Utah Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank

Description

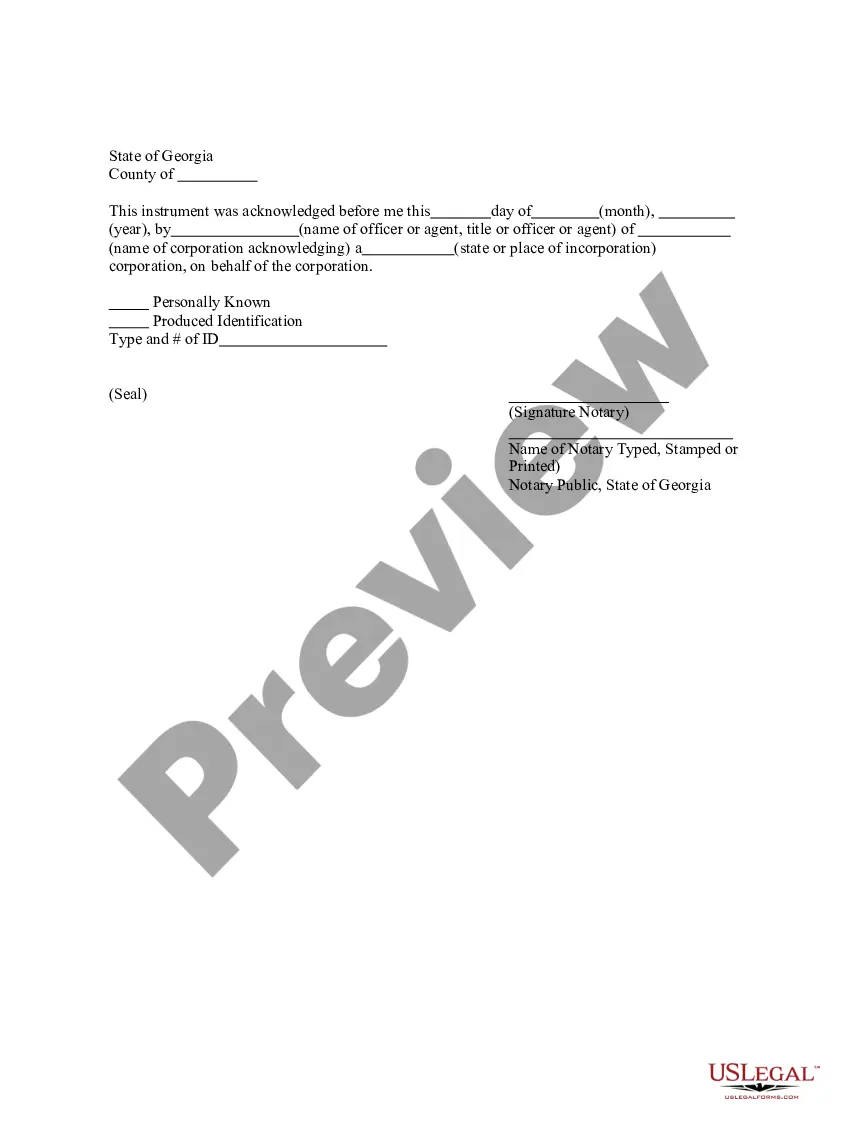

How to fill out Escrow Agreement Public Offering Between Lorelei Corporation And Chase Manhattan Bank?

US Legal Forms - among the most significant libraries of lawful forms in the USA - delivers a wide array of lawful papers layouts you can download or produce. Utilizing the internet site, you can get a huge number of forms for company and person purposes, categorized by types, says, or search phrases.You can get the newest versions of forms just like the Utah Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank within minutes.

If you already have a registration, log in and download Utah Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank through the US Legal Forms collection. The Down load option will show up on each develop you look at. You have accessibility to all earlier acquired forms from the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, listed here are easy instructions to obtain started off:

- Ensure you have picked the right develop for your city/area. Go through the Review option to analyze the form`s information. Look at the develop outline to ensure that you have selected the right develop.

- In the event the develop does not match your needs, utilize the Lookup field at the top of the display screen to obtain the one which does.

- In case you are happy with the form, affirm your decision by clicking the Purchase now option. Then, select the rates prepare you want and offer your qualifications to sign up for the profile.

- Approach the deal. Utilize your charge card or PayPal profile to finish the deal.

- Choose the format and download the form on the device.

- Make alterations. Fill up, modify and produce and signal the acquired Utah Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank.

Each and every format you included in your account lacks an expiration date and is also your own property permanently. So, if you wish to download or produce another backup, just check out the My Forms area and then click about the develop you require.

Gain access to the Utah Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank with US Legal Forms, probably the most comprehensive collection of lawful papers layouts. Use a huge number of professional and express-certain layouts that satisfy your business or person demands and needs.

Form popularity

FAQ

These bank accounts are set up by your mortgage servicer to hold funds for paying property taxes, homeowners insurance and other expenses on your behalf, and there are several reasons why they may have a surplus. If you've received an escrow refund check, the money is yours to keep and use as you desire.

Depending on where you live and your lender, your escrow account may pay interest on the account balance. The interest rate on your escrow account might be higher than market rates on other types of personal deposit accounts.

After closing on a house, escrow accounts are mainly used to pay taxes and insurance. This works by applying for a mortgage. If you go through a mortgage lender to take out a loan in order to buy a home, you may end up using the money in your escrow account to help you with your monthly payments.

In particular, the money that might end up as an overage in an escrow account could be used for short-term investments. Earning interest on such investments may make more financial sense for you, instead of allowing a bank or lender to reap the gains.

Who owns the money in an escrow account? The buyer in a transaction owns the money held in escrow. This is because the escrow agent only has the money in trust. The ownership of the money is transferred to the seller once the transaction's obligations are met.