Utah Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

Choosing the right lawful record template can be quite a have difficulties. Obviously, there are a lot of themes available on the Internet, but how would you obtain the lawful form you will need? Make use of the US Legal Forms internet site. The support gives thousands of themes, such as the Utah Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds, which can be used for company and private requirements. All the varieties are examined by specialists and meet federal and state needs.

In case you are already listed, log in for your account and then click the Acquire key to obtain the Utah Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Use your account to appear with the lawful varieties you have acquired previously. Visit the My Forms tab of your respective account and obtain one more duplicate of the record you will need.

In case you are a new customer of US Legal Forms, listed below are basic instructions for you to comply with:

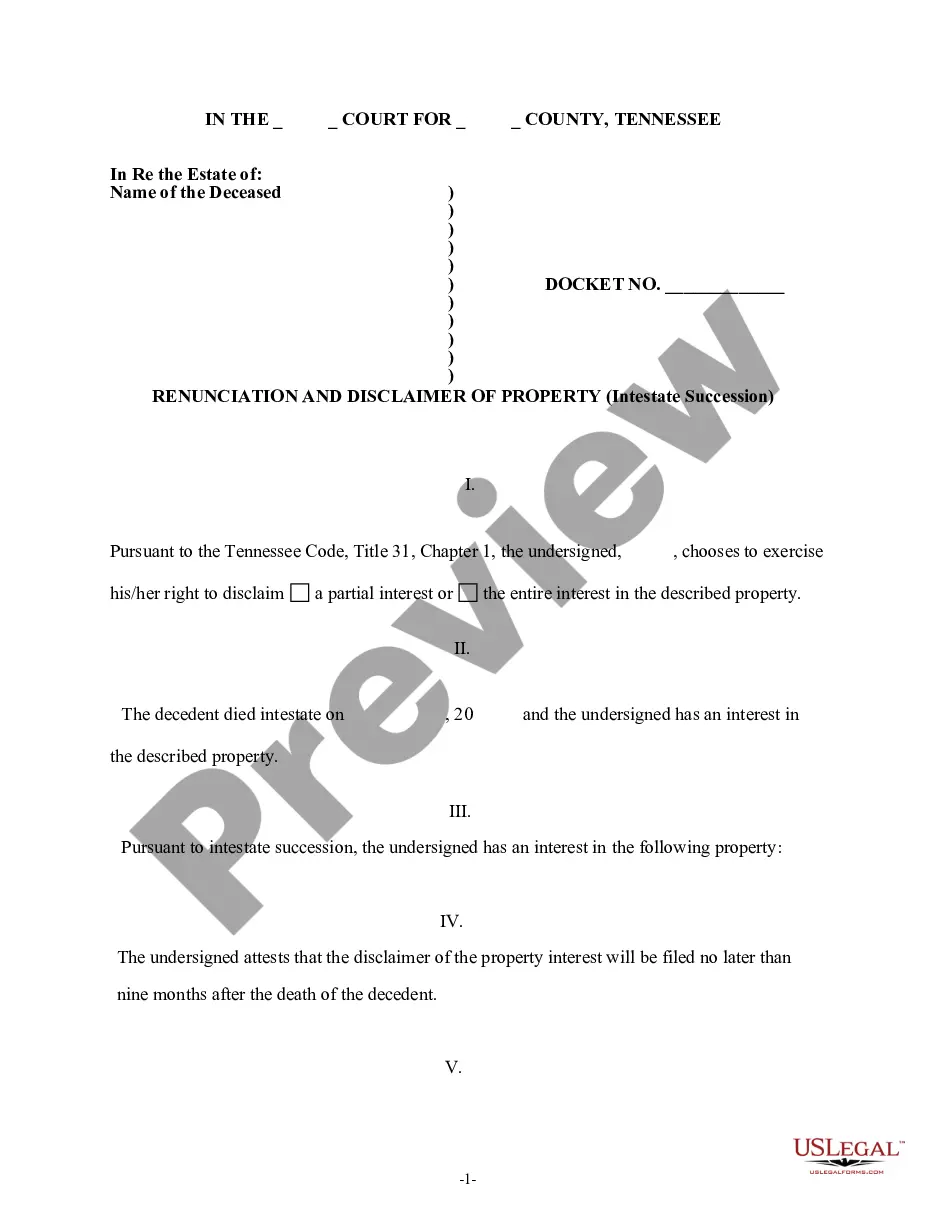

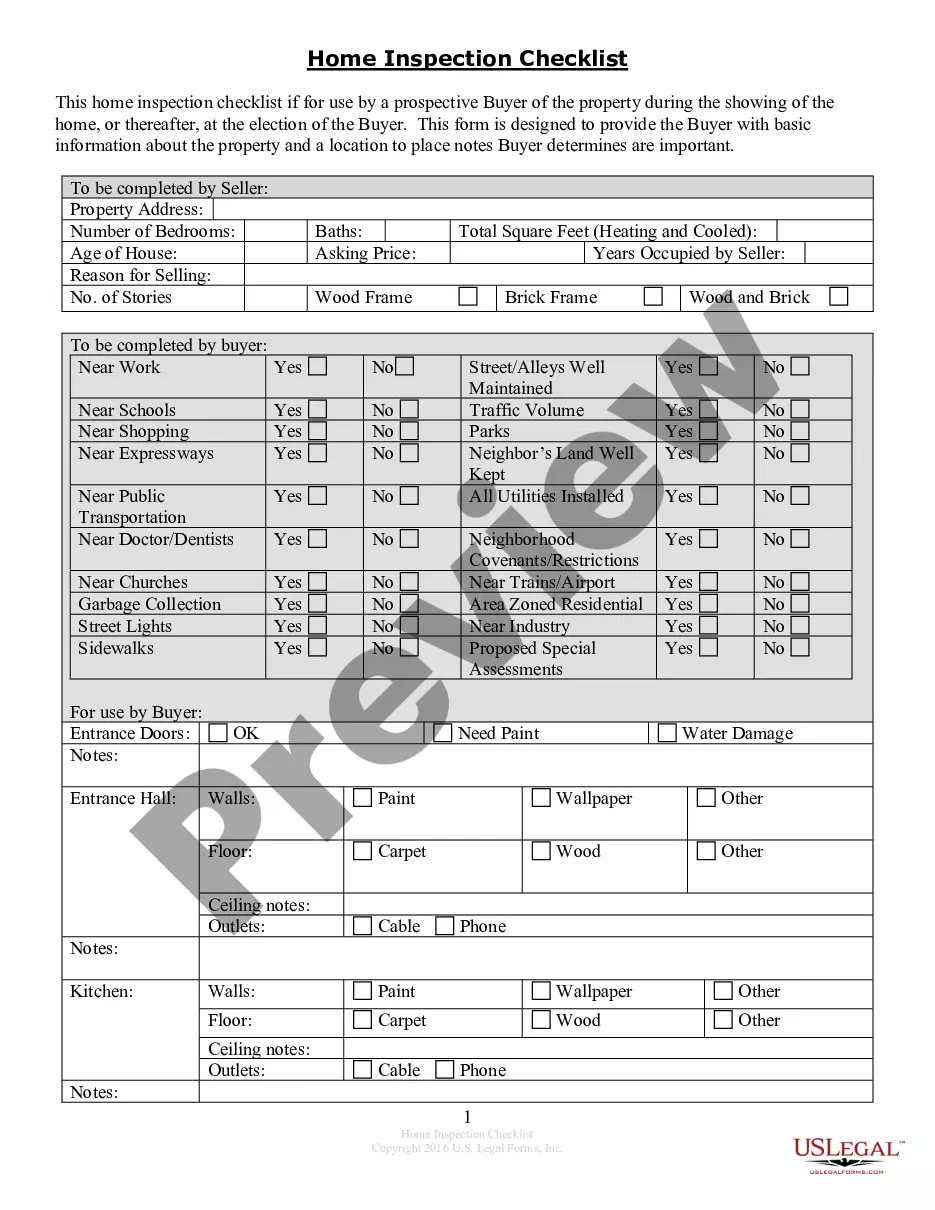

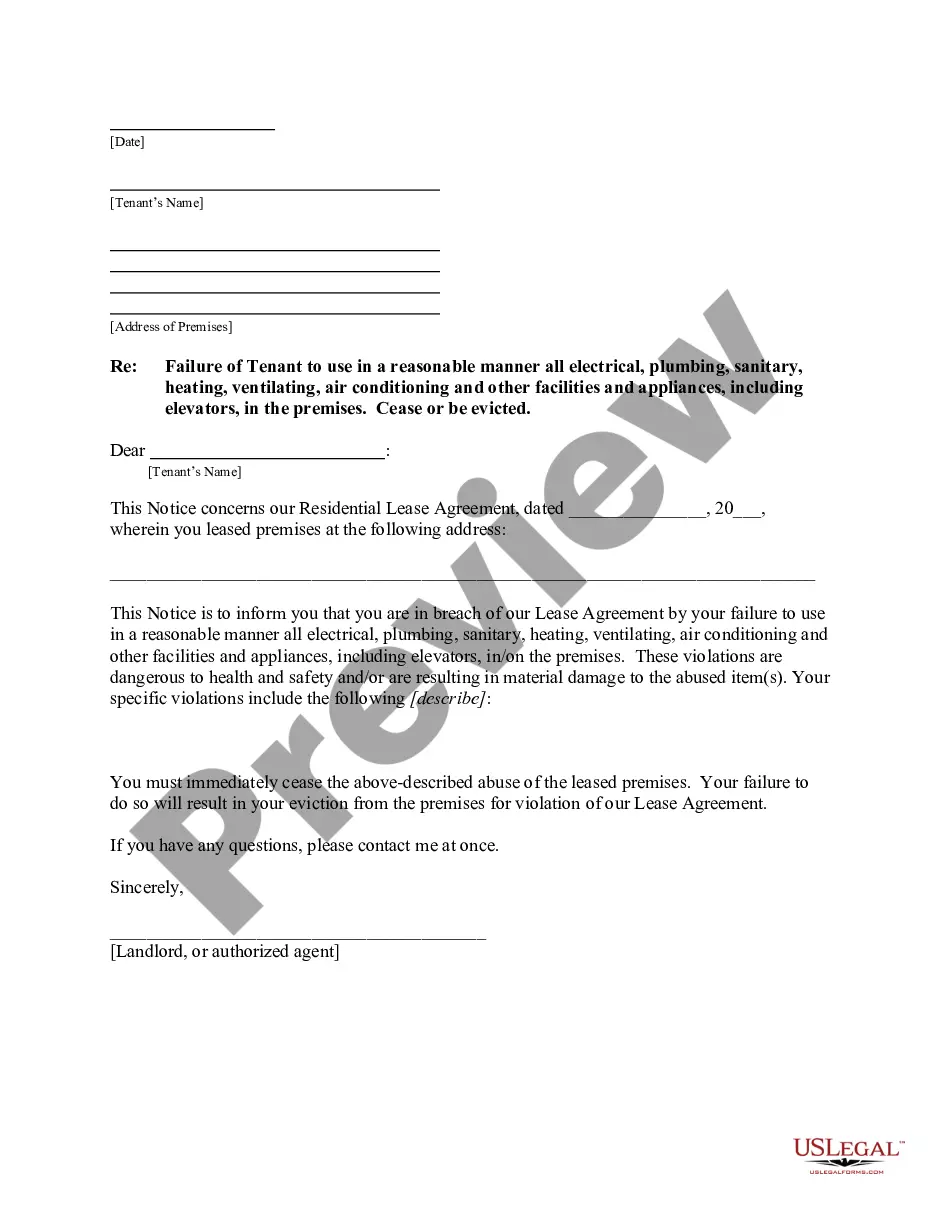

- Very first, make certain you have chosen the appropriate form for the metropolis/region. You may check out the shape making use of the Preview key and study the shape outline to ensure it is the best for you.

- When the form fails to meet your preferences, utilize the Seach field to find the correct form.

- When you are certain that the shape is acceptable, click on the Buy now key to obtain the form.

- Pick the costs strategy you need and type in the necessary information and facts. Make your account and buy the order utilizing your PayPal account or bank card.

- Pick the submit structure and acquire the lawful record template for your gadget.

- Complete, change and print and signal the acquired Utah Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

US Legal Forms may be the most significant local library of lawful varieties that you will find various record themes. Make use of the service to acquire appropriately-created documents that comply with state needs.