Utah Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

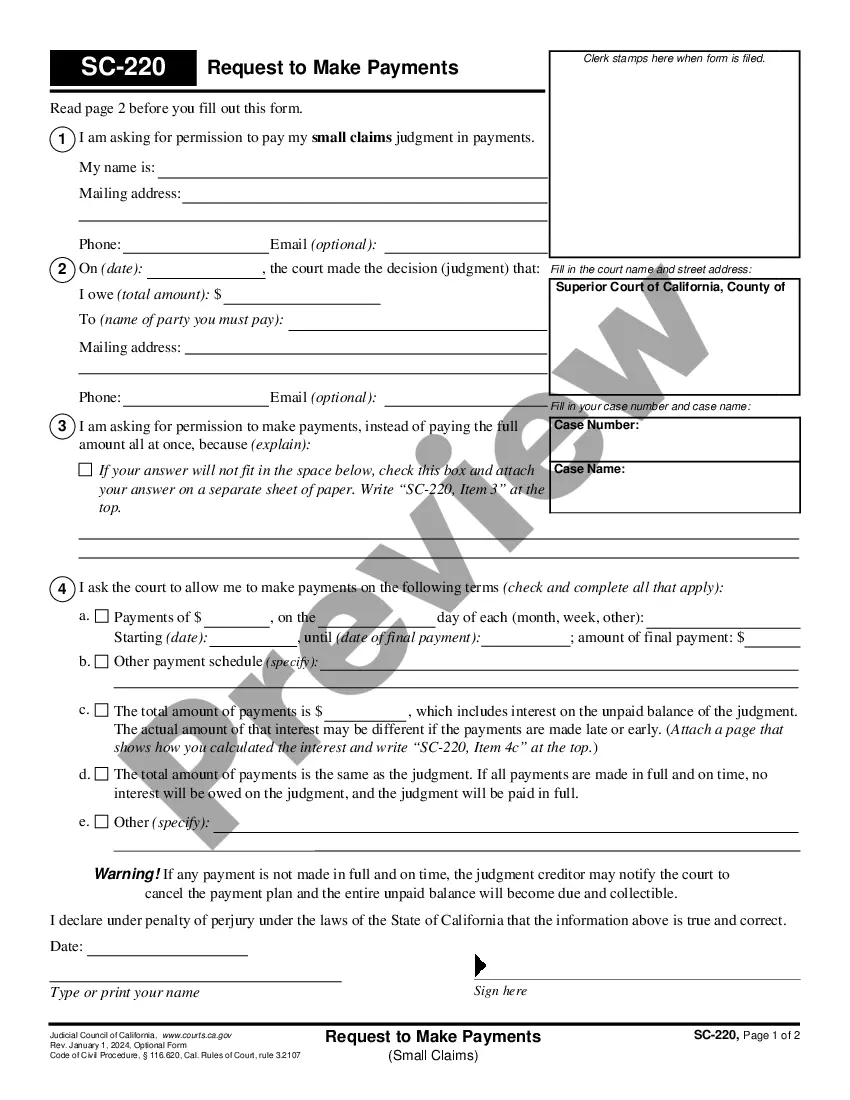

How to fill out Utah Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

US Legal Forms - one of the most significant libraries of legal forms in the USA - provides an array of legal document themes it is possible to download or produce. Making use of the website, you can get thousands of forms for business and person purposes, sorted by categories, states, or keywords and phrases.You can find the newest variations of forms like the Utah Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in seconds.

If you already possess a monthly subscription, log in and download Utah Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself through the US Legal Forms collection. The Acquire switch will show up on each and every form you look at. You get access to all formerly acquired forms from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, listed below are simple guidelines to help you get started:

- Ensure you have picked out the proper form to your metropolis/area. Click on the Preview switch to review the form`s content material. Look at the form explanation to actually have selected the appropriate form.

- In case the form does not fit your specifications, make use of the Look for field on top of the screen to find the one who does.

- Should you be content with the shape, verify your choice by clicking the Buy now switch. Then, select the pricing strategy you prefer and offer your qualifications to sign up for an accounts.

- Method the transaction. Use your Visa or Mastercard or PayPal accounts to perform the transaction.

- Pick the format and download the shape on the system.

- Make modifications. Load, modify and produce and sign the acquired Utah Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Every web template you put into your bank account does not have an expiry time and is also the one you have eternally. So, if you want to download or produce another copy, just proceed to the My Forms segment and click about the form you need.

Obtain access to the Utah Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms, by far the most extensive collection of legal document themes. Use thousands of specialist and status-particular themes that fulfill your business or person requirements and specifications.

Form popularity

FAQ

In Utah, for most debts, a creditor has six years to take legal action on that unpaid debt. After the statute of limitations expires, a creditor or debt collector can no longer sue you for the debt.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The FDCPA defines a "creditor" as the person or entity that extended you the credit in the first place (in other words, your original lender). Because the FDCPA is designed to protect debtors against third-party debt collectors, it doesn't apply to your original creditor or its employees.

In Utah, the statute of limitations for any signed written contract, obligation or liability is 6 years. For unwritten (verbal) contracts, obligations, or liabilities, the statute of limitation for an unpaid debt expires after 4 years.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

In Utah, state tax debt has the shortest statute of limitations at just three years; most other forms of debt, such as credit cards and medical debt, have a statute of limitations of six years.