Utah Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

If you have to complete, acquire, or printing legitimate document themes, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on the Internet. Take advantage of the site`s basic and handy look for to get the paperwork you require. Numerous themes for company and person purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to get the Utah Term Sheet - Convertible Debt Financing with a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in to the accounts and click the Down load switch to obtain the Utah Term Sheet - Convertible Debt Financing. You can also entry kinds you earlier acquired from the My Forms tab of your accounts.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that appropriate town/nation.

- Step 2. Utilize the Preview choice to check out the form`s content. Do not forget to see the description.

- Step 3. If you are unhappy with all the develop, utilize the Research discipline on top of the screen to get other models from the legitimate develop format.

- Step 4. Once you have found the shape you require, click the Acquire now switch. Select the rates plan you favor and add your references to register for the accounts.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Pick the structure from the legitimate develop and acquire it on your system.

- Step 7. Complete, edit and printing or signal the Utah Term Sheet - Convertible Debt Financing.

Every legitimate document format you get is yours eternally. You may have acces to each and every develop you acquired in your acccount. Click on the My Forms portion and pick a develop to printing or acquire again.

Contend and acquire, and printing the Utah Term Sheet - Convertible Debt Financing with US Legal Forms. There are thousands of skilled and status-certain kinds you can utilize for your company or person demands.

Form popularity

FAQ

A term sheet is a written document the parties exchange containing the important terms and conditions of the deal. The document summarizes the main points of the deal agreements and sorts out the differences before actually executing the legal agreements and starting off with the time-consuming due diligence.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

If a convertible debt instrument (where the conversion option was not bifurcated) is converted into a reporting entity's common or preferred stock pursuant to a conversion option in the instrument, it is not an extinguishment; the convertible debt is settled in exchange for equity and no gain or loss is recognized upon ...

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

The convertible debt that was listed as a non-current liability before the conversion now gets get treated as shareholder's equity.

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current.

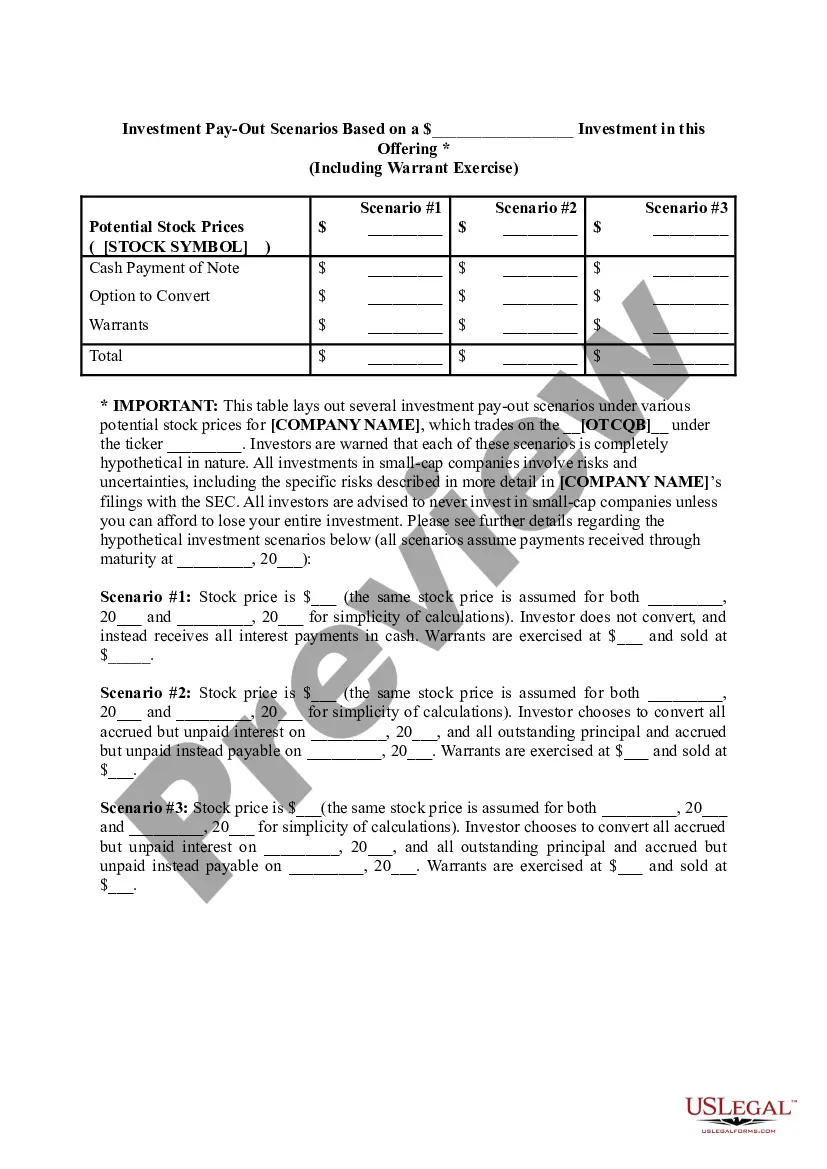

Terms of Convertible Debt The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).