible. You may complete, revise and signal and print Utah Letter to Debt Collector - Only Contact My Attorney.

Obtain and print 1000s of document themes while using US Legal Forms site, that provides the largest collection of lawful varieties. Use skilled and express-distinct themes to take on your small business or individual requires.

Form popularity

FAQ

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline. How to Write Debt Collection Letters to Legal Clients - Embroker embroker.com ? lawyer-debt-collection-letter embroker.com ? lawyer-debt-collection-letter

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector. Should I share personal information with a debt collector? consumerfinance.gov ? ask-cfpb ? should-i-... consumerfinance.gov ? ask-cfpb ? should-i-...

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it. Debt Validation Letter: Definition, Sample, and Your Rights Investopedia ? ... ? Debt Management Investopedia ? ... ? Debt Management

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

If you have a debt collection or eviction case, you can file your answer online with MyCase. You can use it to eFile and see what has been filed. If you can't log in to MyCase and are short on time to file your answer, use one of the forms below and file another way. Answering a Complaint or Petition - Utah State Courts utcourts.gov ? self-help ? family ? answer utcourts.gov ? self-help ? family ? answer

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.