Utah Senior Debt Term Sheet: A Detailed Description The Utah Senior Debt Term Sheet is a contractual document used in financial transactions that involve senior debt financing for businesses or organizations based in the state of Utah, United States. This term sheet outlines the key terms and conditions of the senior debt agreement to provide clarity and transparency to all parties involved, including the senior lender and the borrower. Key Elements of the Utah Senior Debt Term Sheet: 1. Loan Amount: The term sheet specifies the principal loan amount that the borrower is seeking from the senior lender. This amount is often determined based on the borrower's specific financing needs. 2. Seniority: Senior debt holds priority over other forms of debt, making it the primary obligation of the borrower. This term sheet clarifies the seniority of the debt, ensuring that in case of default or bankruptcy, the senior debt is the first to be repaid from the borrower's assets. 3. Interest Rate: The interest rate on the senior debt is stated in the term sheet. It represents the cost of borrowing and is typically fixed or floating, depending on the agreement. The interest rate may also be subject to adjustments based on market conditions or specific factors affecting the borrower's financial situation. 4. Maturity Date: The term sheet includes the maturity date, which is the date by which the borrower must repay the entire loan, including principal and interest. This timeframe is agreed upon by both parties and can vary based on the borrower's ability to repay and the risk associated with the transaction. 5. Collateral: To secure the senior debt, borrowers may provide specific assets or collateral that the lender can claim in case of default. The term sheet outlines the collateral requirements, ensuring that the lender has a legal claim to specified assets in case of non-payment. Different Types of Utah Senior Debt Term Sheets: 1. Revolving Line of Credit: This type of senior debt agreement provides borrowers with access to a predetermined credit limit, which they can draw from as needed and repay over time. Interest is charged only on the amount utilized, making it a flexible financing option. 2. Term Loan: A term loan provides borrowers with a lump sum amount that they must repay over a specified period, typically in monthly installments. This type of senior debt is often used for financing specific projects or acquisitions. 3. Bridge Loan: In cases where immediate financing is required, a bridge loan offers short-term funding until a permanent financing solution is obtained. Bridge loans are commonly used during mergers, acquisitions, or while waiting for long-term financing to be finalized. In summary, the Utah Senior Debt Term Sheet is a comprehensive document that outlines the terms and conditions of a senior debt agreement in Utah. By specifying crucial details such as loan amount, seniority, interest rate, maturity date, and collateral, this term sheet ensures transparency and establishes a framework for a mutually beneficial financial transaction.

Utah Senior Debt Term Sheet

Description

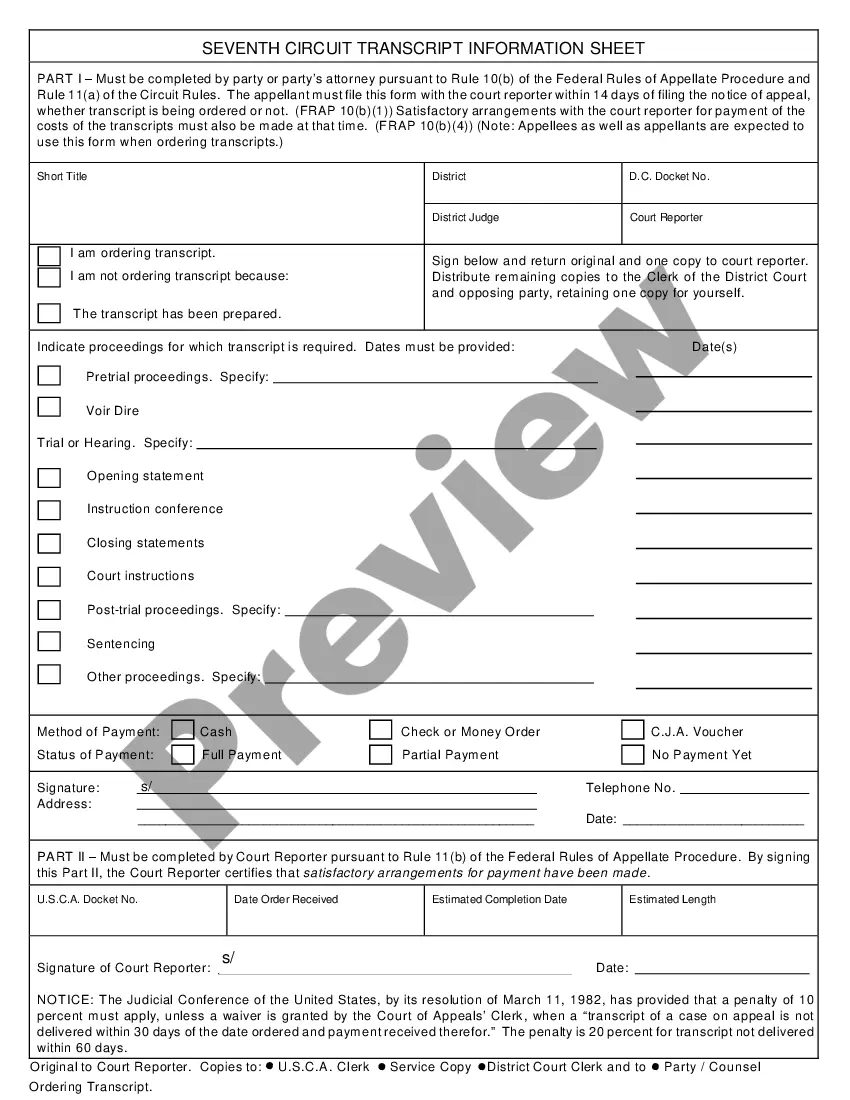

How to fill out Utah Senior Debt Term Sheet?

Finding the right authorized file format might be a have a problem. Needless to say, there are a lot of themes available online, but how do you get the authorized kind you want? Use the US Legal Forms web site. The assistance delivers a huge number of themes, such as the Utah Senior Debt Term Sheet, which you can use for company and personal requirements. All of the kinds are checked by specialists and fulfill federal and state specifications.

When you are already listed, log in in your account and click on the Obtain option to have the Utah Senior Debt Term Sheet. Make use of account to appear throughout the authorized kinds you might have purchased in the past. Visit the My Forms tab of your own account and get yet another version in the file you want.

When you are a new end user of US Legal Forms, listed below are simple directions so that you can adhere to:

- Initially, be sure you have chosen the correct kind for the town/state. You may check out the form making use of the Preview option and study the form description to guarantee this is basically the best for you.

- In the event the kind will not fulfill your requirements, make use of the Seach area to get the proper kind.

- Once you are sure that the form is proper, select the Purchase now option to have the kind.

- Opt for the costs plan you want and enter in the necessary information and facts. Build your account and buy the order using your PayPal account or bank card.

- Select the submit structure and down load the authorized file format in your product.

- Full, edit and print and signal the attained Utah Senior Debt Term Sheet.

US Legal Forms is the biggest collection of authorized kinds that you will find different file themes. Use the company to down load appropriately-manufactured paperwork that adhere to state specifications.

Form popularity

FAQ

On the other hand, senior debt financing is a high-priority loan backed by collateral and offered at a lower interest rate. How is senior debt calculated? Senior loan or debt is 2 to 3 times EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization).

The term (or duration) of a senior term cash flow loan is usually around 5 years. The rate of interest for a cash flow term loan is typically higher than an asset based term loan but pricing depends on current market rates and the company's financial characteristics and performance.

Senior Debt Ratio means, with respect to any Loan, the ratio of Senior Total Funded Debt to TTM EBITDA of the related Obligor, calculated in ance with the corresponding amount or ratio in the underlying Related Documents for such Loan utilizing the most recently delivered financial results for the related Obligor ...

Senior debt is debt and obligations which are prioritized for repayment in the case of bankruptcy. Senior debt has the highest priority and therefore the lowest risk. Thus, this type of debt typically carries or offers lower interest rates.

Any debt with higher priority over other forms of debt is considered senior debt. For example, a company has debt A that totals $1 million and debt B that totals $500,000. Debt A is senior debt, and debt B is subordinated debt. If the company files for bankruptcy, it must liquidate all of its assets to repay the debt.

Senior debts are loans secured by collateral (assets) that must be paid off before any other debts when a company goes into default. The lender in this case is paid out of the sale of the company's assets in priority sequence. Their priority position makes senior debts less risky for lenders.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.