Utah Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc.

Description

How to fill out Sample Asset Purchase Agreement Between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. And WPI Group, Inc.?

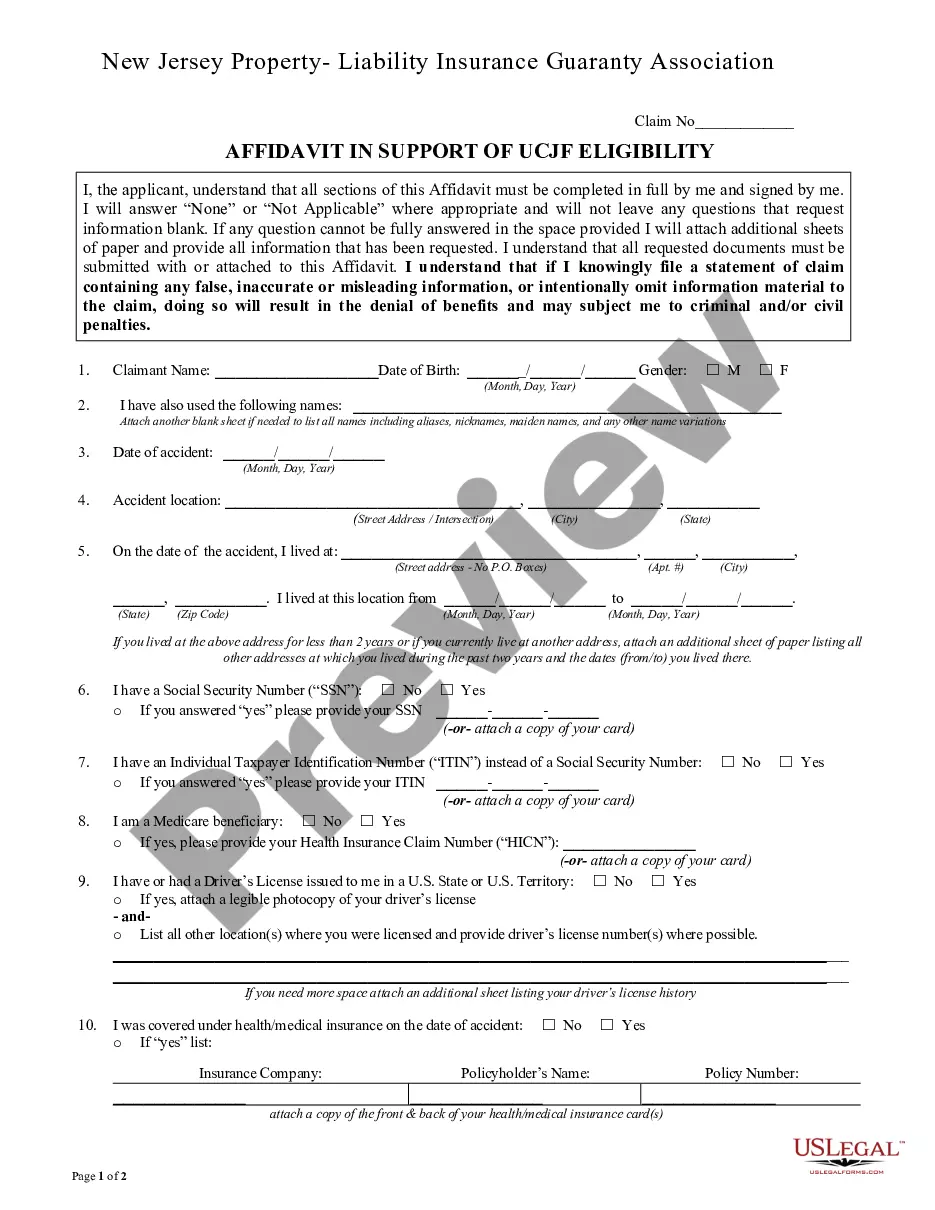

Are you currently in a position where you need to have paperwork for both organization or individual reasons virtually every working day? There are a variety of authorized record layouts available on the net, but finding versions you can rely on isn`t straightforward. US Legal Forms provides thousands of form layouts, much like the Utah Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc., that happen to be composed to satisfy federal and state requirements.

When you are presently acquainted with US Legal Forms website and get your account, merely log in. Afterward, you can download the Utah Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc. format.

Should you not come with an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is to the appropriate city/area.

- Utilize the Review button to review the form.

- Browse the information to ensure that you have selected the right form.

- In case the form isn`t what you`re seeking, take advantage of the Search field to find the form that fits your needs and requirements.

- Whenever you get the appropriate form, click Get now.

- Pick the costs prepare you want, complete the necessary information to make your bank account, and pay money for the order using your PayPal or charge card.

- Pick a hassle-free file formatting and download your copy.

Discover all of the record layouts you have purchased in the My Forms menus. You can aquire a more copy of Utah Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc. anytime, if required. Just click on the necessary form to download or print the record format.

Use US Legal Forms, one of the most comprehensive selection of authorized varieties, to save time and stay away from blunders. The support provides professionally made authorized record layouts which can be used for a range of reasons. Make your account on US Legal Forms and initiate producing your daily life easier.