The Utah Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks, and Financial Institutions is a legal document that governs the terms and conditions of the credit facility provided to SBA Communications and SBA Telecommunications by various banks and financial institutions within the state of Utah. This agreement is designed to outline the borrowing arrangements, repayment terms, interest rates, collateral requirements, and other important provisions related to the credit extended by the lenders to the borrowers. It serves as a vital document that establishes the rights and obligations of all parties involved. Specifically, the Utah Second Amended and Restated Credit Agreement aims to provide SBA Communications and its subsidiary, SBA Telecommunications, with the necessary financing to support their operations, expansion initiatives, and other strategic objectives. By entering into this agreement, the participating banks and financial institutions demonstrate their willingness to provide the required funds, generally in the form of a revolving credit facility or term loan. The agreement typically specifies the maximum borrowing limit available to SBA Communications and SBA Telecommunications. It also outlines the conditions under which the borrowers can access the credit, whether it is for working capital purposes, capital expenditures, or other approved uses. The interest rates and fees applicable to the credit facility are clearly defined within the agreement, ensuring transparency and certainty for all parties involved. Additionally, the Utah Second Amended and Restated Credit Agreement may include a variety of covenants that establish certain operational and financial performance requirements that SBA Communications and SBA Telecommunications must meet throughout the term of the agreement. These covenants help protect the lenders' interests and ensure that the borrowers maintain a strong financial position. It is important to note that there may be multiple types of Utah Second Amended and Restated Credit Agreements among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks, and Financial Institutions. These agreements may differ in terms of the total credit amount, term length, specific conditions, and participating lenders. While the overall purpose remains the same, these variations allow for flexibility based on the specific needs of the borrowers and the preferences of the lenders. Some potential keywords relevant to this topic are: Utah Second Amended and Restated Credit Agreement, SBA Communications, SBA Telecommunications, banks, financial institutions, borrowing arrangement, repayment terms, interest rates, collateral requirements, financing, revolving credit facility, term loan, working capital, capital expenditures, strategic objectives, borrowing limit, operational covenants, financial covenants.

Utah Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

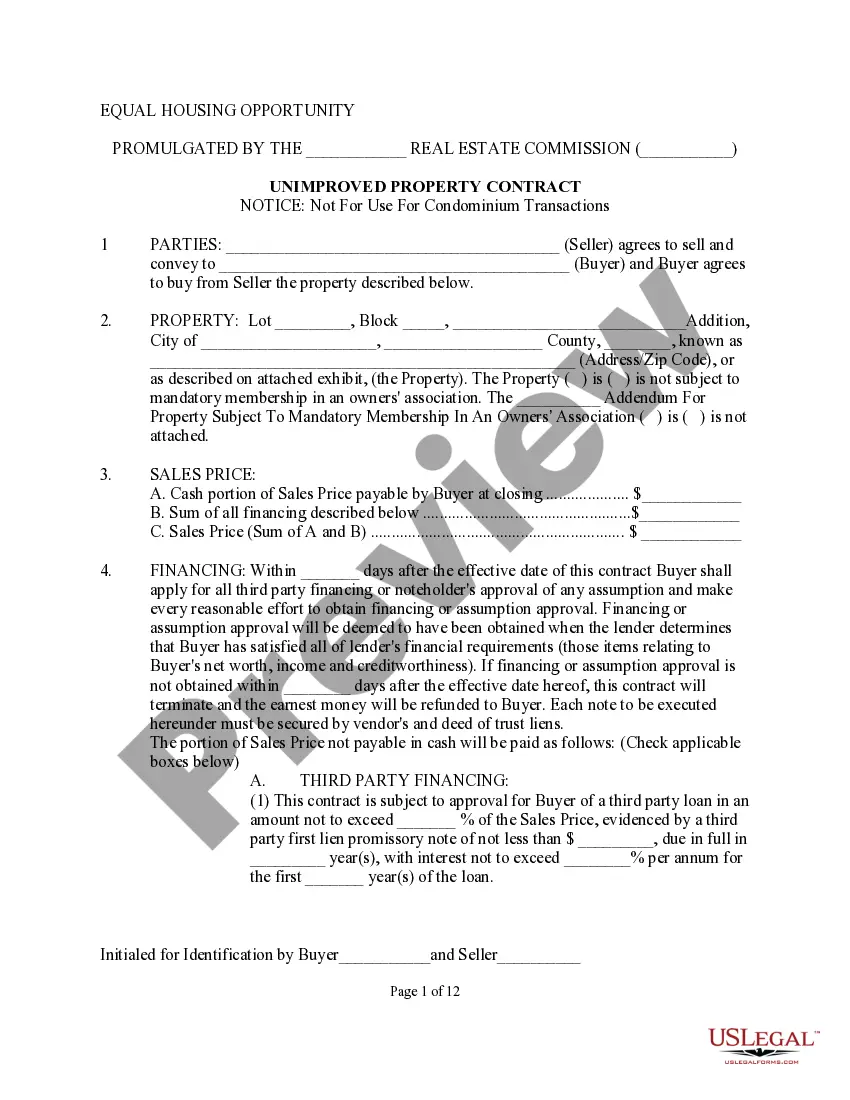

How to fill out Utah Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

It is possible to commit time on the Internet searching for the lawful document format which fits the federal and state specifications you need. US Legal Forms offers a huge number of lawful kinds that are analyzed by professionals. It is possible to down load or print the Utah Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions from your service.

If you currently have a US Legal Forms accounts, it is possible to log in and click the Obtain key. Following that, it is possible to comprehensive, change, print, or indicator the Utah Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Every lawful document format you get is yours for a long time. To have another backup of any obtained form, check out the My Forms tab and click the related key.

If you work with the US Legal Forms internet site the very first time, follow the straightforward guidelines beneath:

- Very first, be sure that you have chosen the proper document format to the state/city that you pick. Browse the form information to ensure you have picked out the proper form. If readily available, take advantage of the Review key to check through the document format too.

- If you wish to discover another edition of the form, take advantage of the Lookup discipline to discover the format that meets your needs and specifications.

- After you have discovered the format you would like, click Acquire now to proceed.

- Pick the pricing strategy you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your charge card or PayPal accounts to purchase the lawful form.

- Pick the structure of the document and down load it in your device.

- Make changes in your document if needed. It is possible to comprehensive, change and indicator and print Utah Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Obtain and print a huge number of document web templates utilizing the US Legal Forms site, which offers the most important collection of lawful kinds. Use specialist and state-specific web templates to take on your business or personal requirements.