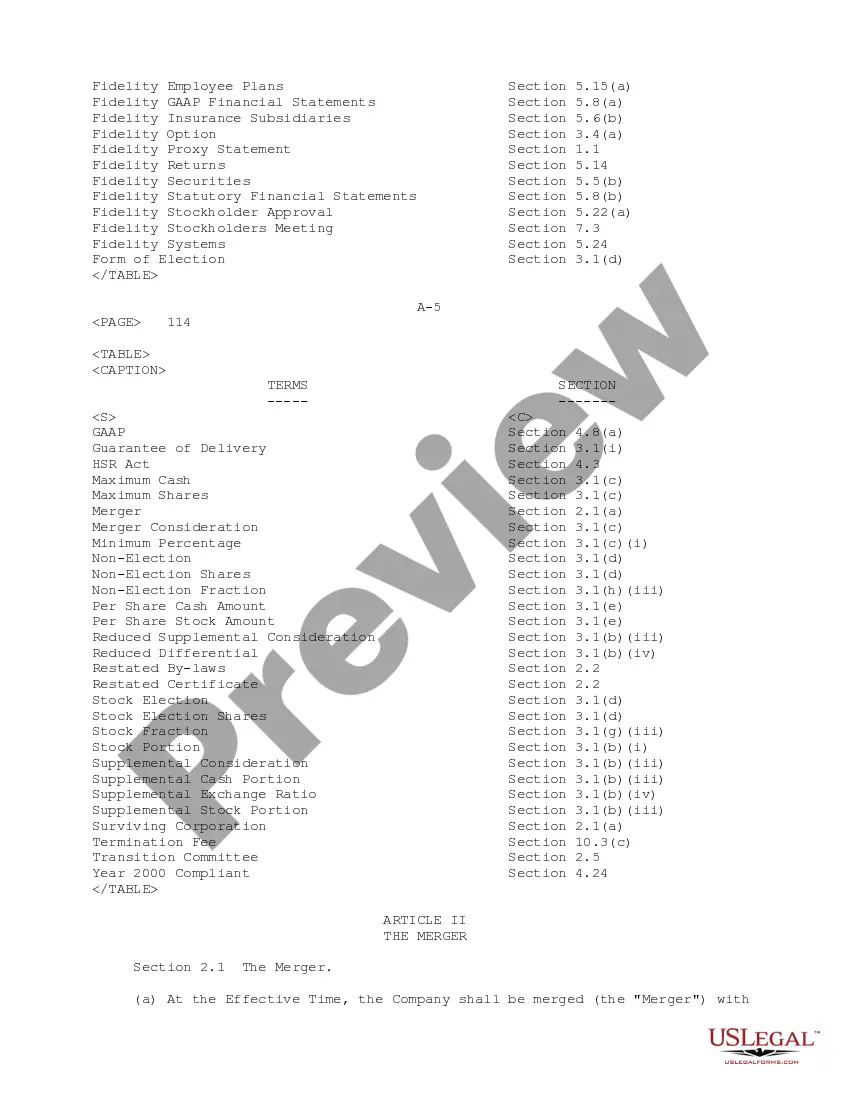

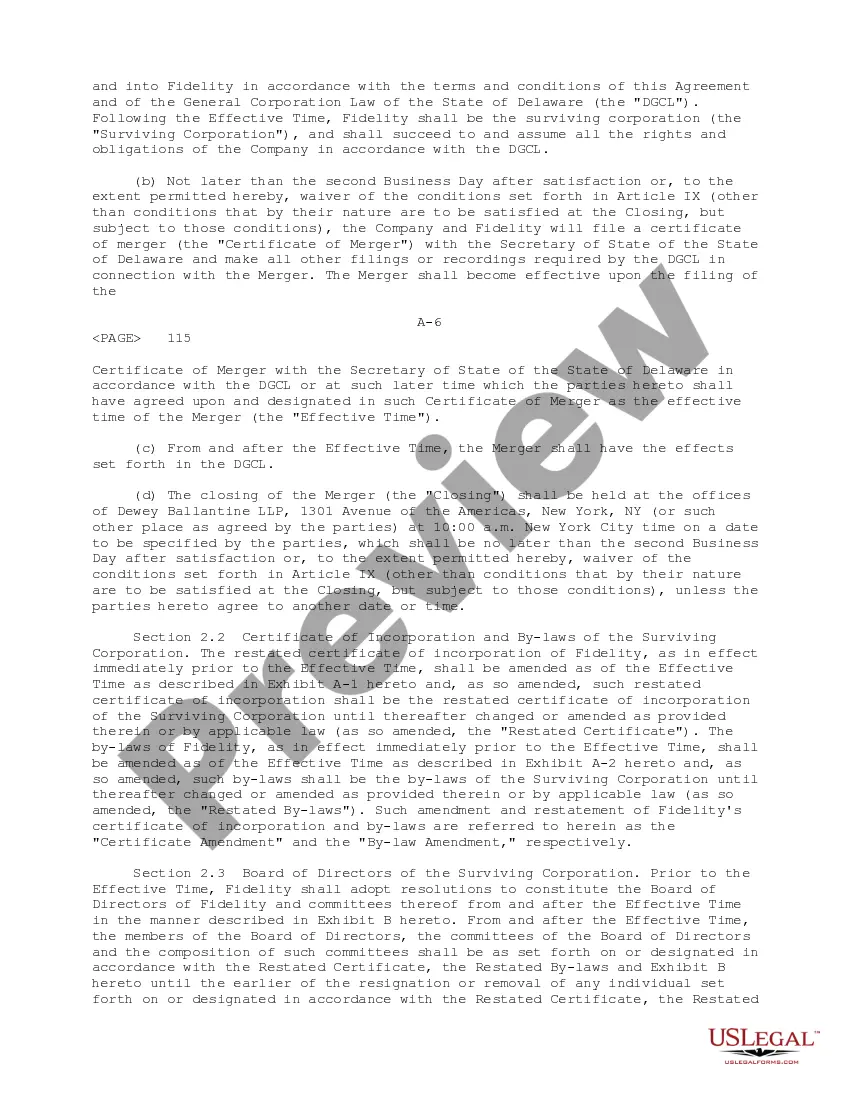

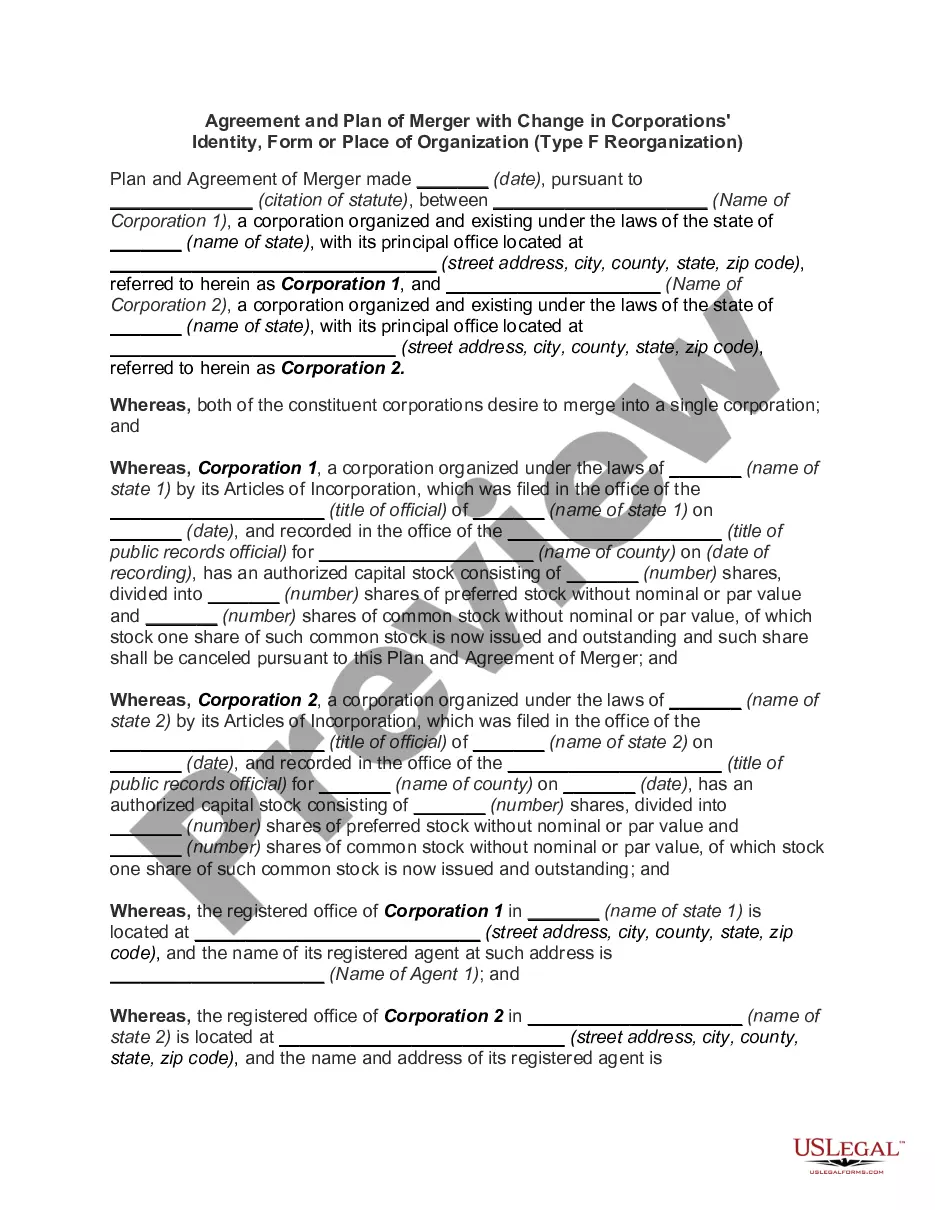

Utah Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

You are able to invest hours on-line searching for the legitimate file format that suits the state and federal requirements you require. US Legal Forms gives 1000s of legitimate types which are reviewed by professionals. It is possible to obtain or print out the Utah Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp from my assistance.

If you currently have a US Legal Forms account, you are able to log in and click the Down load key. Following that, you are able to complete, edit, print out, or signal the Utah Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp. Every legitimate file format you acquire is yours for a long time. To get yet another duplicate of the bought type, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site the first time, adhere to the basic instructions listed below:

- Initially, ensure that you have chosen the best file format for that area/area that you pick. See the type explanation to ensure you have selected the right type. If available, use the Review key to appear throughout the file format at the same time.

- If you want to discover yet another variation in the type, use the Look for area to find the format that meets your needs and requirements.

- After you have found the format you need, just click Acquire now to proceed.

- Choose the costs program you need, key in your references, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal account to fund the legitimate type.

- Choose the format in the file and obtain it to the product.

- Make adjustments to the file if required. You are able to complete, edit and signal and print out Utah Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp.

Down load and print out 1000s of file themes using the US Legal Forms website, that offers the greatest variety of legitimate types. Use professional and status-certain themes to take on your small business or individual requirements.

Form popularity

FAQ

Being a public company we continued to grow through our many acquisitions.

Fidelity National Financial split the company into Fidelity National Financial and F&G Annuity & Life. The structure of the spinoff was the distribution of F&G Annuity & Life shares as a taxable dividend.

Western Title Insurance Company (now Fidelity National Title Insurance Company of California) traced its origin to C.V. Gillespie (founder), a notary public and searcher of records in San Francisco.

On November 10, 2006, our common stock began trading on the New York Stock Exchange under the trading symbol ?FNF.? Old FNF's chairman of the board and chief executive officer assumed the same positions in FNF, as well as the position of executive chairman of the board of FIS.

Chicago Title - A Division of Fidelity National Financial: Read reviews and ask questions | Handshake.

About Chicago Title - A Division of Fidelity National Financial. Fidelity National Financial, Inc., is organized into two groups, FNF Core (NYSE:FNF) and FNFV. FNF Core is a leading provider of title insurance, technology and transaction services to the real estate and mortgage industries.

With a 21% market share and more than $4 billion in premiums in 2020, First American Title is part of the top title insurance companies 2022, recognized as the largest from the list of title companies, with 41% more than the next-largest company.