Utah Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation is a legally binding contract that outlines the terms and conditions regarding the purchase and sale of stock options between the two parties within the state of Utah. This agreement allows Northern Bank of Commerce to grant Cowling Ban corporation the right to buy a specified number of shares in the bank's stock at a predetermined price, known as the exercise price, within a certain timeframe. This particular type of stock option agreement provides Cowling Ban corporation with the opportunity to invest in Northern Bank of Commerce's stock, potentially allowing them to benefit from any future increase in the bank's share value. It also offers Northern Bank of Commerce a mechanism to incentivize and retain key employees, as stock options can serve as a valuable form of compensation. The Utah Stock Option Agreement typically includes various essential elements, such as: 1. Grant of Options: This section specifies the number of stock options granted to Cowling Ban corporation, including details of vesting schedules and any restrictions on exercising the options. 2. Exercise Price: The agreement establishes the exercise price at which Cowling Ban corporation can purchase the granted stock options. This price is usually determined upfront and may be subject to adjustment under certain circumstances. 3. Exercise Period: The agreement defines the timeframe during which Cowling Ban corporation can exercise their stock options. It sets the start and end dates within which they must exercise their rights. 4. Termination and Forfeiture: This section outlines conditions under which the stock option agreement can be terminated or the options forfeited, such as if the employee/option holder leaves the company before the options have fully vested. 5. Tax Consequences: The agreement may include provisions addressing potential tax implications for both parties involved. It can outline any tax withholding requirements or any applicable tax benefits associated with exercising the stock options. It is important to note that there may be different types of Utah Stock Option Agreements between Northern Bank of Commerce and Cowling Ban corporation. These can include: 1. Employee Stock Option Agreement: Specifically tailored for employees, this agreement grants stock options as part of an employee compensation package, typically subject to vesting schedules and other conditions. 2. Director Stock Option Agreement: Designed for directors serving on the board of either Northern Bank of Commerce or Cowling Ban corporation, this agreement provides stock options as a means of aligning the interests of the directors with the company's success. 3. Executive Stock Option Agreement: Targeting executive-level employees, such as CEOs or CFOs, this agreement offers enhanced stock options with potentially more favorable terms than standard employee agreements, reflecting the executive's crucial role within the company. In conclusion, the Utah Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation establishes the terms of stock option grants, enabling Cowling Ban corporation to purchase Northern Bank of Commerce's shares at a predetermined price within a specified period. Different variations of such agreements cater to various role types within the organizations, such as employees, directors, or executives. These agreements serve as valuable tools for incentivizing employees and aligning their interests with the success of the company.

Utah Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation

Description

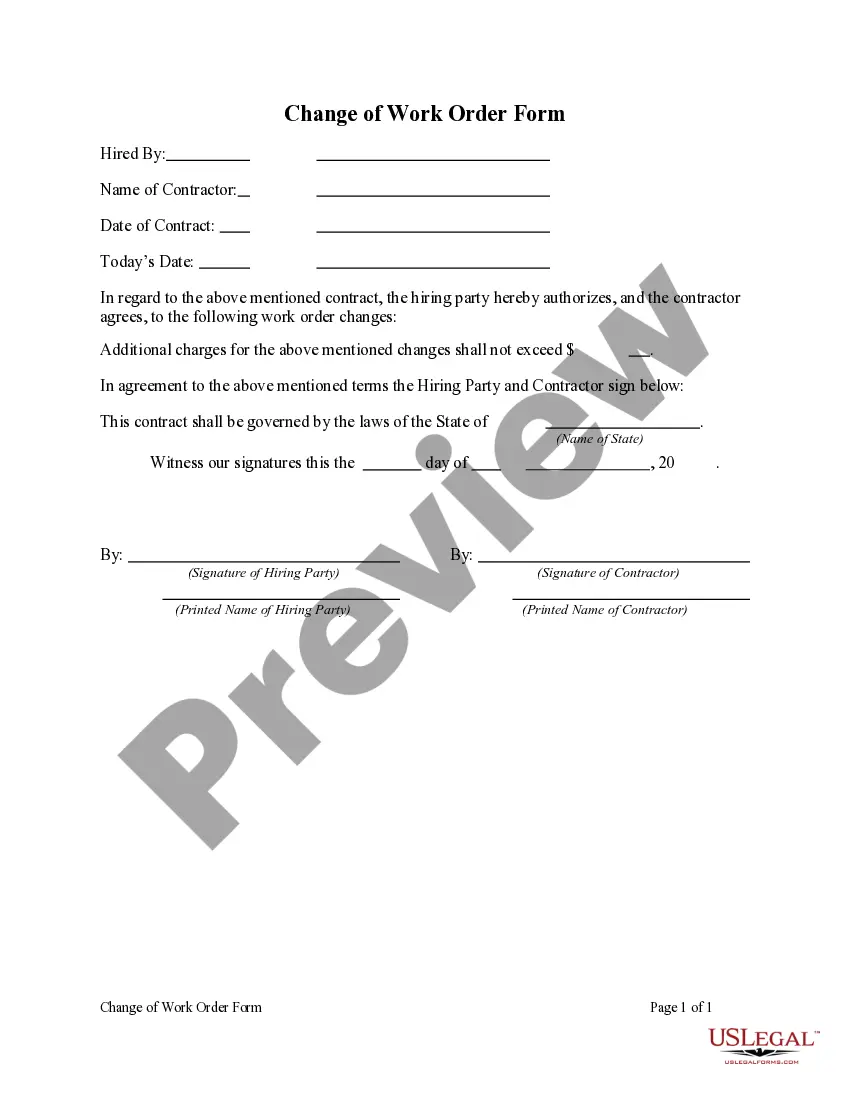

How to fill out Utah Stock Option Agreement Between Northern Bank Of Commerce And Cowlitz Bancorporation?

Finding the right legal file design can be a struggle. Needless to say, there are tons of templates available on the Internet, but how do you obtain the legal type you need? Use the US Legal Forms web site. The support offers thousands of templates, for example the Utah Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation, that can be used for enterprise and private requirements. Each of the types are checked by specialists and meet up with state and federal specifications.

If you are currently listed, log in to the accounts and click on the Obtain button to have the Utah Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation. Make use of accounts to search with the legal types you may have acquired in the past. Visit the My Forms tab of your accounts and have an additional backup in the file you need.

If you are a brand new customer of US Legal Forms, listed below are easy recommendations so that you can stick to:

- Initially, make certain you have chosen the appropriate type to your city/county. You may look through the form making use of the Review button and read the form information to ensure it will be the best for you.

- When the type will not meet up with your requirements, make use of the Seach area to discover the proper type.

- When you are certain that the form is suitable, go through the Acquire now button to have the type.

- Pick the prices strategy you need and enter the required details. Create your accounts and pay for your order with your PayPal accounts or charge card.

- Choose the file format and down load the legal file design to the system.

- Total, change and print out and signal the obtained Utah Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation.

US Legal Forms may be the most significant catalogue of legal types where you will find different file templates. Use the service to down load appropriately-made paperwork that stick to state specifications.