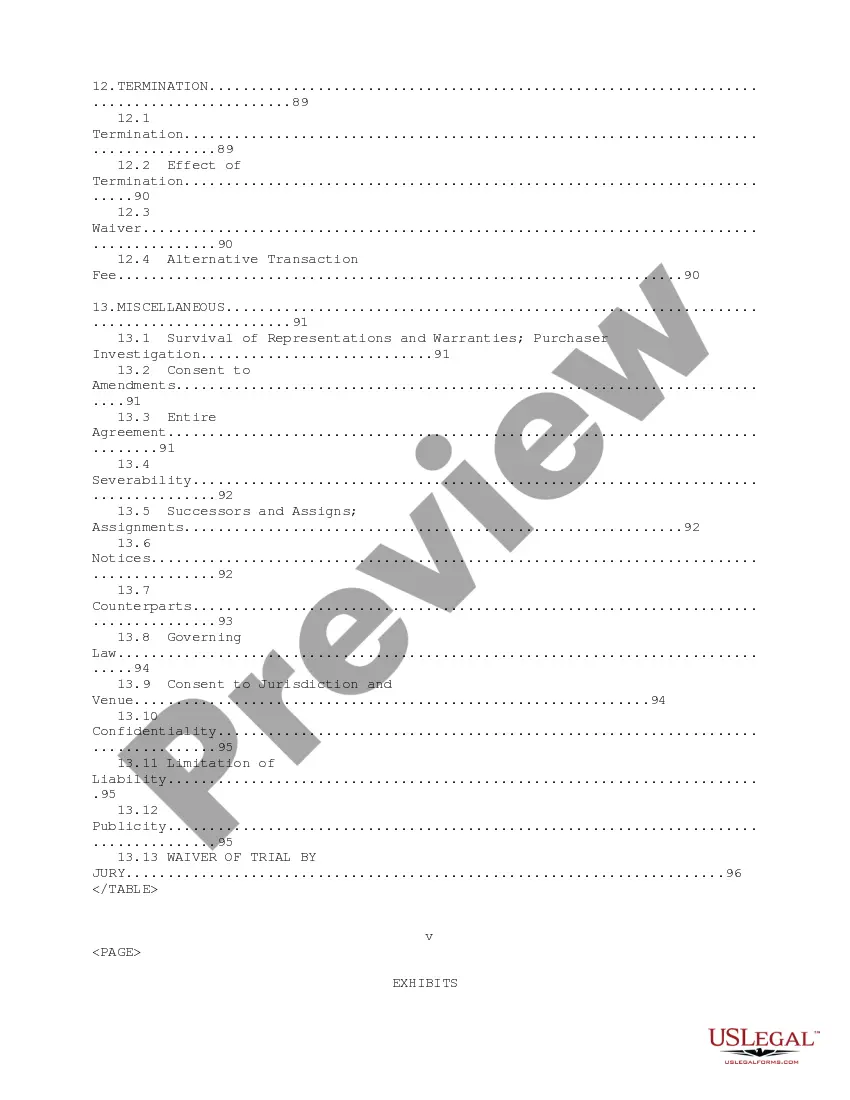

Title: Utah Sample Purchase Agreement between Similar, Inc., and its Subsidiaries and Levine Eastman Capital Partners II, LP for the Sale and Issuance of Secured Senior Notes Keywords: Utah, Sample Purchase Agreement, Similar, Inc., subsidiaries, Levine Eastman Capital Partners II, LP, sale, issuance, secured senior notes Introduction: In this content, we will provide a detailed description of the Utah Sample Purchase Agreement between Similar, Inc., and its subsidiaries and Levine Eastman Capital Partners II, LP. This agreement revolves around the sale and issuance of secured senior notes. We will explore the various types of agreements that exist within this framework, highlighting their importance and implications. 1. Utah Sample Purchase Agreement Overview: The Utah Sample Purchase Agreement serves as a comprehensive legal document between Similar, Inc., its subsidiaries, and Levine Eastman Capital Partners II, LP. It outlines the terms and conditions for the sale and issuance of secured senior notes. This agreement is governed by Utah state laws and is designed to protect the interests of all parties involved. 2. Sale of Secured Senior Notes: The agreement encompasses provisions for the sale of secured senior notes by Similar, Inc., and its subsidiaries to Levine Eastman Capital Partners II, LP. This type of financing involves issuing debt securities with a higher priority of payment, offering enhanced security to the lender. The agreement outlines the terms, amount, maturity, interest rates, and collateral associated with the notes. 3. Issuance of Secured Senior Notes: Within the agreement, the issuance of secured senior notes refers to the process through which Similar, Inc., and its subsidiaries offer these debt securities to Levine Eastman Capital Partners II, LP. The terms and conditions are detailed, covering aspects such as the pricing, payment terms, covenants, events of default, and registration rights associated with the notes. 4. Security and Collateral: The Utah Sample Purchase Agreement establishes the security and collateral provisions related to the senior notes. It specifies the assets or properties pledged as collateral, ensuring the lenders have a secured interest in case of default or bankruptcy. These provisions aim to safeguard the investment of Levine Eastman Capital Partners II, LP. Possible Types of Sample Purchase Agreements: a) Utah Sample Purchase Agreement for Simple Senior Notes: This type of agreement focuses on the sale and issuance of straightforward secured senior notes, detailing the terms, conditions, and repayment structure. b) Utah Sample Purchase Agreement for Convertible Senior Notes: This type of agreement pertains to the sale and issuance of secured senior notes that are convertible into common stock or other forms of equity in Similar, Inc., or its subsidiaries. It contains clauses addressing conversion mechanics, adjustment provisions, and anti-dilution measures. c) Utah Sample Purchase Agreement for Callable Senior Notes: This agreement covers the sale and issuance of secured senior notes that grant Similar, Inc., or its subsidiaries the option to redeem the notes before their maturity date. It outlines the terms, call price, notification requirements, and other provisions related to early redemption. Conclusion: The Utah Sample Purchase Agreement between Similar, Inc., and Levine Eastman Capital Partners II, LP facilitates the sale and issuance of secured senior notes, providing a legal framework to protect the interests of both parties. It encompasses various types of agreements concerning standard, convertible, callable notes, each catering to specific requirements and considerations.

Title: Utah Sample Purchase Agreement between Similar, Inc., and its Subsidiaries and Levine Eastman Capital Partners II, LP for the Sale and Issuance of Secured Senior Notes Keywords: Utah, Sample Purchase Agreement, Similar, Inc., subsidiaries, Levine Eastman Capital Partners II, LP, sale, issuance, secured senior notes Introduction: In this content, we will provide a detailed description of the Utah Sample Purchase Agreement between Similar, Inc., and its subsidiaries and Levine Eastman Capital Partners II, LP. This agreement revolves around the sale and issuance of secured senior notes. We will explore the various types of agreements that exist within this framework, highlighting their importance and implications. 1. Utah Sample Purchase Agreement Overview: The Utah Sample Purchase Agreement serves as a comprehensive legal document between Similar, Inc., its subsidiaries, and Levine Eastman Capital Partners II, LP. It outlines the terms and conditions for the sale and issuance of secured senior notes. This agreement is governed by Utah state laws and is designed to protect the interests of all parties involved. 2. Sale of Secured Senior Notes: The agreement encompasses provisions for the sale of secured senior notes by Similar, Inc., and its subsidiaries to Levine Eastman Capital Partners II, LP. This type of financing involves issuing debt securities with a higher priority of payment, offering enhanced security to the lender. The agreement outlines the terms, amount, maturity, interest rates, and collateral associated with the notes. 3. Issuance of Secured Senior Notes: Within the agreement, the issuance of secured senior notes refers to the process through which Similar, Inc., and its subsidiaries offer these debt securities to Levine Eastman Capital Partners II, LP. The terms and conditions are detailed, covering aspects such as the pricing, payment terms, covenants, events of default, and registration rights associated with the notes. 4. Security and Collateral: The Utah Sample Purchase Agreement establishes the security and collateral provisions related to the senior notes. It specifies the assets or properties pledged as collateral, ensuring the lenders have a secured interest in case of default or bankruptcy. These provisions aim to safeguard the investment of Levine Eastman Capital Partners II, LP. Possible Types of Sample Purchase Agreements: a) Utah Sample Purchase Agreement for Simple Senior Notes: This type of agreement focuses on the sale and issuance of straightforward secured senior notes, detailing the terms, conditions, and repayment structure. b) Utah Sample Purchase Agreement for Convertible Senior Notes: This type of agreement pertains to the sale and issuance of secured senior notes that are convertible into common stock or other forms of equity in Similar, Inc., or its subsidiaries. It contains clauses addressing conversion mechanics, adjustment provisions, and anti-dilution measures. c) Utah Sample Purchase Agreement for Callable Senior Notes: This agreement covers the sale and issuance of secured senior notes that grant Similar, Inc., or its subsidiaries the option to redeem the notes before their maturity date. It outlines the terms, call price, notification requirements, and other provisions related to early redemption. Conclusion: The Utah Sample Purchase Agreement between Similar, Inc., and Levine Eastman Capital Partners II, LP facilitates the sale and issuance of secured senior notes, providing a legal framework to protect the interests of both parties. It encompasses various types of agreements concerning standard, convertible, callable notes, each catering to specific requirements and considerations.