The Utah Investors' Rights Agreement is a legally binding document that outlines the rights and obligations of Velocity, Inc., existing holders, and founders in regard to investments made in Utah. It serves as a means to protect the interests and provide certain privileges to investors while ensuring transparency and accountability. Under the Utah Investors' Rights Agreement, the existing holders and founders agree to grant certain investor rights to parties who have made significant financial contributions to Velocity, Inc. Some key provisions covered in this agreement include: 1. Voting Rights: The agreement establishes the voting rights of investors, allowing them to participate in corporate decisions that may have a material impact on the company's operations, such as changes to the board of directors or major corporate transactions. 2. Information Rights: Investors are granted access to certain financial and operational information about Velocity, Inc., allowing them to evaluate the company's performance and make informed investment decisions. 3. Registration Rights: The agreement may include provisions that grant investors the right to have their shares registered for resale. This enables investors to freely transfer their shares, subject to certain conditions and regulatory requirements. 4. Anti-Dilution Protection: In some cases, the agreement may provide anti-dilution protection to investors, ensuring that their ownership percentage is not diluted in the event of subsequent financing rounds or the issuance of additional shares. 5. Preemptive Rights: The document may outline the preemptive rights of investors, giving them the opportunity to participate in future fundraising activities to maintain their ownership percentage in Velocity, Inc. 6. Tag-Along Rights: Tag-along rights enable investors to sell their shares along with the founders or existing holders, should they choose to sell their stakes in the company. This provision ensures investors have the opportunity to exit their investment on the same terms and conditions as the majority shareholders. It is important to note that there may be different types or variations of the Utah Investors' Rights Agreement. These could include versions tailored for different stages of financing, such as Seed Investor Rights Agreement, Series A Investor Rights Agreement, or Series B Investor Rights Agreement. Each agreement would typically have specific provisions relevant to the corresponding investment stage. In conclusion, the Utah Investors' Rights Agreement between Velocity, Inc., existing holders, and founders is a comprehensive legal instrument that ensures investor protection, governance, and transparency. It outlines the rights and privileges of investors, allowing them to actively participate in the decision-making processes of the company while safeguarding their financial interests.

Utah Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders

Description

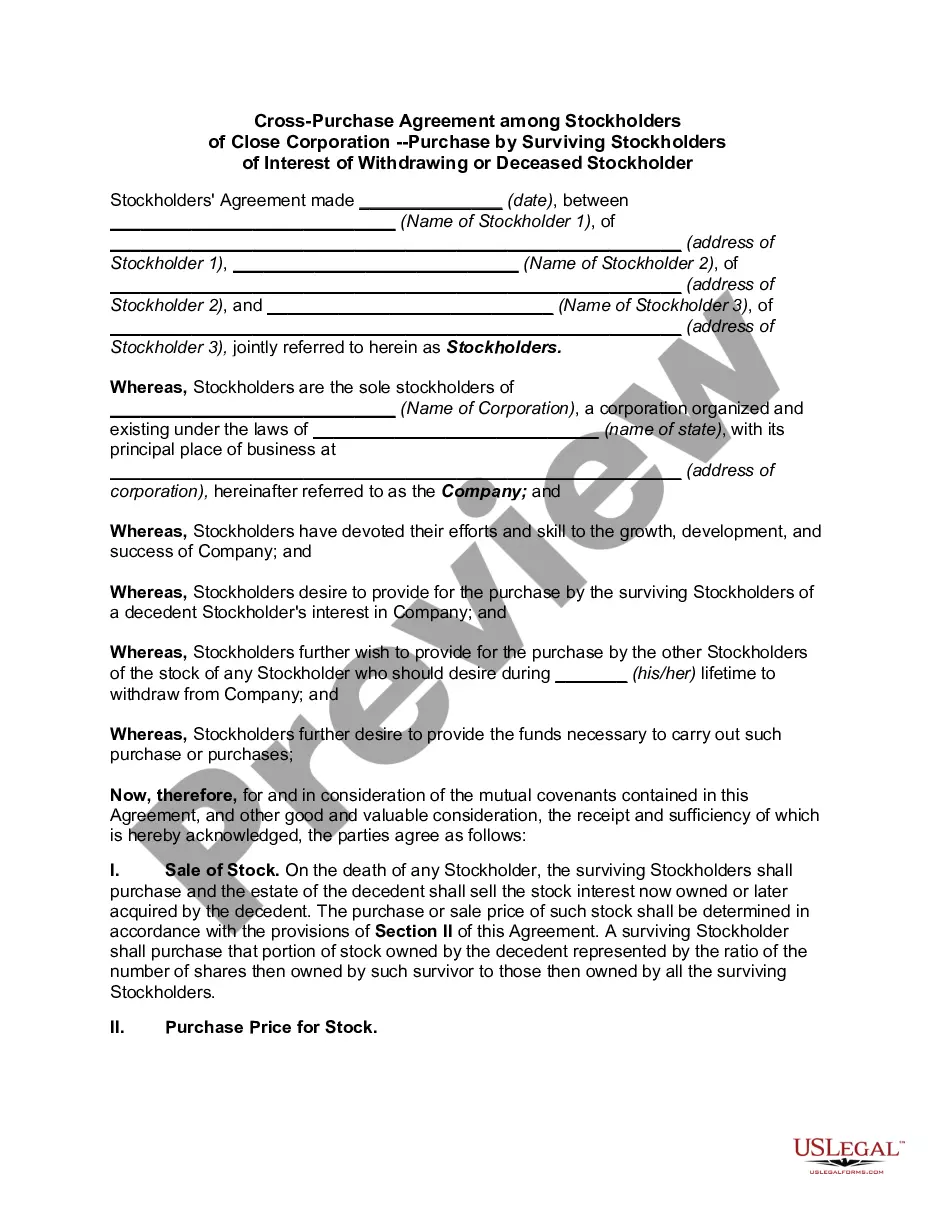

How to fill out Utah Investors' Rights Agreement Between Telocity, Inc., Existing Holders, And Founders?

Choosing the best lawful record template might be a struggle. Naturally, there are a lot of templates available on the net, but how would you get the lawful type you want? Utilize the US Legal Forms site. The assistance offers a huge number of templates, for example the Utah Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders, which you can use for enterprise and personal requirements. Each of the types are inspected by professionals and meet state and federal demands.

If you are already registered, log in in your profile and then click the Obtain switch to have the Utah Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders. Use your profile to search throughout the lawful types you may have purchased formerly. Check out the My Forms tab of your respective profile and have another backup from the record you want.

If you are a fresh customer of US Legal Forms, here are straightforward directions that you can adhere to:

- Very first, make certain you have chosen the right type for your personal metropolis/region. You may look through the shape using the Preview switch and look at the shape information to make certain this is basically the right one for you.

- In case the type is not going to meet your needs, use the Seach area to obtain the appropriate type.

- When you are certain the shape is proper, go through the Get now switch to have the type.

- Opt for the pricing strategy you want and enter the needed info. Make your profile and purchase the transaction using your PayPal profile or credit card.

- Choose the document structure and down load the lawful record template in your product.

- Full, revise and printing and signal the received Utah Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders.

US Legal Forms will be the most significant catalogue of lawful types in which you will find various record templates. Utilize the company to down load professionally-created documents that adhere to express demands.