Utah Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

Description

How to fill out Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

Are you presently in a place in which you need to have papers for possibly company or individual functions virtually every time? There are tons of legal papers web templates available online, but getting kinds you can depend on is not straightforward. US Legal Forms offers a large number of form web templates, much like the Utah Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation, that happen to be written to meet state and federal demands.

Should you be already acquainted with US Legal Forms website and have your account, basically log in. Afterward, you can download the Utah Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation template.

If you do not provide an accounts and would like to start using US Legal Forms, adopt these measures:

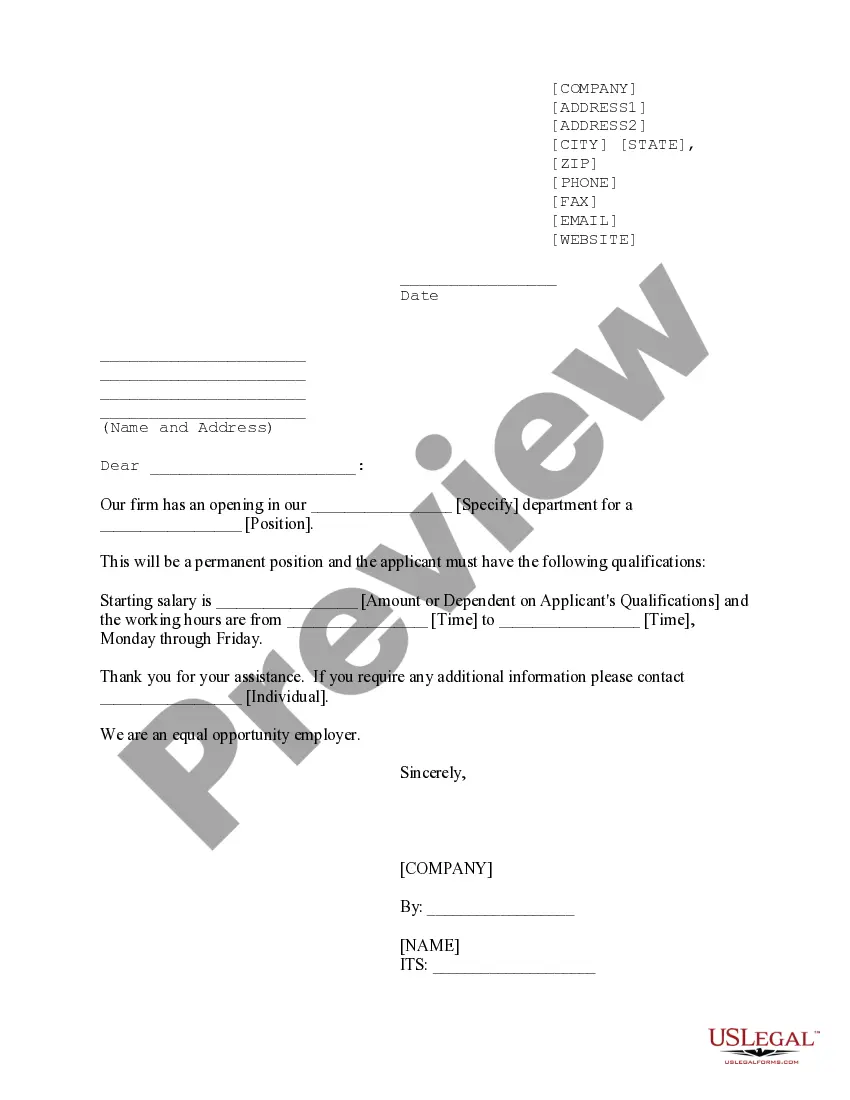

- Get the form you require and make sure it is to the right city/county.

- Make use of the Preview switch to check the form.

- Browse the information to actually have chosen the appropriate form.

- When the form is not what you are looking for, make use of the Look for industry to discover the form that fits your needs and demands.

- If you discover the right form, click Buy now.

- Choose the prices prepare you would like, fill out the specified information and facts to produce your account, and pay for your order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free file file format and download your copy.

Get each of the papers web templates you may have purchased in the My Forms food selection. You can get a extra copy of Utah Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation any time, if required. Just select the necessary form to download or produce the papers template.

Use US Legal Forms, probably the most extensive selection of legal types, to conserve time and avoid blunders. The assistance offers professionally created legal papers web templates which you can use for a selection of functions. Create your account on US Legal Forms and commence producing your way of life a little easier.